Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When solving for 2019 Tax Year, please ASSUME that the real property was placed in business after May 13,1993 46. At the beginning of the

When solving for 2019 Tax Year, please ASSUME that the real property was placed in business after May 13,1993

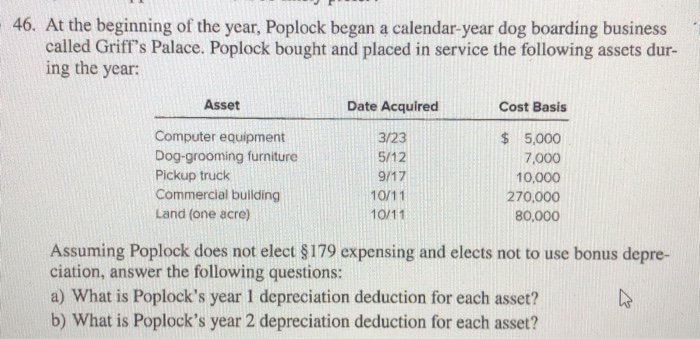

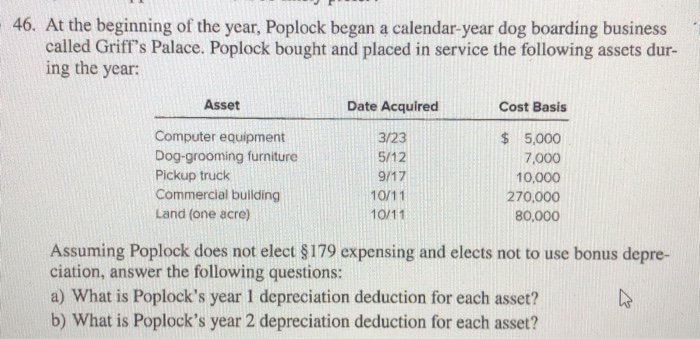

46. At the beginning of the year, Poplock began a calendar-year dog boarding business called Griff's Palace. Poplock bought and placed in service the following assets dur- ing the year: Asset Date Acquired Cost Basis Computer equipment Dog-grooming furniture Pickup truck Commercial building Land (one acre) 3/23 5/12 9/17 10/11 10/11 $ 5,000 7,000 10,000 270,000 80,000 Assuming Poplock does not elect 8179 expensing and elects not to use bonus depre- ciation, answer the following questions: a) What is Poplock's year 1 depreciation deduction for each asset? b) What is Poplock's year 2 depreciation deduction for each asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started