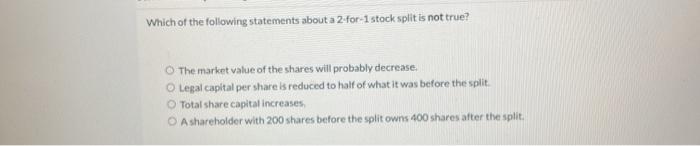

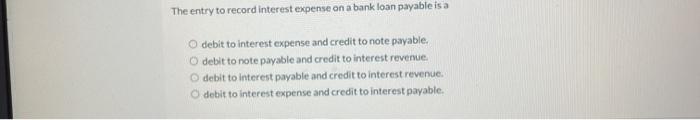

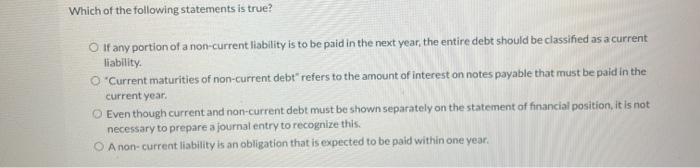

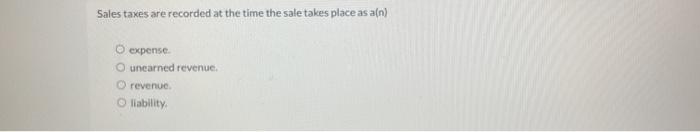

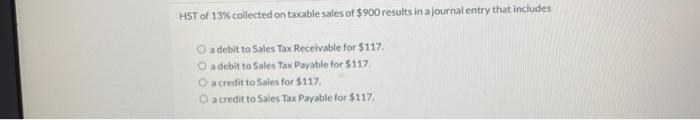

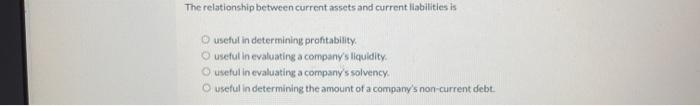

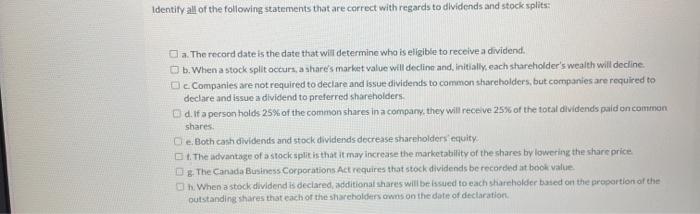

When stock dividends are distributed no entry is necessary common shares is debited. retained earnings is decreased stock dividends distributable is decreased Which of the following statements about a 2-for-1 stock split is not true? The market value of the shares will probably decrease. Legal capital per share is reduced to half of what it was before the split Total share capital increases A shareholder with 200 shares before the split owns 400 shares after the split. The entry to record interest expense on a bank loan payable is a debit to interest expense and credit to note payable. O debit to note payable and credit to interest revenue debit to interest payable and credit to interest revenue debit to interest expense and credit to interest payable, Which of the following statements is true? If any portion of a non-current liability is to be paid in the next year, the entire debt should be classified as a current liability. O'Current maturities of non-current debt" refers to the amount of interest on notes payable that must be paid in the current year. Even though current and non-current debt must be shown separately on the statement of financial position, it is not necessary to prepare a journal entry to recognize this. O A non-current liability is an obligation that is expected to be paid within one year. Sales taxes are recorded at the time the sale takes place as aln) expense Ouncarned revenue revenue liability HST of 23% collected on taxable sales of $900 results in a journal entry that includes o adebit to Sales Tax Receivable for $117. O adebit to Sales Tax Payable for $117 O a credit to Sales for $117. a credit to Sales Tax Payable for $117. The relationship between current assets and current liabilities is useful in determining profitability useful in evaluating a company's liquidity. useful in evaluating a company's solvency O useful in determining the amount of a company's non-current debt. Identity all of the following statements that are correct with regards to dividends and stock splits: a. The record date is the date that will determine who is eligible to receive a dividend, b. When a stock split occurs, a share's market value will decline and initially, each shareholder's wealth will decline. Dc Companies are not required to declare and issue dividends to common shareholders, but companies are required to declare and issue a dividend to preferred shareholders. Od. If a person holds 25% of the common shares in a company, they will receive 25% of the total dividends pald on common shares De Both canh dividends and stock dividends decrease shareholders equity D. The advantage of a stock split is that it may increase the marketability of the shares by lowering the share price g. The Canada Business Corporations Act requires that stock dividends be recorded at book value h. When a stock dividend is declared, additional shares will be issued to each shareholder based on the proportion of the outstanding shares that each of the shareholders owns on the date of declaration