Question: When Ivanhoe Ltd. received its bank statement for the month of June, it showed that the company had a cash balance of $15,252 as at

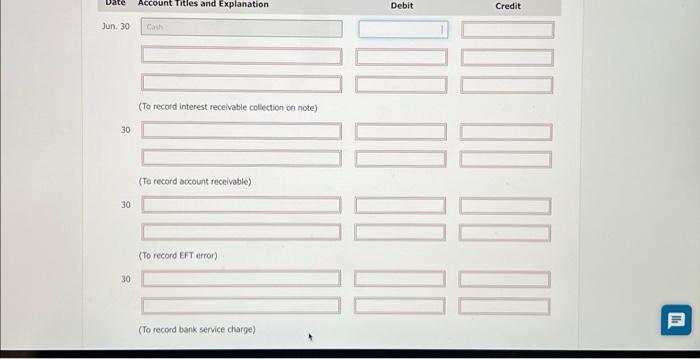

When Ivanhoe Ltd. received its bank statement for the month of June, it showed that the company had a cash balance of $15,252 as at June 30. Ivanhoe's general ledger showed a cash balance of $19,000 at that date. A comparison of the bank statement and the accounting records revealed the following information: 1. AnEFT payment for utilities expenses had been correctly made for $970 but had been incorrectly recorded in the general ledger as $717. 2. Ivanhoe had written and mailed out cheques with a value of $1,890 that had not yet cleared the bank account. 3. The cash receipts for June 30 amounted to $4,800 and had been deposited in the night deposit chute at the bank on the evening of June 30 . These were not reflected on the bank statement for June. 4. Bank service charges and debit and credit card processing fees for the month were $205. 5. During the month, the bank collected a $2,380 note receivable plus the outstanding interest of $440 on behalf of Ivanhoe. The interest had already been accrued by Ivanhoe. 6. A cheque in the amount of $3,200 from one of Ivanhoe's customers that had been deposited during the last week of May was returned with the bank statement as "NSF:" Jun. 30 Credit (To record interest receivable collection on note) 30 (To record account receivable) 30 (To record EFT error) 30 (To record bank service charge)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts