Question

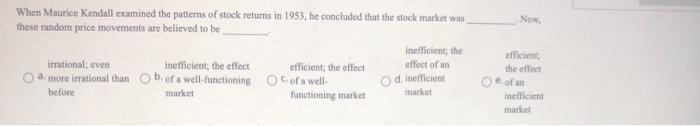

When Maurice Kendall examined the patterns of stock returns in 1953, he concluded that the stock market was these random price movements are believed

When Maurice Kendall examined the patterns of stock returns in 1953, he concluded that the stock market was these random price movements are believed to be irrational; even inefficient; the effect a. more irrational than Ob. of a well-functioning before market efficient; the effect of a well- functioning market Od, inefficient; the effect of an inefficient market Now, efficient, the effect e of an inefficient market

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Business Statistics Communicating With Numbers

Authors: Sanjiv Jaggia, Alison Kelly

1st Edition

78020549, 978-0078020544

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App