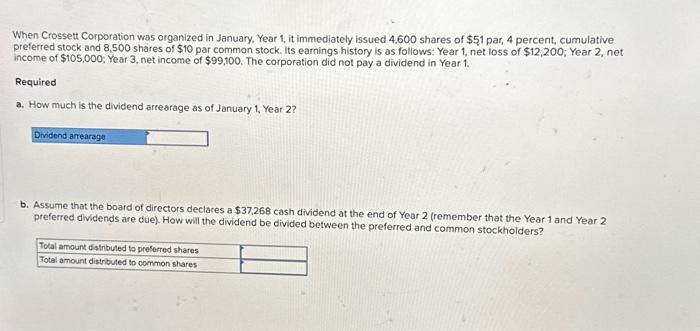

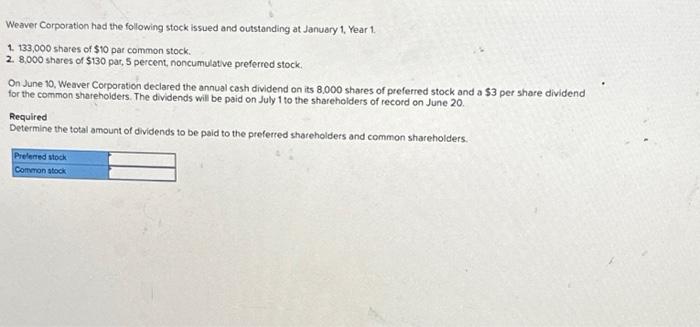

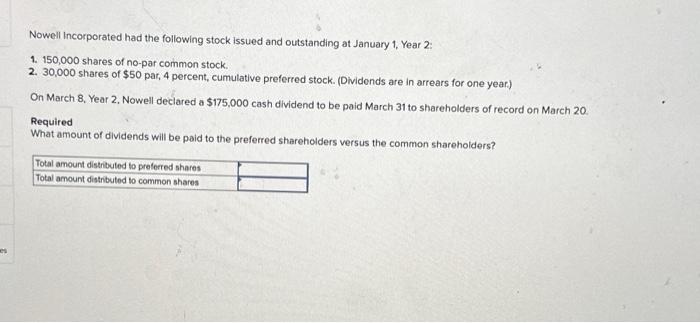

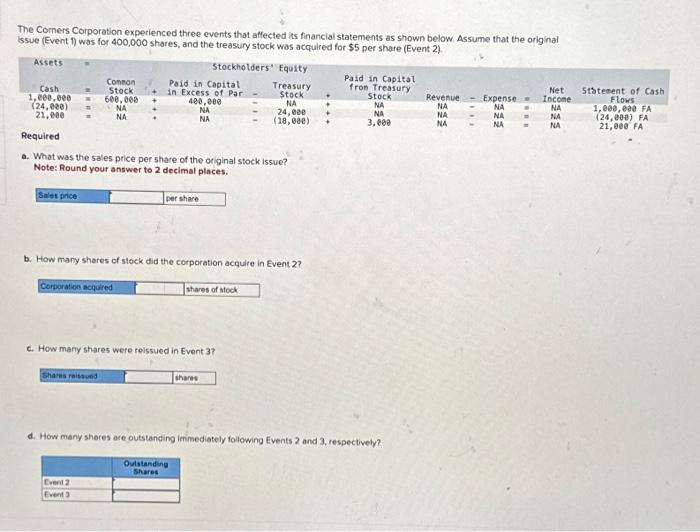

When Crossett Corporation was organized in January, Year 1 , it immediately issued 4,600 shares of $51 par, 4 percent, cumulative preferred stock and 8,500 shares of $10 par common stock. Its earnings history is as follows: Year 1, net loss of $12,200;;ear 2 , net income of $105,000; Year 3, net income of $99,100, The corporation did not pay a dividend in Year 1 . Required a. How much is the dividend arrearage as of January 1, Year 2? b. Assume that the board of directors declares a $37,268 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? Weaver Corporation had the following stock issued and outstanding at January 1, Year 1. 1. 133,000 shares of $10 par common stock. 2. 8,000 shares of $130 par, 5 percent, noncumulatve preferred stock. On June 10 , Weaver Corporation declared the annual cash dividend on its 8.000 shares of preferred stock and a $3 per share dividend for the common sharehoiders. The dividends will be paid on July 1 to the sharehoiders of record on June 20 . Required Determine the total amount of dividends to be paid to the preferred shareholders and common sharehoiders. Nowell Incorporated had the following stock issued and outstanding at January 1, Year 2 : 1. 150,000 shares of no-par common stock. 2. 30,000 shares of $50 par, 4 percent, cumulative preferred stock. (Dividends are in arrears for one year) On March 8, Year 2, Nowell declared a $175,000 cash dividend to be paid March 31 to shareholders of record on March 20. Required What amount of dividends will be paid to the preferred shareholders versus the common sharehoiders? The Corners Corporation experienced three events that affected its financial statements as shown below, Assume that the original Issue (Event 1) was for 400,000 shares, and the treasury stock was acquired for $5 per share (Event 2) a. What was the sales price per share of the original stock issue? Note: Round your answer to 2 decimal places. b. How many shares of stock did the corporation acquire in Event 2 ? c. How many shares were relssued in Event 3 ? d. How many shares are outstanding immediately following Events 2 and 3 , respectively