Answered step by step

Verified Expert Solution

Question

1 Approved Answer

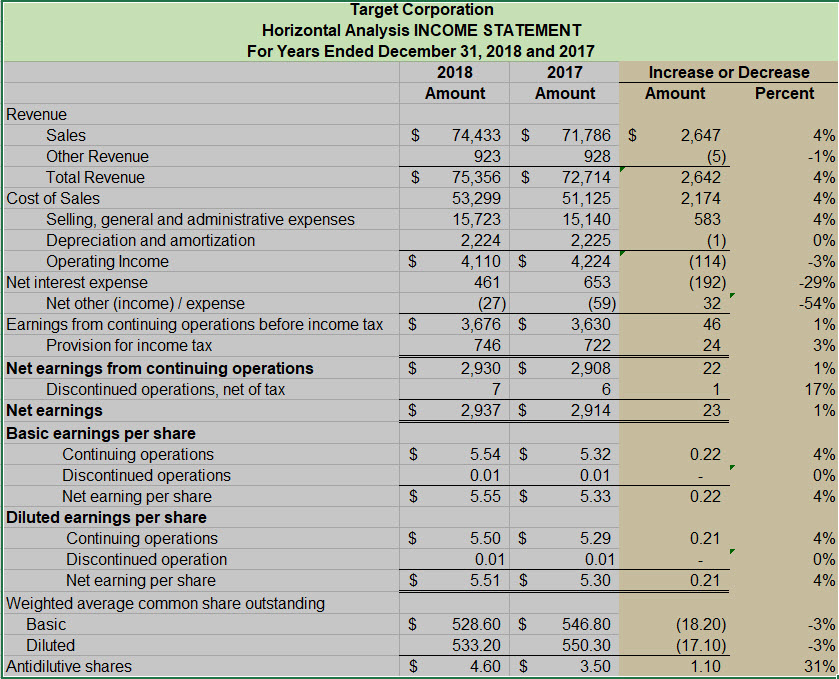

When looking at the horizontal analysis for Target, why do you think Target's costs are increasing at a higher rate than their revenues? Increase or

When looking at the horizontal analysis for Target, why do you think Target's costs are increasing at a higher rate than their revenues?

Increase or Decrease Amount Percent $ 2,647 928 -1% 4% 2,642 2,174 4% 583 4% (1) (114) 653 (192) 0% -3% -29% -54% 1% 32 46 Target Corporation Horizontal Analysis INCOME STATEMENT For Years Ended December 31, 2018 and 2017 2018 2017 Amount Amount Revenue Sales $ 74,433 $ 71,786 Other Revenue 923 Total Revenue $ 75,356 $ 72,714 Cost of Sales 53,299 51,125 Selling, general and administrative expenses 15,723 15,140 Depreciation and amortization 2,224 2,225 Operating Income $ 4,110 $ 4,224 Net interest expense 461 Net other (income) / expense (27) (59) Earnings from continuing operations before income tax $ 3,676 $ 3,630 Provision for income tax 746 722 Net earnings from continuing operations $ 2,930 $ 2,908 Discontinued operations, net of tax Net earnings $ 2,937 $ 2,914 Basic earnings per share Continuing operations $ 5.54 $ 5.32 Discontinued operations 0.01 0.01 Net earning per share $ 5.55 $ 5.33 Diluted earnings per share Continuing operations $ 5.50 $ 5.29 Discontinued operation 0.01 0.01 Net earning per share $ 5.51 $ 5.30 Weighted average common share outstanding Basic $ 528.60 $ 546.80 Diluted 533.20 550.30 Antidilutive shares $ 4.60 $ 3.50 3% 22 1 1% 0.22 0.21 0.21 (18.20) (17.10) 1.10 -3% -3% 31%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started