when field, a lis pendens indicates a

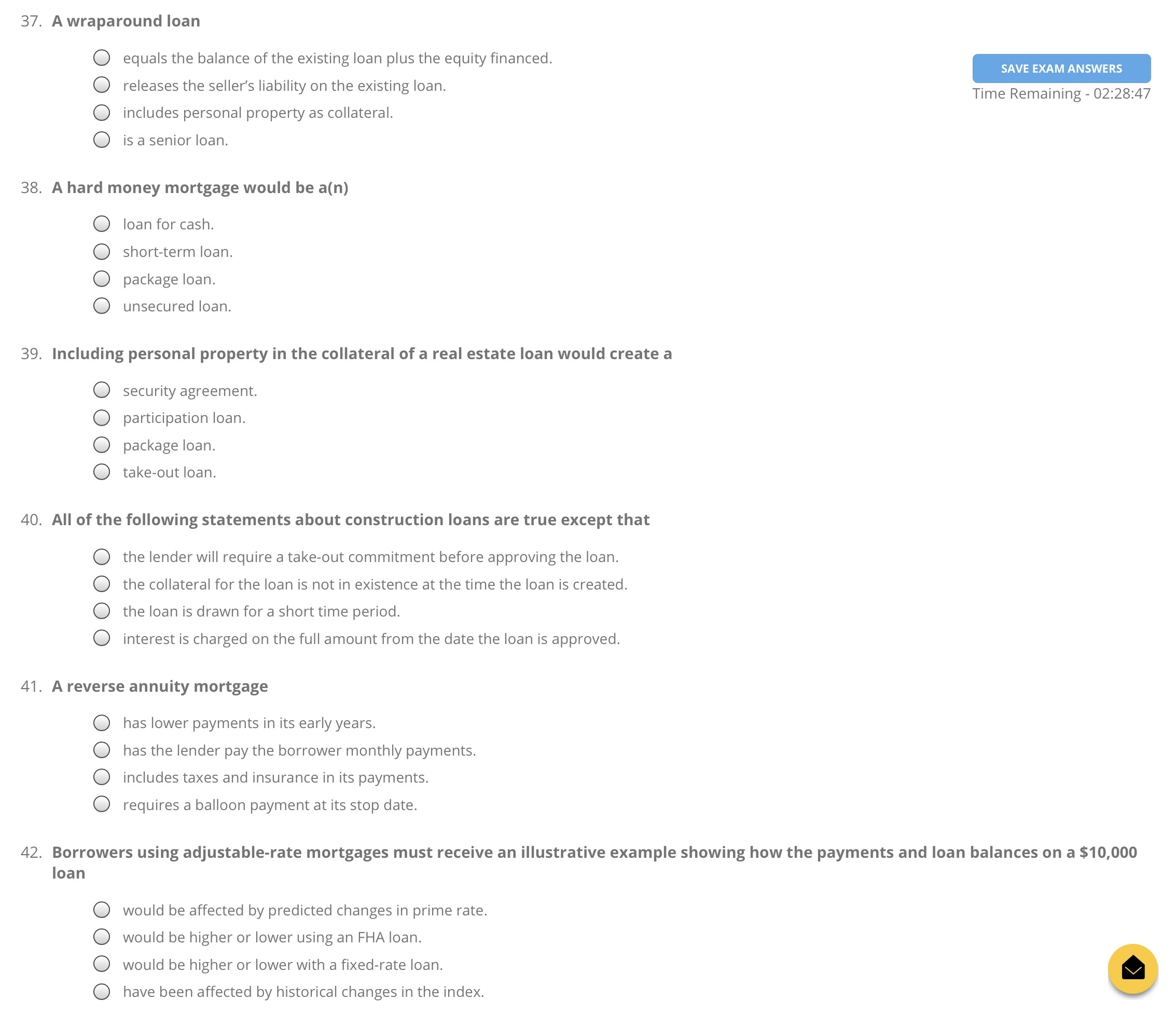

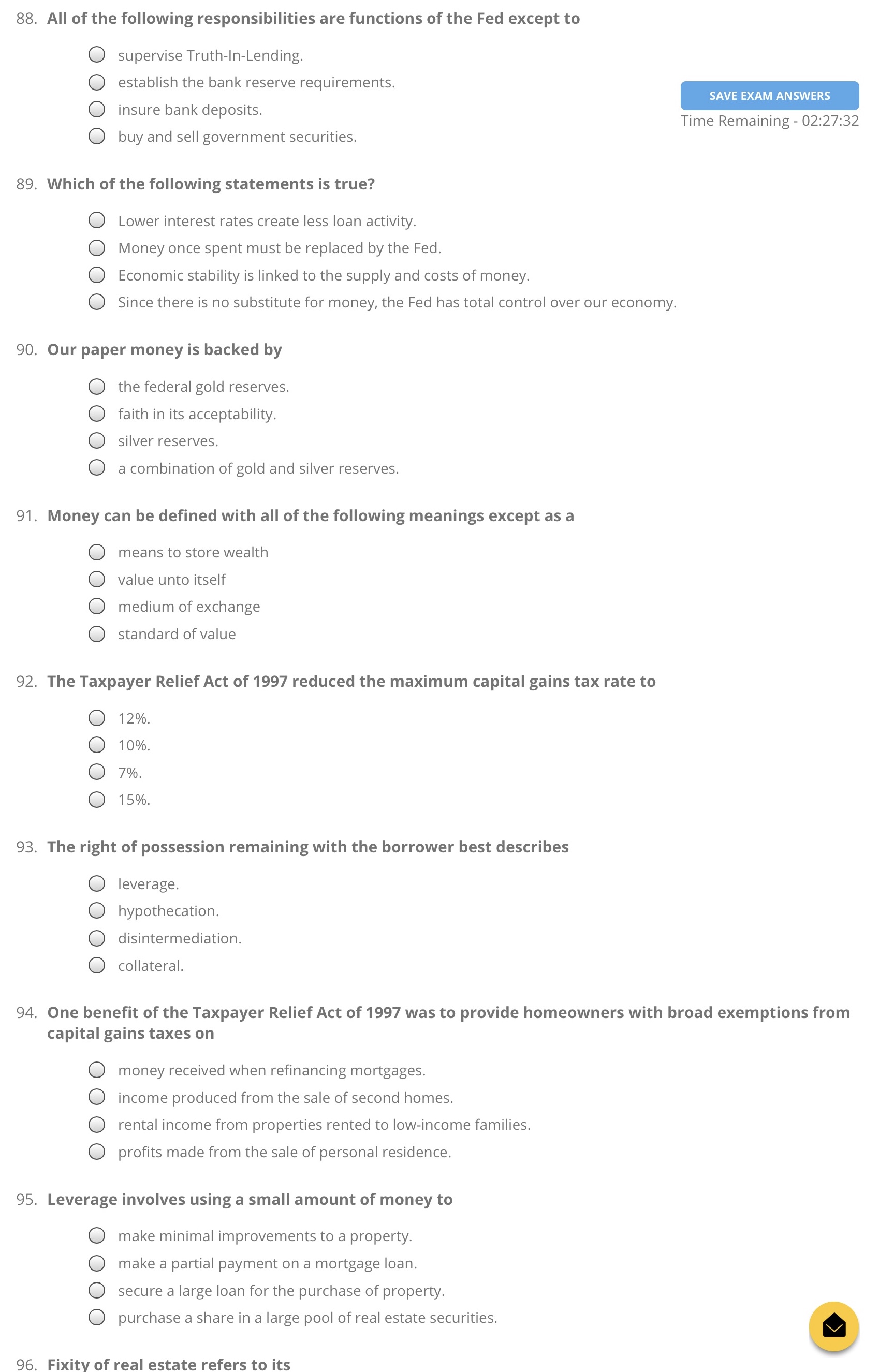

80. Penalties for loan refusals based on the collateral location (redlining) are imposed by O TRA '86. 0 Civil RightsAct. o H... At 0 en c. O R f dAt Time Remaining-02:27:41 um or c. 81. Which of the following lenders has the most flexibility in mortgage lending operations? 0 Private lenders 0 Life insurance companies 0 Savings associations 0 Commercial banks 82. What is the major source of funds for the mortgage loans offered by savings and loan associations? 0 real estate taxes. 0 governmentgrants. O savers'deposits. 0 private corporations. 83. 0f the following types of real estate loans, commercial banks are most interested in O interim loans. 0 conventional single-family loans. 0 unsecured loans. 0 government-insured single-family loans. 84. An example of a demand deposit is a(n) O certificate of deposit. 0 checking account. 0 insurance annuity. 0 savings account. 85. Which statement best describes California's position among the states for real estate lending dollar volume by insurance companies? 0 It does not allow real estate lending activity by insurance companies. Q It is at the top. 0 It ranks near the bottom. 0 It ranks in the middle. 86. Mortgage bankers are a type of intermediary also known as O correspondents. O conduits. O thrifts. O trusts. 87. The Federal Open Market Committee (FOMC) impacts the O reorganization of failed banks and thrifts. O availability of money for real estate 0 reserve requirements of member banks. 0 sale of mortgages on the secondary market. 88. All of the following responsibilities are functions of the Fed except to 16. Fannie Mae participates in all of the following activities except 0 making loans directly to borrowers. 0 allowing loan originators to service the loans sold. SAVE EXAM ANSWERS setting standards for purchasmg conventional loans. Time Remaining _ 02:29:31 0 dealing in the secondary market. 17. Fannie Mae replaced its free-market system auction with a(n) O incremental-rate system. 0 administered price system. 0 direct-issue system. Q bidder-call system. 18. The secondary mortgage market provides all of the following benefits except 0 reducing discounts on resale of loans. 0 distributing money nationally. O stabilizing the mortgage money markets. 0 freeing capital for lenders. 19. The sale of mortgage loans on the secondary market has a positive impact on the economy by O imposing rigid qualifications on applicants. 0 stabilizing the mortgage money market. 0 discouraging home purchases by transients. O lowering the national foreclosure rate. 20. The transfer of the right, title, and interest in a property of one person to another is known as O assumption. 0 novation. 0 claim. 0 assignment. 21. Monthly payments on a fixed-rate mortgage loan may change due to changes in the O principal. 0 index. 0 propertytaxes. 