Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When an employee has a roth 4 0 1 ( k ) with an employer match, how are the employer's matching funds applied? The employee

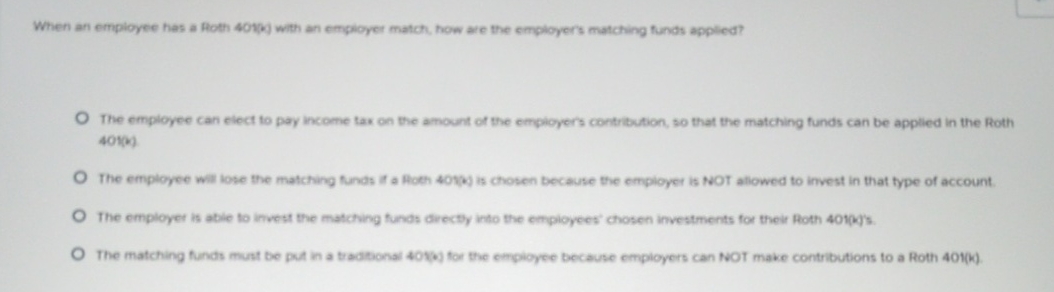

When an employee has a roth k with an employer match, how are the employer's matching funds applied?

The employee can elect to pay income tax on the amount of the emptoyers contribution, so that the matching funds can be applied in the Roth

The employee will lose the matching funds it a Hoth is chosen because the employer is fiot aliowed to invest in that type of account.

The employer is abie fio invest the matching funds directy into the employees' chosen investments for their Roth k s

The matching finds must be put in a tradtional vej for the empioyee because employers can fiOt make contributions to a Roth

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started