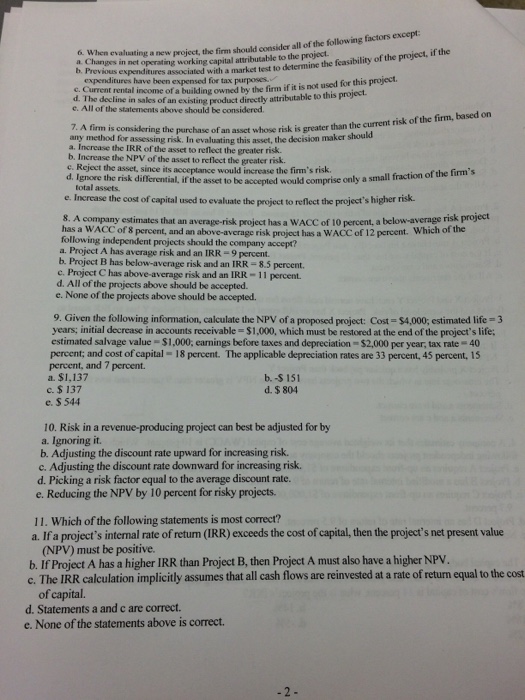

When evaluating a new project, the firm should consider all of the following factors except: Changes in net operating working capital attributable to the project. Previous expenditures associated with a market test to determine the feasibility of the project, if the expenditures have been expensed for tax purposes. Current rental income of a building owned by the firm if it is not used for this project. The decline in sales of an existing product directly attributable to this project. All of the statement above should be considered. A firm is considering the purchase of an asset whose risk is greater than the current risk of the firm, based on any method for assessing risk. In evaluating this asset, the decision maker should Increase the IRR of the asset to reflect the greater risk. Increase the NPV of the asset to reflect the greater risk. Reject the asset, since its acceptance would increase the firm's risk. Ignore the risk differential, if the asset to be accepted would comprise only a small fraction of the firm's total assets. Increase the cost of capital used to evaluate the project to reflect the project's higher risk. A company estimates that an average-risk project has a WACC of 10 percent a below-average risk project has a WACC of 8 percent, and an above-average risk project has a WACC of 12 percent. Which of the following independent projects should the company accept? Project A has average risk and an IRR = 9 percent. Project B has below-average risk and an IRR = 8.5 percent. Project C has above-average risk and an IRR = 11 percent. All of the projects above should be accepted. None of the projects above should be accepted. Given the following information, calculate the NPV of a proposed project: Cost = $4,000; estimated life = 3 years: initial decrease in accounts receivable = $1,000, which must be restored at the end of the project's life; estimated salvage value = $1,000; earnings before taxes and depreciation = $2,000 per year; tax rate = 40 percent; and cost of capital = 18 percent. The applicable depreciation rates are 33 percent, 45 percent, 15 percent, and 7 percent. $1,137 -$ 151 $ 137 $ 804 $ 544 Risk in a revenue-producing project can best be adjusted for by Ignoring it. Adjusting the discount rate upward for increasing risk. Adjusting the discount rate downward for increasing risk. Picking a risk factor equal to the average discount rate. Reducing the NPV by 10 percent for risky projects. Which of the following statements is most correct? If a project's internal rate of return (IRR) exceeds the cost of capital, then the project's net present value (NPV) must be positive. If Project A has a higher IRR than Project B, then Project A must also have a higher NPV. The IRR calculation implicitly assumes that all cash flows are reinvested at a rate of return equal to the cost of capital. Statements a and c are correct. None of the statements above is correct. When evaluating a new project, the firm should consider all of the following factors except: Changes in net operating working capital attributable to the project. Previous expenditures associated with a market test to determine the feasibility of the project, if the expenditures have been expensed for tax purposes. Current rental income of a building owned by the firm if it is not used for this project. The decline in sales of an existing product directly attributable to this project. All of the statement above should be considered. A firm is considering the purchase of an asset whose risk is greater than the current risk of the firm, based on any method for assessing risk. In evaluating this asset, the decision maker should Increase the IRR of the asset to reflect the greater risk. Increase the NPV of the asset to reflect the greater risk. Reject the asset, since its acceptance would increase the firm's risk. Ignore the risk differential, if the asset to be accepted would comprise only a small fraction of the firm's total assets. Increase the cost of capital used to evaluate the project to reflect the project's higher risk. A company estimates that an average-risk project has a WACC of 10 percent a below-average risk project has a WACC of 8 percent, and an above-average risk project has a WACC of 12 percent. Which of the following independent projects should the company accept? Project A has average risk and an IRR = 9 percent. Project B has below-average risk and an IRR = 8.5 percent. Project C has above-average risk and an IRR = 11 percent. All of the projects above should be accepted. None of the projects above should be accepted. Given the following information, calculate the NPV of a proposed project: Cost = $4,000; estimated life = 3 years: initial decrease in accounts receivable = $1,000, which must be restored at the end of the project's life; estimated salvage value = $1,000; earnings before taxes and depreciation = $2,000 per year; tax rate = 40 percent; and cost of capital = 18 percent. The applicable depreciation rates are 33 percent, 45 percent, 15 percent, and 7 percent. $1,137 -$ 151 $ 137 $ 804 $ 544 Risk in a revenue-producing project can best be adjusted for by Ignoring it. Adjusting the discount rate upward for increasing risk. Adjusting the discount rate downward for increasing risk. Picking a risk factor equal to the average discount rate. Reducing the NPV by 10 percent for risky projects. Which of the following statements is most correct? If a project's internal rate of return (IRR) exceeds the cost of capital, then the project's net present value (NPV) must be positive. If Project A has a higher IRR than Project B, then Project A must also have a higher NPV. The IRR calculation implicitly assumes that all cash flows are reinvested at a rate of return equal to the cost of capital. Statements a and c are correct. None of the statements above is correct