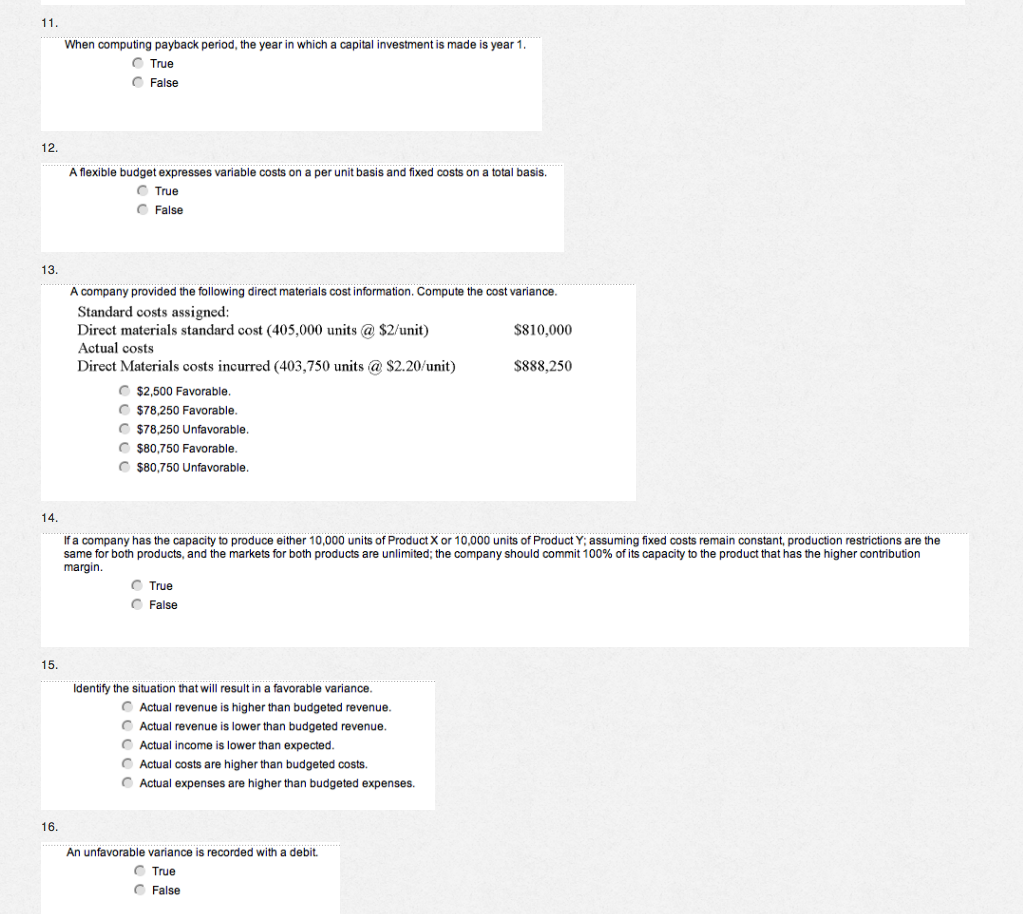

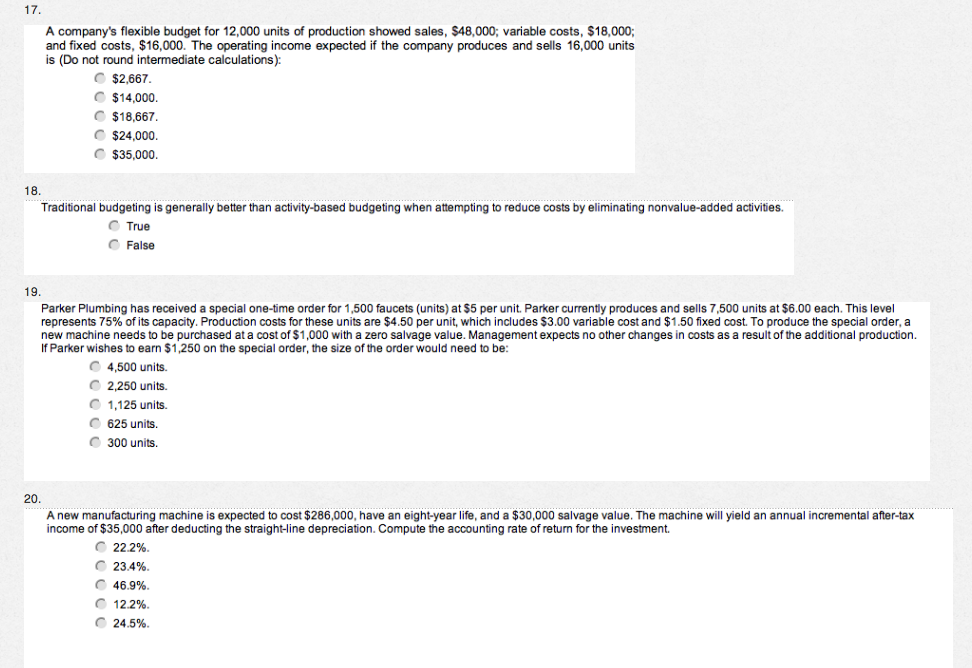

When computing payback period, the year in which a capital investment is made is year 1. True False A flexible budget expresses variable costs on a per unit basis and fixed costs on a total basis. True False A company provided the following direct materials cost information. Compute the cost variance. Standard costs assigned: Direct materials standard cost (405,000 units @ $2/unit) $810,000 Actual costs Direct Materials costs incurred (403,750 units @ $2.20/unit) S888.250 $2,500 Favorable. $78,250 Favorable. $78,250 Unfavorable. $80,750 Favorable. $80,750 Unfavorable. If a company has the capacity to produce either 10,000 units of Product X or 10.000 units of Product Y; assuming fixed costs remain constant, production restrictions are the same for both products, and the markets for both products are unlimited: the company should commit 100% of its capacity to the product that has the higher contribution margin. True False Identify the situation that will result in a favorable variance. Actual revenue is higher than budgeted revenue. Actual revenue is lower than budgeted revenue. Actual income is lower than expected. Actual costs are higher than budgeted costs. Actual expenses are higher than budgeted expenses. An unfavorable variance is recorded with a debit. True False A company's flexible budget for 12,000 units of production showed sales, $48,000; variable costs, $18,000; and fixed costs. $16,000. The operating income expected if the company produces and sells 16,000 units is (Do not round intermediate calculations): $2,667. $14,000. $18,667. $24,000. $35,000. Traditional budgeting is generally better than activity-based budgeting when attempting to reduce costs by eliminating nonvalue-added activities. True False Parker Plumbing has received a special one-time order for 1,500 faucets (units) at $5 per unit. Parker currently produces and sells 7.500 units at $6.00 each. This level represents 75% of its capacity. Production costs for these units are $4.50 per unit, which includes $3.00 variable cost and $1.50 fixed cost. To produce the special order, a new machine needs to be purchased at a cost of $1,000 with a zero salvage value. Management expects no other changes in costs as a result of the additional production. If Parker wishes to earn $1,250 on the special order, the size of the order would need to be: 4,500 units. 2,250 units. 1,125 units. 625 units. 300 units. A new manufacturing machine is expected to cost $286,000, have an eight-year life, and a $30,000 salvage value. The machine will yield an annual incremental after-tax income of $35,000 after deducting the straight-line depreciation. Compute the accounting rate of return for the investment. 22.2%. 23.4%. 46.9%. 12.2%. 24.5%