Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When dealing with futures, speculation / hedging involves betting on future price movements. In a long hedge / short hedge , futures contracts are sold

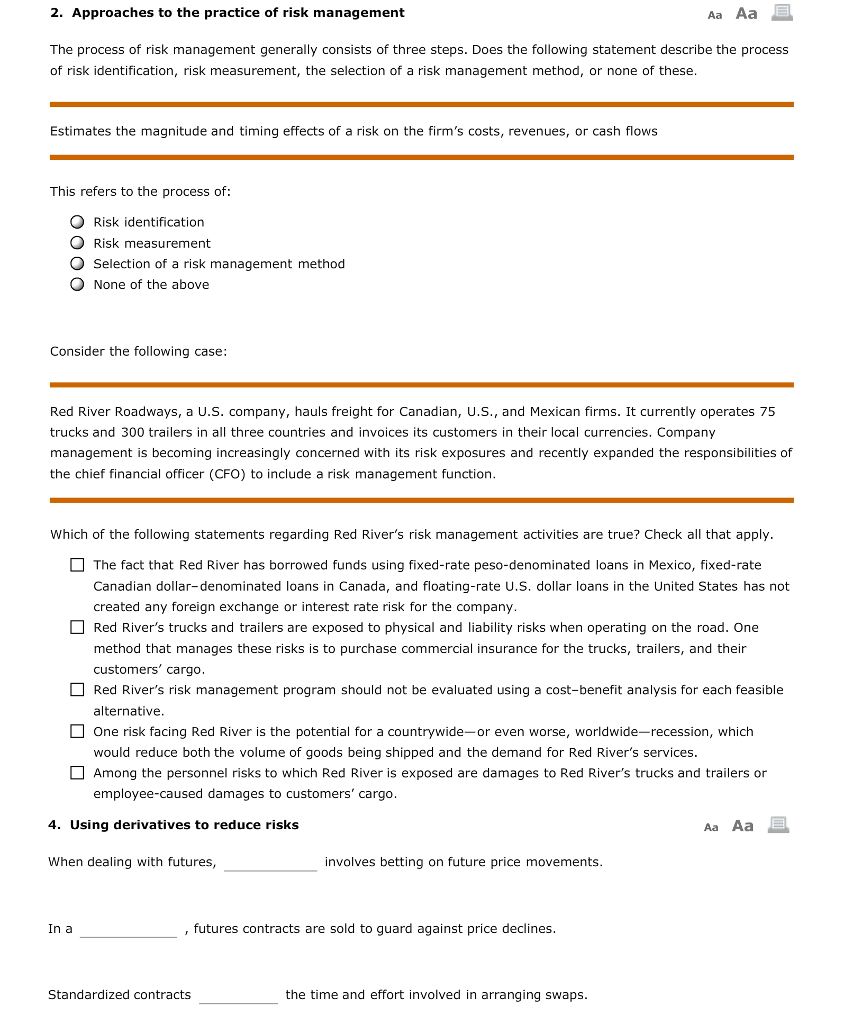

When dealing with futures, speculation / hedging involves betting on future price movements.

In a long hedge / short hedge , futures contracts are sold to guard against price declines.

Standardized contracts increase / decrease the time and effort involved in arranging swaps.

2. Approaches to the practice of risk management Aa Aa The process of risk management generally consists of three steps. Does the following statement describe the process of risk identification, risk measurement, the selection of a risk management method, or none of these Estimates the magnitude and timing effects of a risk on the firm's costs, revenues, or cash flows This refers to the process of: Q Risk identification O Risk measurement O Selection of a risk management method None of the above Consider the following case: Red River Roadways, a U.S. company, hauls freight for Canadian, U.S., and Mexican firms. It currently operates 75 trucks and 300 trailers in all three countries and invoices its customers in their local currencies. Company management is becoming increasingly concerned with its risk exposures and recently expanded the responsibilities of the chief financial officer (CFO) to include a risk management function Which of the following statements regarding Red River's risk management activities are true? Check all that apply The fact that Red River has borrowed funds using fixed-rate peso-denominated loans in Mexico, fixed-rate Canadian dollar-denominated loans in Canada, and floating-rate U.S, dollar loans in the United States has not created any foreign exchange or interest rate risk for the company Red River's trucks and trailers are exposed to physical and liability risks when operating on the road. One method that manages these risks is to purchase commercial insurance for the trucks, trailers, and their customers' cargo Red River's risk management program should not be evaluated using a cost-benefit analysis for each feasible alternative One risk facing Red River is the potential for a countrywide-or even worse, worldwide-recession, which would reduce both the volume of goods being shipped and the demand for Red River's services Among the personnel risks to which Red River is exposed are damages to Red River's trucks and trailers or employee-caused damages to customers' cargo 4. Using derivatives to reduce risks Aa Aa When dealing with futures involves betting on future price movements In a , futures contracts are sold to guard against price declines Standardized contracts the time and effort involved in arranging swapsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started