Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When firms make capital budgeting decisions, they should concern themselves with incremental cash flows, not net income, when evaluating projects. To determine the incremental cash

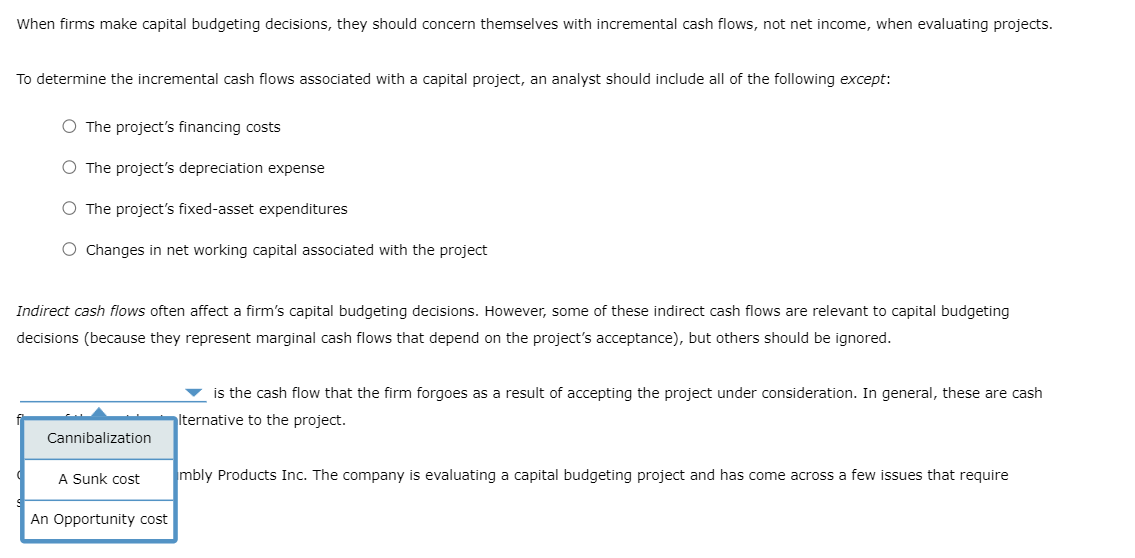

When firms make capital budgeting decisions, they should concern themselves with incremental cash flows, not net income, when evaluating projects.

To determine the incremental cash flows associated with a capital project, an analyst should include all of the following except:

The project's financing costs

The project's depreciation expense

The project's fixedasset expenditures

Changes in net working capital associated with the project

Indirect cash flows often affect a firm's capital budgeting decisions. However, some of these indirect cash flows are relevant to capital budgeting

decisions because they represent marginal cash flows that depend on the project's acceptance but others should be ignored.

is the cash flow that the firm forgoes as a result of accepting the project under consideration. In general, these are cash

Iternative to the project.

Cannibalization

A Sunk cost

mbly Products Inc. The company is evaluating a capital budgeting project and has come across a few issues that require

An Opportunity cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started