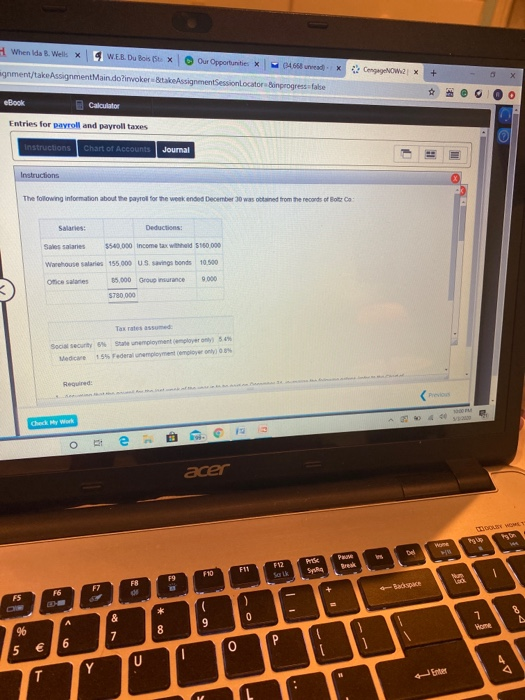

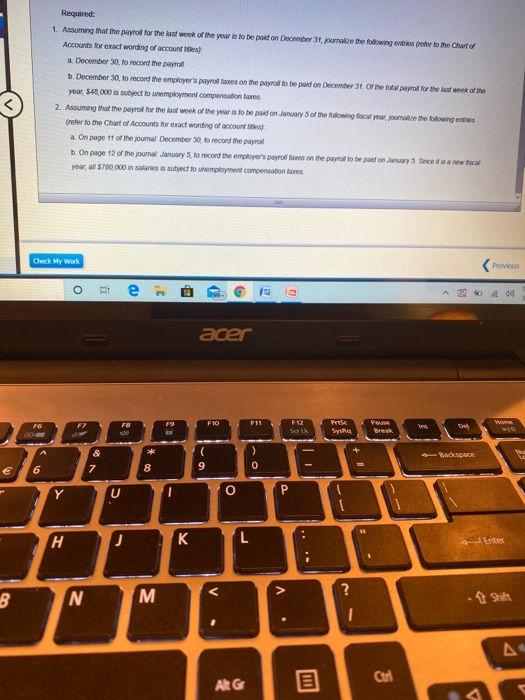

When da. Wells X WEB D Box Our Opportunities X ignment/takeAssignmentMain doinvokerStake AssignmentSessionLocator Binprogressive X CengagNW2x + X *@OOO eBook Calculator Entries for payroll and payroll taxes Instruction Chart of Accounts Journal Instructions The following information about the payroll for the week ended December 30 was obtained from the records of Botz Co Salaries: Deductions: Sales salaries $540.000 income tax w had 5160.000 Warehouse salaries 155.000 US savings bonds 10.500 Omice salaries 35,000 Grou n ce 0.000 5780,000 Social Security State employment employer only Medicare 15% Federal employment moyeonly 5 3% 19 O e acer E - 762 Required: Assuming that the payroll for the last week of the years to be paid on December 3, journalize the following en refer to the Chart of Accounts for exact wording of accounts a December 30, to record the payrol b. December 30, to record the employer's payroll taxes on the payroll to be part on December 31. or the total p ol for the last week of the year 548,000 is subject to unemployment compensation ares 2. Assuming that the payroll for the last week of the year is to be paid on January 5 of the following focal your make the following (refer to the Chart of Accounts for exact wording of accounts a. On page 11 of the journal December 30, to record the payroll b. On page 12 of the joumal January 5, to record the employer's payrols on the payroll to be paid on January 5 Since now focal year, al 5780,000 in salaries is subject to unemployment compensation Bus Check My Work acer Badespace 1 & Shift ALG When da. Wells X WEB D Box Our Opportunities X ignment/takeAssignmentMain doinvokerStake AssignmentSessionLocator Binprogressive X CengagNW2x + X *@OOO eBook Calculator Entries for payroll and payroll taxes Instruction Chart of Accounts Journal Instructions The following information about the payroll for the week ended December 30 was obtained from the records of Botz Co Salaries: Deductions: Sales salaries $540.000 income tax w had 5160.000 Warehouse salaries 155.000 US savings bonds 10.500 Omice salaries 35,000 Grou n ce 0.000 5780,000 Social Security State employment employer only Medicare 15% Federal employment moyeonly 5 3% 19 O e acer E - 762 Required: Assuming that the payroll for the last week of the years to be paid on December 3, journalize the following en refer to the Chart of Accounts for exact wording of accounts a December 30, to record the payrol b. December 30, to record the employer's payroll taxes on the payroll to be part on December 31. or the total p ol for the last week of the year 548,000 is subject to unemployment compensation ares 2. Assuming that the payroll for the last week of the year is to be paid on January 5 of the following focal your make the following (refer to the Chart of Accounts for exact wording of accounts a. On page 11 of the journal December 30, to record the payroll b. On page 12 of the joumal January 5, to record the employer's payrols on the payroll to be paid on January 5 Since now focal year, al 5780,000 in salaries is subject to unemployment compensation Bus Check My Work acer Badespace 1 & Shift ALG