Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When bonds are fairly priced, for bonds with a maturity of 5 years, A bond with a coupon rate of 5% will yield higher than

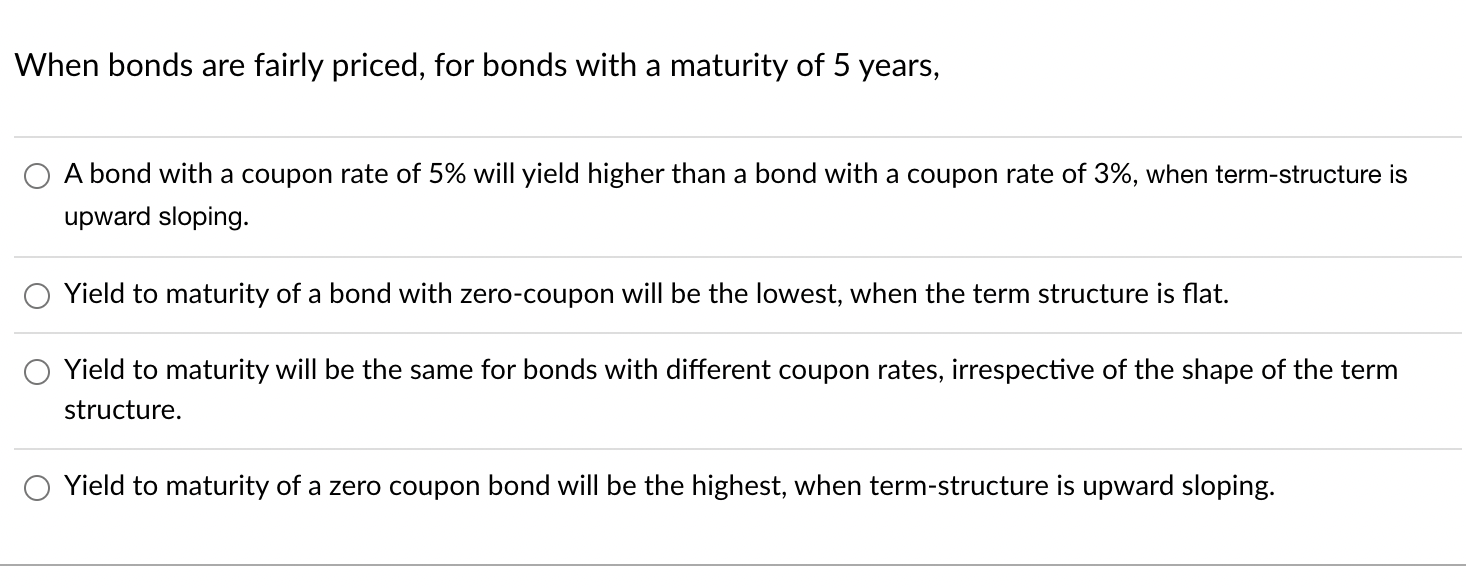

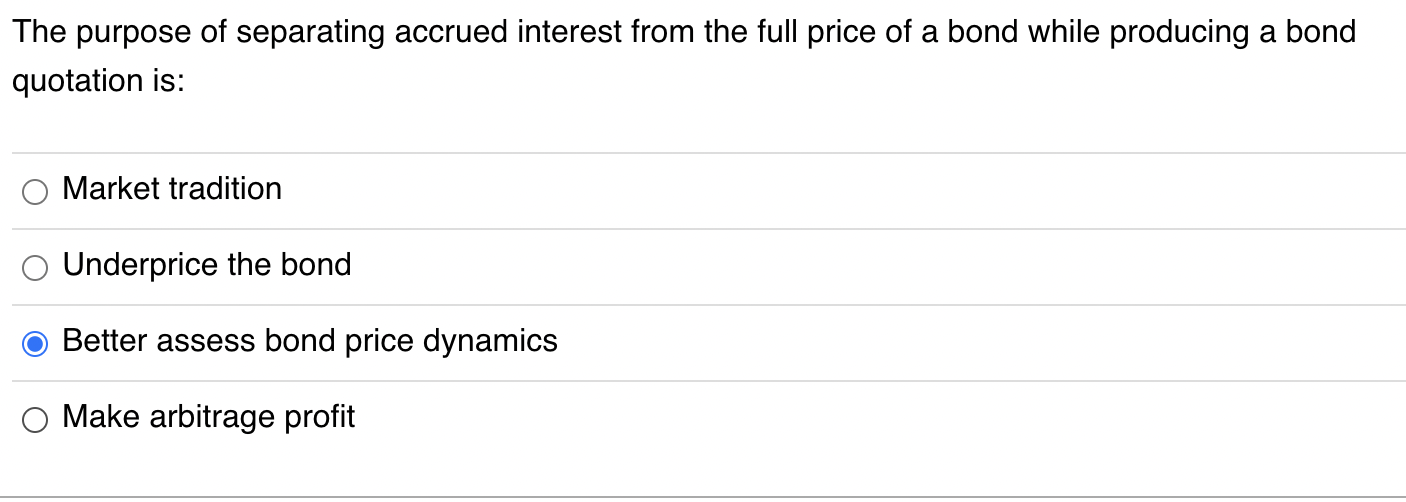

When bonds are fairly priced, for bonds with a maturity of 5 years, A bond with a coupon rate of 5% will yield higher than a bond with a coupon rate of 3%, when term-structure is upward sloping. Yield to maturity of a bond with zero-coupon will be the lowest, when the term structure is flat. Yield to maturity will be the same for bonds with different coupon rates, irrespective of the shape of the term structure. Yield to maturity of a zero coupon bond will be the highest, when term-structure is upward sloping. The purpose of separating accrued interest from the full price of a bond while producing a bond quotation is: Market tradition Underprice the bond Better assess bond price dynamics Make arbitrage profit

When bonds are fairly priced, for bonds with a maturity of 5 years, A bond with a coupon rate of 5% will yield higher than a bond with a coupon rate of 3%, when term-structure is upward sloping. Yield to maturity of a bond with zero-coupon will be the lowest, when the term structure is flat. Yield to maturity will be the same for bonds with different coupon rates, irrespective of the shape of the term structure. Yield to maturity of a zero coupon bond will be the highest, when term-structure is upward sloping. The purpose of separating accrued interest from the full price of a bond while producing a bond quotation is: Market tradition Underprice the bond Better assess bond price dynamics Make arbitrage profit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started