0 interest rate. 22. What is guaranteed to a home buyer who purchases title insurance? 0 Protection against future liens on title 0 Validity and accuracy of the title search 0 Protection against high interest adjustments 0 Value of the property 23. A synopsis of the recorded history of a property is called a(n) 0 complete legal description. 0 guarantee of title. 0 verification ofvalue. O abstract. 24. A duplex has a monthly income of $400 per unit. Using an annual gross rent multiplier of 8, its valu estimate is 24. A duplex has a monthly income of $400 per unit. Using an annual gross rent multiplier of 8, its value estimate is 0 $76,800. 0 $3,200 Time Remaining 02:29:25 0 $6,400. 25. In determining the net income for an apartment property, all of the following expenses would be deducted from the gross income except 0 property taxes. 0 insurance premiums. 0 managementfees. 0 interest charges. 26. What is the total maximum debt ratio that underwriters apply to borrowers applying for conventional loans? 0 38% O 41% O 43% O 36% 27. Net worth is described as 0 gross income less liabilities. O assets plus liabilities. Q assets less liabilities. 0 income plus assets less liabilities. 28. On a financial statement, liabilities include all of the following items except 0 unpaid taxes. 0 loan balances. 0 insurance premiums due. 0 notes receivable. 29. The price a property would most likely bring if it were exposed for sale in the open market for a reasonable period of time is the property's Q estimated value. 0 sales price. 0 market value. 0 appraised value. 30. The original maker of a real estate loan is completely relieved of any contingent obligations when the purchaser of the collateral O completes a novation process. 0 assumes the loan. 0 takes title subject to the loan. 0 has subordinated the loan. 31. Which of the following clauses is a form of prepayment penalty? 0 Lock-in clause 0 Due-onsale clause nn'FnFIL-'Flnrn rim Irn 72. Compared with 30-year fixed-rate loans, 15-year fixed rate loans tend to have higher 0 private mortgage insurance requirements. 0 down payments. SAVE EXAM ANSWERS 0 monthly payments. Time Remaining- 02:27:51 0 interest rates 73. Most real estate mortgages originate as 0 federal insured loans. 0 conventional loans. 0 federal guaranteed loans. 0 noninstitutional loans. 74. Negative amortization describes a loan balance that O is subject to an adjustable interest rate. 0 increases each month. 0 is in default. 0 has been recasted. 75. Private real estate loan companies are primarily engaged in O the secondary market. 0 unsecured loans. 0 junior financing. 0 first deeds oftrust. 76. Unsecured corporate bonds are known as O debentures. 0 coupon bonds. 0 registered bonds. 0 bearer bonds. 77. Mortgage bankers 0 do not originate loans. 0 use savings deposits to make loans. 0 manage real estate loans. 0 obligations end when loan is issued. 