Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When analyzing a transaction outside of the accounting equation. We must consider what each account is doing on a standalone basis. That is, we

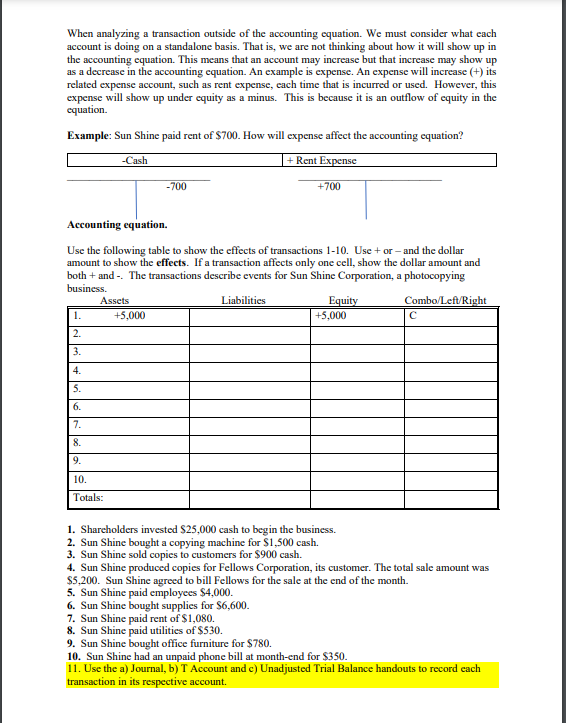

When analyzing a transaction outside of the accounting equation. We must consider what each account is doing on a standalone basis. That is, we are not thinking about how it will show up in the accounting equation. This means that an account may increase but that increase may show up as a decrease in the accounting equation. An example is expense. An expense will increase (+) its related expense account, such as rent expense, each time that is incurred or used. However, this expense will show up under equity as a minus. This is because it is an outflow of equity in the equation. Example: Sun Shine paid rent of $700. How will expense affect the accounting equation? -Cash -700 + Rent Expense +700 Accounting equation. Use the following table to show the effects of transactions 1-10. Use + or - and the dollar amount to show the effects. If a transaction affects only one cell, show the dollar amount and both + and -. The transactions describe events for Sun Shine Corporation, a photocopying business. Assets 1. +5,000 2. 3. 4. 5. 6. 7. 8. 9. 10. Totals: Liabilities Equity +5,000 Combo/Left/Right C 1. Shareholders invested $25,000 cash to begin the business. 2. Sun Shine bought a copying machine for $1,500 cash. 3. Sun Shine sold copies to customers for $900 cash. 4. Sun Shine produced copies for Fellows Corporation, its customer. The total sale amount was $5,200. Sun Shine agreed to bill Fellows for the sale at the end of the month. 5. Sun Shine paid employees $4,000. 6. Sun Shine bought supplies for $6,600. 7. Sun Shine paid rent of $1,080. 8. Sun Shine paid utilities of $530. 9. Sun Shine bought office furniture for $780. 10. Sun Shine had an unpaid phone bill at month-end for $350. 11. Use the a) Journal, b) T Account and c) Unadjusted Trial Balance handouts to record each transaction in its respective account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started