Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When might you want to consider using the Exit Multiple Method to value a firm as a part of an FCF / DCF analysis? Select

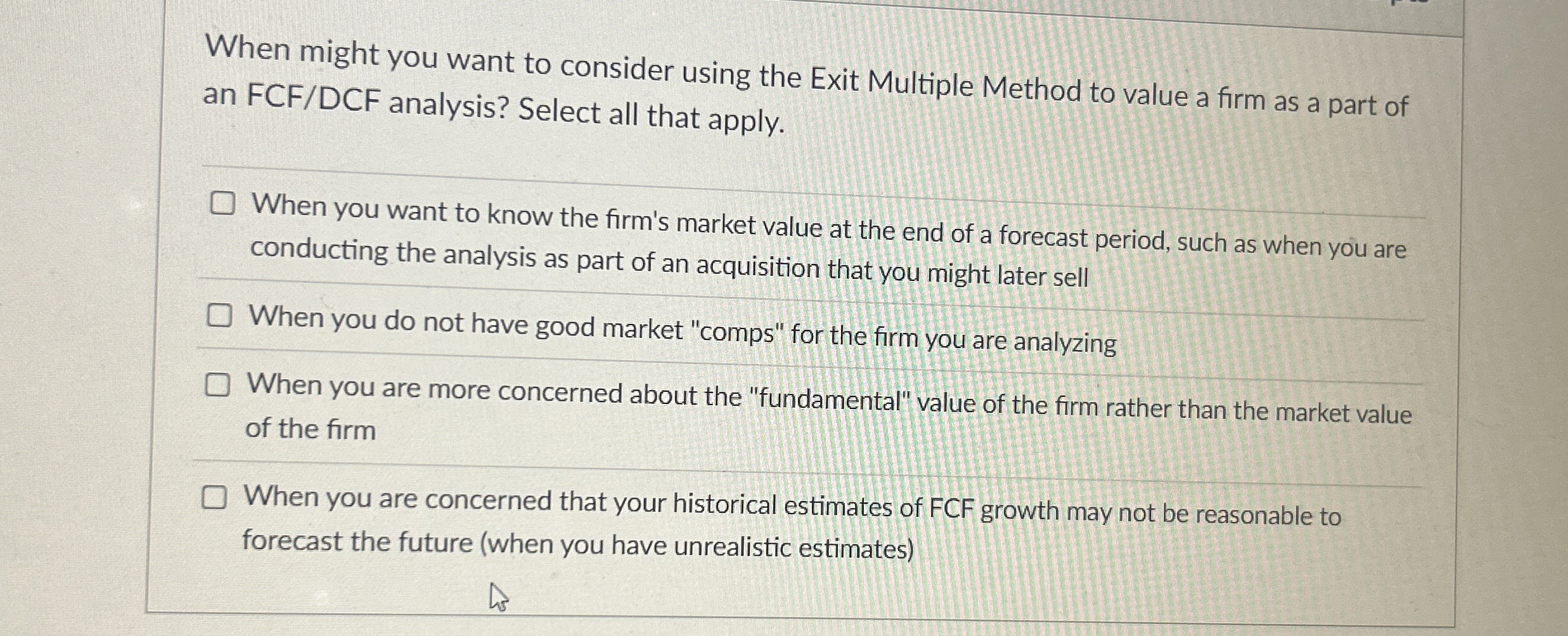

When might you want to consider using the Exit Multiple Method to value a firm as a part of

an FCFDCF analysis? Select all that apply.

When you want to know the firm's market value at the end of a forecast period, such as when you are

conducting the analysis as part of an acquisition that you might later sell

When you do not have good market "comps" for the firm you are analyzing

When you are more concerned about the "fundamental" value of the firm rather than the market value

of the firm

When you are concerned that your historical estimates of FCF growth may not be reasonable to

forecast the future when you have unrealistic estimates

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started