78. All of the following statements are general characteristics of mortgage brokers except that O fees are charged to borrowers 0 loan payments are made directly to lenders. 0 they qualify borrowers. 0 they use their own capital to create new loans. 79. Life insurance companies are least interested in 0 large commercial loans. 0 small loans. 0 participation loans. 0 large apartment loans. 80. Penalties for loan refusals based on the collateral location (redlining) are imposed by 96. Fixity of real estate refers to its Q uniqueness. Q appreciation. SAVE EXAM ANSWERS 0 location. Time Remaining - 02:27:22 0 indestructibility. 97. Economic characteristics of land include 0 nonhomogeneity. Q fixity of improvements. 0 definable boundaries. 0 indestructibility. 98. The highest bundle of rights a person may enjoy under our allodial system is a(n) Q equitable estate. O estate for years. 0 a fee simple absolute estate. 0 determinate estate. 99. Trade fixtures are O usuallyunattached. Q hereditaments. 0 real property. Q personal property. 100. The best definition of real property is O anything affixed to the land. Q chattels. O all that is immovable and the bundle of rights. Q a possessory interest. COMPLETE EXAM SAVE EXAM ANSWERS 41. A reverse annuity mortgage 0 has lower payments in its early years. 0 has the lender pay the borrower monthly payments. 0 includes taxes and insurance in its payments. Time Remaining - 02:28:31 0 requires a balloon payment at its stop date. 42. Borrowers using adjustable-rate mortgages must receive an illustrative example showing how the payments and loan balances on a $10,000 loan 0 would be affected by predicted changes in prime rate. 0 would be higher or lower using an FHA loan. 0 would be higher or lower with a fixed-rate loan. 0 have been affected by historical changes in the index. 43. The index on an adjustable-rate mortgage loan must be 0 the national average of outstanding loans. 0 pegged to US. Treasury rates. 0 selected by the borrower at closing. 0 beyond the control of the lender. 44. An very low initial interest rate offered on an adjustable-rate loan is referred to as a 0 margin. 0 graduation. 0 discount. 0 teaser. 45. A feature of the graduated payment loan is a(n) 0 negative amortization in the early years. 0 interest rate tied to a national index. 0 constant principal, but varying interest rates. 0 lower interest in the early years. 46. Which of the following clauses allows an existing senior loan to be refinanced without disturbing the junior loan's status? 0 Subordination clause 0 Lifting clause 0 Release clause 0 Exculpatory clause 47. Which of the following clauses makes the delinquency on a senior loan a delinquency on the existing junior loan? 0 Lifting clause 0 Defeasance clause 0 Cross-default clause 0 Release clause 48. The Community Reinvestment Act does not require public disclosure. requires lenders to meet community credit needs. requires the Fed to make loans for public housing. DOOO encourages private citizens to helo each other. 