Question

When Sharon Michaels arrived at her office at Waltham Motors Division on June 4, 2004, she was pleased to find the monthly performance report for

When Sharon Michaels arrived at her office at Waltham Motors Division on June 4, 2004, she was pleased to find the monthly performance report for May on her desk. Her job as division controller was to analyze results of operations each month and to prepare a narrative report on operations that was to be forwarded to the corporate headquarters of Marco Corporation. Waltham Motors was a wholly owned subsidiary of Marco. The atmosphere at the division had been one of apprehensiveness throughout the month of May, and today would provide a chance to find out how well division management had compensated for the recent loss of a major customer contract.

The Current Situation

Waltham Motors manufactured electric motors of a single design that were sold to household appliance manufacturers. Originally a family-owned business, the division had been acquired in late 2003 by the Marco Corporation. Few changes had been made in either the companys operating procedures or systems because Marcos management had chosen to delay changing procedures and systems until it was able to observe how well those already in use at Waltham functioned. In April, Sharon Michaels, who had earned a masters degree in business administration in 2002, was transferred from the corporate headquarters controllers office to Waltham Motors. She was joined in late May by David Marshall, also from Marco, who was to be the new division manager.

Because of the lost contract, Michaels had asked the plant accountant to assemble the May figures as quickly as possible, but she was amazed that they were ready so soon. At headquarters, monthly results had rarely been available until several days after the end of each month. Even though the plant accountant had promised Sharon that he would be able to prepare the report in a single day with some overtime work, she was surprised that he had been able to do so.

The division had prepared a budget for 2004 based on estimated sales and production costs. Because sales were not subject to seasonal fluctuations, the monthly budget was merely one-twelfth of the annual budget. No adjustments had been made to the May budget when the contract was lost in April.

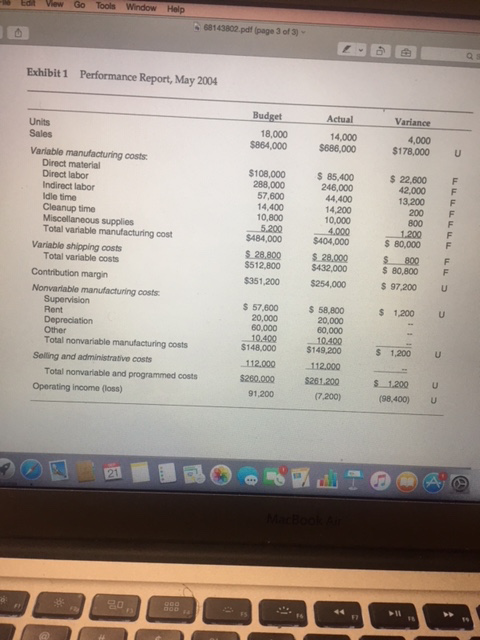

The Performance Report

A glance at the performance report confirmed Michaelss worst fears. Instead of a budgeted profit of $91,200, the report showed the division had lost $7,200 in May. Even allowing for the lost volume, she had expected a better showing than indicated by the performance report. The plant accountant had attached the following memo to the report:

June 3, 11:00 P.M.

Sharon:

As promised, here is the performance report for May. (I told you smaller is better; well show headquarters how efficient our plant accounting department is!) I am sure youll find the bottom line as disappointing as I did, but plant performance really looks good, and the crews there may deserve our compliments. Note how they are at or under budget on every single cost except for supervision. I suspect that the unfavorable variance in supervision was caused directly by the work involved in controlling other costs.

Because I worked late, I am taking a day off tomorrow. The other data you requested are as follows:

1.List some facts that recently have occurred at Waltham Motors.

2.Analyze the report that was presented by the accountant. Do you agree with his conclusions and recommendations?

3.How can the cost control process be improved?

4.Prepare a flexible budget and estimate the line by line variances. How does this result compare with the report presented in question #2.

5.Prepare a comprehensive variance analysis.

6.How do you dispose of the variances for the variable and fixed costs?

7.How is the report from question 5 useful to improve the cost control systems of the firm.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started