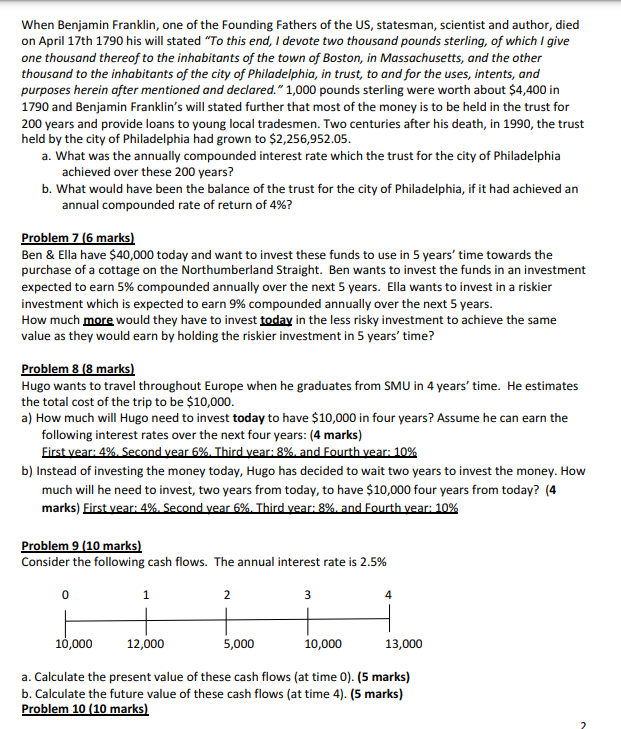

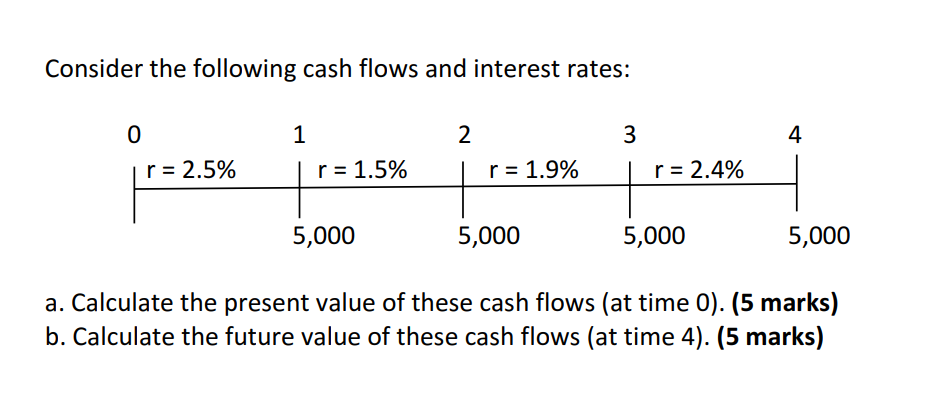

When Benjamin Franklin, one of the Founding Fathers of the US, statesman, scientist and author, died on April 17th 1790 his will stated "To this end, I devote two thousand pounds sterling, of which I give one thousand thereof to the inhabitants of the town of Boston, in Massachusetts, and the other thousand to the inhabitants of the city of Philadelphia, in trust, to and for the uses, intents, and purposes herein after mentioned and declared." 1,000 pounds sterling were worth about $4,400 in 1790 and Benjamin Franklin's will stated further that most of the money is to be held in the trust for 200 years and provide loans to young local tradesmen. Two centuries after his death, in 1990, the trust held by the city of Philadelphia had grown to $2,256,952.05. a. What was the annually compounded interest rate which the trust for the city of Philadelphia achieved over these 200 years? b. What would have been the balance of the trust for the city of Philadelphia, if it had achieved an annual compounded rate of return of 4%? Problem 7 (6 marks) Ben & Ella have $40,000 today and want to invest these funds to use in 5 years' time towards the purchase of a cottage on the Northumberland Straight. Ben wants to invest the funds in an investment expected to earn 5% compounded annually over the next 5 years. Ella wants to invest in a riskier investment which is expected to earn 9% compounded annually over the next 5 years. How much more would they have to invest today in the less risky investment to achieve the same value as they would earn by holding the riskier investment in 5 years' time? Problem 8 (8 marks) Hugo wants to travel throughout Europe when he graduates from SMU in 4 years' time. He estimates the total cost of the trip to be $10,000. a) How much will Hugo need to invest today to have $10,000 in four years? Assume he can earn the following interest rates over the next four years: (4 marks) First vear: 4%. Second year 6%. Third vear: 8% and Fourth vear: 10% b) Instead of investing the money today, Hugo has decided to wait two years to invest the money. How much will he need to invest, two years from today, to have $10,000 four years from today? (4 marks) First vear: 4% Second vear 6%. Third year: 8% and Fourth year: 10% Problem 9 (10 marks) Consider the following cash flows. The annual interest rate is 2.5% 0 1 2 3 10,000 12,000 5,000 10,000 13,000 a. Calculate the present value of these cash flows (at time 0). (5 marks) b. Calculate the future value of these cash flows (at time 4). (5 marks) Problem 10 (10 marks) Consider the following cash flows and interest rates: 0 1 2 3 4 r = 2.5% r = 1.5% r = 1.9% r = 2.4% 5,000 5,000 5,000 5,000 a. Calculate the present value of these cash flows (at time 0). (5 marks) b. Calculate the future value of these cash flows (at time 4)