64. DVA loans require 0 buyer down payments. 0 buyer points. SAVE EXAM ANSWERS O borrowers to be married. Time Remaining - 02:28:01 0 borrower's occupancy. 65. Under coinsurance, an FHA approved lender O shares any losses with the FHA. O sells loan participation certificates. 0 obtains private insurance as well as FHA insurance. 0 is allowed to substitute PMI for FHA insurance. 66. When monthly payments are insufficient to meet the interest required 0 the portion applying to principal must be increased. 0 the loan must be recast. O the loan is automatically accelerated. 0 negative amortization occurs. 67. All of the following items are advantages to borrowers under the FHA insured loan programs except the 0 high LN ratios. 0 due-on-sale clauses. O assumability ofthe loans. 0 absence of prepayment penalties. 68. The purpose of FHA insurance is to O inhibit foreclosures. 0 protect the property against loss in value. 0 indemnify the lender against default loss. 0 protect the borrower against a loan default. 69. The FHA is under thejurisdiction of the O GNMA. 0 FNMA. O FHLBC. O HUD. 70. Private mortgage insurance has led to O fewer home purchases. 0 the transfer of risk from lender to insurer. O greater reliance on government-insured loans. 0 lower LN ratios. 71. Loans made to borrowers with very marginal or poor credit are called 0 nonconforming. O subprime. O crunchdown. O balloon. 72. Compared with 30-year fixed-rate loans, 15-year fixed rate loans tend to have higher 30. The original maker of a real estate loan is completely relieved of any contingent obligations when the purchaser of the collateral O completes a novation process. SAVE EXAM ANSWERS 0 assumes the loan. Time Remaining - 02:29:03 C) takes title subject to the loan. 0 has subordinated the loan. 31. Which of the following clauses is a form of prepayment penalty? 0 Lock-in clause 0 Due-on-sale clause 0 Defeasance clause 0 Lifting clause 32. In California, a real property sales contract is foreclosed by using a O strict foreclosure. 0 judicial foreclosure. 0 power ofsale. O quitclaim deed. 33. An acceleration clause in a real estate loan allows the lender to C) evict the borrower. 0 call in the loan balance. 0 increase the interest rate. Q adjust the payments. 34. A note would be used with all of the following types of loans except a(n) 0 land contract. 0 unsecured loan. 0 mortgage. 0 deed of trust. 35. Which of the following items is considered a lien? O Deed of trust 0 Subdivision restriction O Easement 0 Zoning restriction 36. A deed of trust on a home is a O specificinvoluntarylien. 0 general specificlien. O specificvoluntarylien. O voluntary general lien. 37. A wraparound loan 0 equals the balance of the existing loan plus the equity financed. O releases the seller's liability on the existing loan. 0 includes personal property as collateral. O is a senior loan. 8. When filed, a lis pendens indicates a O pending foreclosure action. 