Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When his family move to town awhile back, Michael borrowed $734,000 to buy a house. The mortgage required 29 years of monthly payments, with the

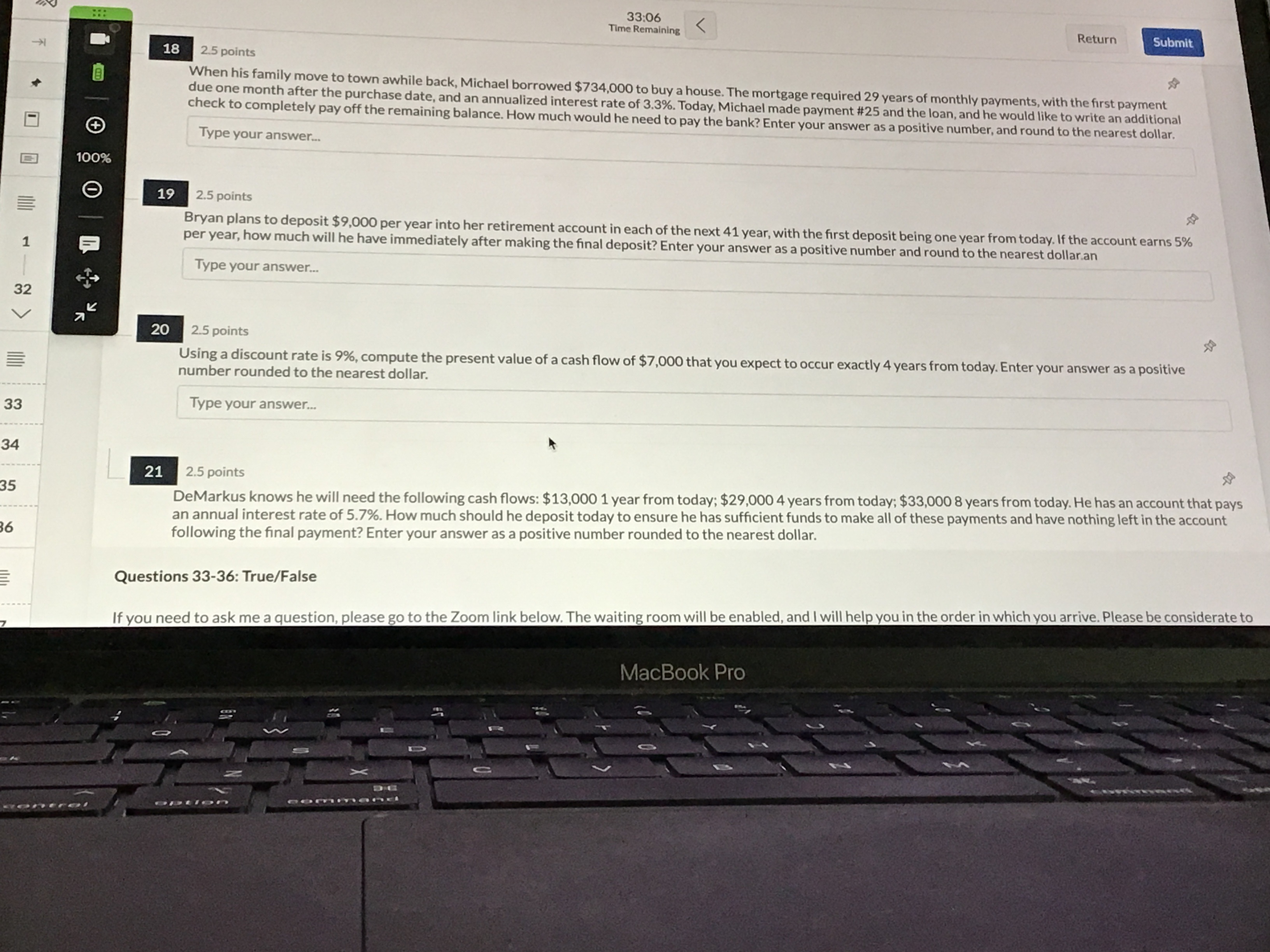

When his family move to town awhile back, Michael borrowed $734,000 to buy a house. The mortgage required 29 years of monthly payments, with the first payment due one month after the purchase date, and an annualized interest rate of 3.3\%. Today, Michael made payment \#25 and the loan, and he would like to write an additional check to completely pay off the remaining balance. How much would he need to pay the bank? Enter your answer as a positive number, and round to the nearest dollar. Type your answer... 192.5 points Bryan plans to deposit $9,000 per year into her retirement account in each of the next 41 year, with the first deposit being one year from today. If the account earns 5% per year, how much will he have immediately after making the final deposit? Enter your answer as a positive number and round to the nearest dollar.an Type your answer... 2.5 points Using a discount rate is 9%, compute the present value of a cash flow of $7,000 that you expect to occur exactly 4 years from today. Enter your answer as a positive number rounded to the nearest dollar. Type your answer... 2.5 points DeMarkus knows he will need the following cash flows: $13,0001 year from today; $29,0004 years from today; $33,0008 years from today. He has an account that p an annual interest rate of 5.7%. How much should he deposit today to ensure he has sufficient funds to make all of these payments and have nothing left in the account following the final payment? Enter your answer as a positive number rounded to the nearest dollar

When his family move to town awhile back, Michael borrowed $734,000 to buy a house. The mortgage required 29 years of monthly payments, with the first payment due one month after the purchase date, and an annualized interest rate of 3.3\%. Today, Michael made payment \#25 and the loan, and he would like to write an additional check to completely pay off the remaining balance. How much would he need to pay the bank? Enter your answer as a positive number, and round to the nearest dollar. Type your answer... 192.5 points Bryan plans to deposit $9,000 per year into her retirement account in each of the next 41 year, with the first deposit being one year from today. If the account earns 5% per year, how much will he have immediately after making the final deposit? Enter your answer as a positive number and round to the nearest dollar.an Type your answer... 2.5 points Using a discount rate is 9%, compute the present value of a cash flow of $7,000 that you expect to occur exactly 4 years from today. Enter your answer as a positive number rounded to the nearest dollar. Type your answer... 2.5 points DeMarkus knows he will need the following cash flows: $13,0001 year from today; $29,0004 years from today; $33,0008 years from today. He has an account that p an annual interest rate of 5.7%. How much should he deposit today to ensure he has sufficient funds to make all of these payments and have nothing left in the account following the final payment? Enter your answer as a positive number rounded to the nearest dollar Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started