Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When Richard evaluated a capital budgeting project, a new machine needed to manufacture inventory using his firm's required rate of return, b discovered that

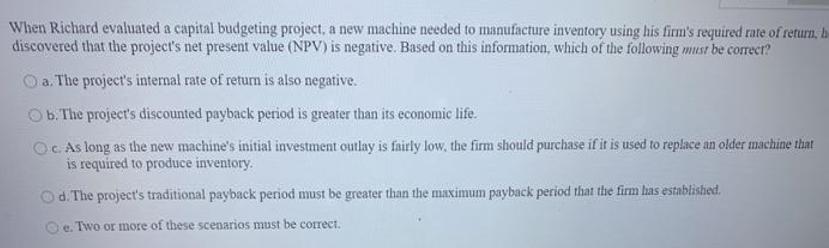

When Richard evaluated a capital budgeting project, a new machine needed to manufacture inventory using his firm's required rate of return, b discovered that the project's net present value (NPV) is negative. Based on this information, which of the following must be correcr? O a. The project's internal rate of return is also negative. Ob. The project's discounted payback period is greater than its economic life. Oc As long as the new machine's initial investment outlay is fairly low, the firm should purchase if it is used to replace an older machine that is required to produce inventory. d. The project's traditional payback period must be greater than the maximum payback period that the firm has established. e. Two or more of these scenarios must be correct.

Step by Step Solution

★★★★★

3.59 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

b The projects ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started