0 redemption period. 0 judgment for eviction. Time Remaining - 02:29:35 0 change of ownership. 9. The purpose for recasting a loan when the borrower is in default is to 0 lower the monthly payments. 0 increase the interest rate. 0 increase the loan security. 0 reduce the amount of indebtedness. 10. To avoid foreclosure, a lender and borrower might agree to all of the following actions except 0 recasting the loan. 0 a moratorium on payments. 0 a deed in lieu offoreclosure. O naming the lender as co-owner. 11. An agreement to waive payments for a period of time is a(n) O lispendens. O moratorium. O estoppel. O equitable foreclosure. 12. A breach of one or more of the conditions or terms of a loan agreement is a O grievance. O delinquency. O recast. O default. 13. Disintermediation seriously affected 0 privatelenders. 0 savings associations. 0 the Fed. O pension funds. 14. Freddie Mac's Loan Prospector is an electronic 0 underwriting service. 0 identity-validation software. 0 listingservice. O title-search network. 15. What is the relationship between the interest rate paid on pass-through certificates and the interest on the loans in the pool? 0 The rate on the pass-through certificate is lower. 0 It is impossible to predict the relationship. 0 The rates are equal. 0 The rate on the pass-through certificate is higher. 48. The Community Reinvestment Act O does not require public disclosure. 0 requires lenders to meet community credit needs. O requires the Fed to make loans for public housing. . _ _ Time Remaining - 02:28:22 0 encourages private citizens to help each other. 49. Under the Equal Credit Opportunity Act, lenders O must inform rejected applicants in writing why their credit was denied. 0 may not ask ifthe applicant is married or divorced. O can discount or exclude income based on its source. 0 can eliminate applicants with welfare income. 50. The Equal Credit Opportunity Act prohibits lender discrimination based on all of the following reasons except 0 dependency on welfare. 0 race. 0 prior credit history. 0 marital status. 51. The illegal act of trying to convince a homeowner to sell a home by saying that property values in the community are dropping is referred to as the inducement of O panic selling. 0 block busting. O redlining. O boycotting. 52. The Truth in Lending Act is popularly referred to as 0 Regulation Z. 0 Regulation B. 0 Regulation T. 0 Regulation E. 53. Any citizen injured by discrimination in housing practices may, under the Fair Housing Act of 1968 0 file criminal charges in federal court. 0 bring a civil action for specific performance. 0 file a complaint with the local commissioner. 0 file criminal charges with local law enforcement. 54. HUD's Housing Choice Voucher Program provides 0 rent subsidies. O loan-payment guarantees. O interest