Answered step by step

Verified Expert Solution

Question

1 Approved Answer

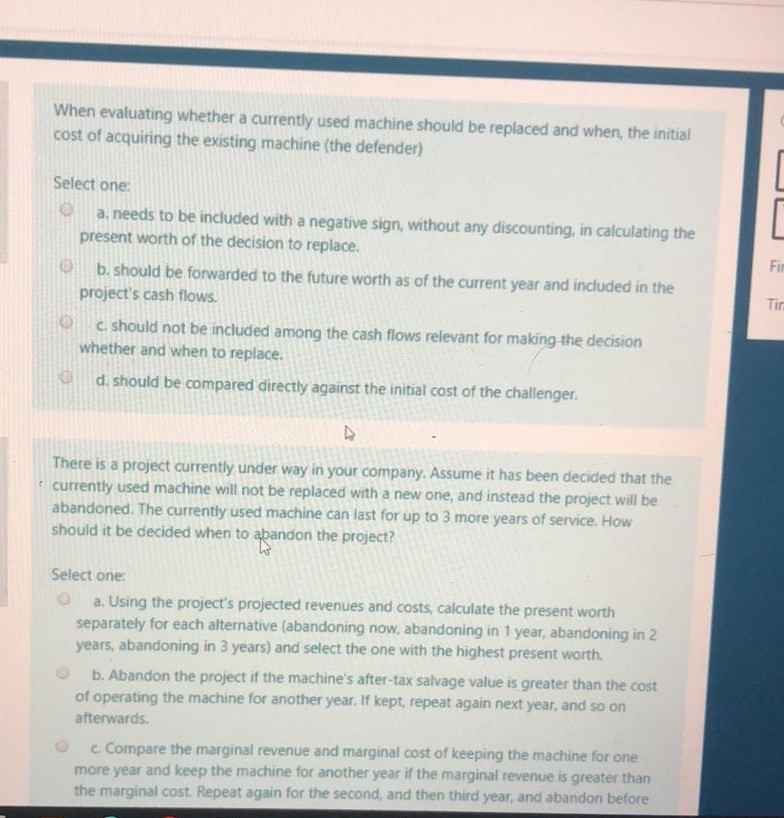

When evaluating whether a currently used machine should be replaced and when the initial cost of acquiring the existing machine (the defender) Select one a.

When evaluating whether a currently used machine should be replaced and when the initial cost of acquiring the existing machine (the defender) Select one a. needs to be included with a negative sign, without any discounting, in calculating the present worth of the decision to replace. b. should be forwarded to the future worth as of the current year and included in the project's cash flows. should not be included among the cash flows relevant for making the decision whether and when to replace. d. should be compared directly against the initial cost of the challenger. There is a project currently under way in your company. Assume it has been decided that the currently used machine will not be replaced with a new one, and instead the project will be abandoned. The currently used machine can last for up to 3 more years of service. How should it be decided when to abandon the project? Select one a. Using the project's projected revenues and costs, calculate the present worth separately for each alternative (abandoning now, abandoning in 1 year, abandoning in 2 years, abandoning in 3 years) and select the one with the highest present worth b. Abandon the project if the machine's after-tax salvage value is greater than the cost of operating the machine for another year. If kept repeat again next year, and so on afterwards. cCompare the marginal revenue and marginal cost of keeping the machine for one more year and keep the machine for another year if the marginal revenue is greater than the marginal cost. Repeat again for the second, and then third year, and abandon before

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started