Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When calculating the yield to maturity, we've been told to use Newton Raphson numerical method through a couple of iterations. Could you please show me

When calculating the yield to maturity, we've been told to use Newton Raphson numerical method through a couple of iterations. Could you please show me how that works in relation to part b?

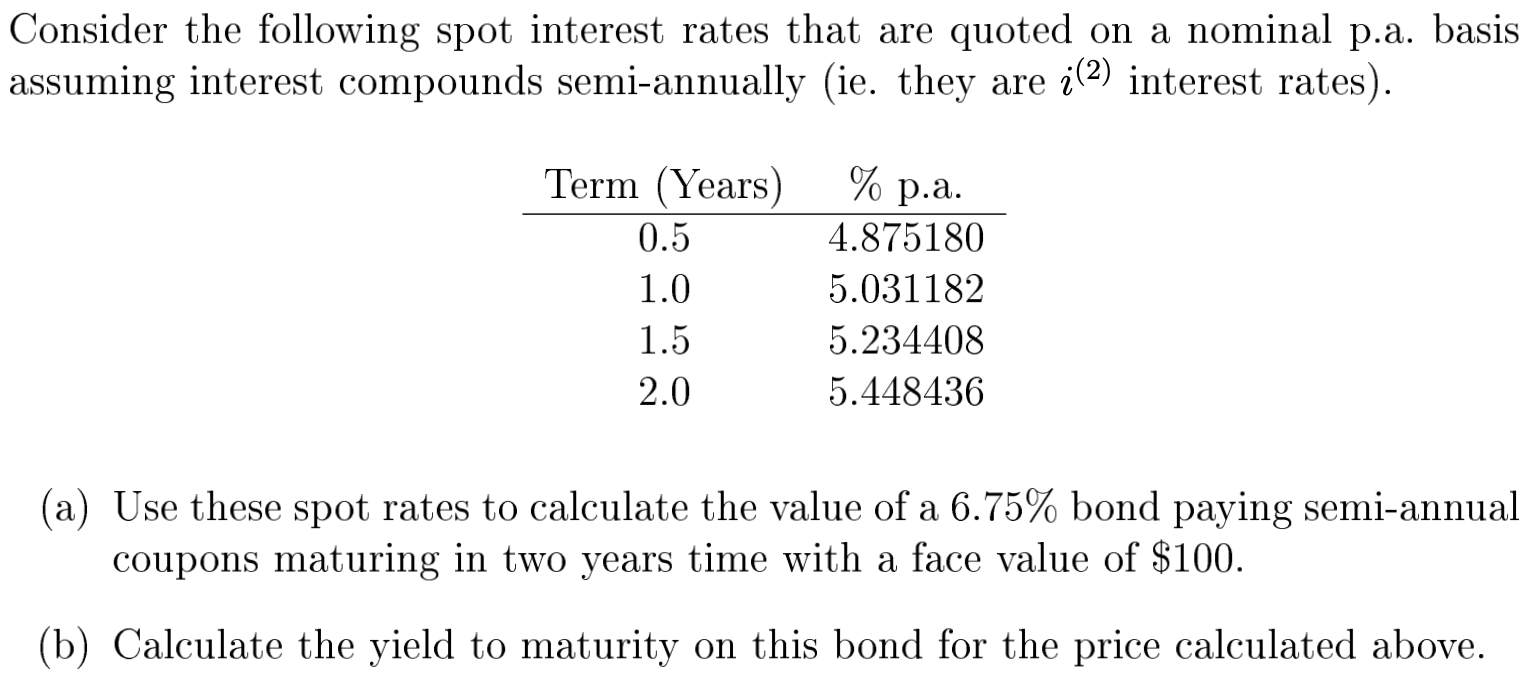

Consider the following spot interest rates that are quoted on a nominal p.a. basis assuming interest compounds semi-annually (ie. they are 2(2) interest rates). % p.a. Term (Years) 0.5 1.0 1.5 2.0 4.875180 5.031182 5.234408 5.448436 (a) Use these spot rates to calculate the value of a 6.75% bond paying semi-annual coupons maturing in two years time with a face value of $100. (b) Calculate the yield to maturity on this bond for the price calculated aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started