Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When Liam moved into a new home, he kept his old home, which he purchased eight years earlier, and converte to use as a rental

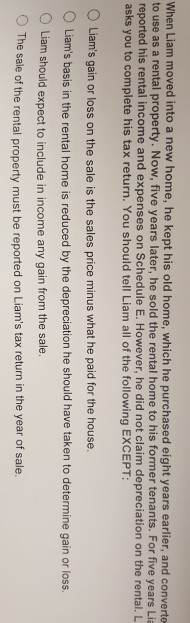

When Liam moved into a new home, he kept his old home, which he purchased eight years earlier, and converte to use as a rental property. Now, five years later, he sold the rental home to his former tenants. For five years Lia reported his rental income and expenses on Schedule E. However, he did not claim depreciation on the rental. L asks you to complete his tax return. You should tell Liam all of the following EXCEPT: O Liam's gain or loss on the sale is the sales price minus what he paid for the house. ( Liam's basis in the rental home is reduced by the depreciation he should have taken to determine gain or loss. O Liam should expect to include in income any gain from the sale. O The sale of the rental property must be reported on Liam's tax return in the year of sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started