Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When Stock Z was trading at 60, Dee purchased a 1-year put option with a strike price of 58, for a premium of 5, and

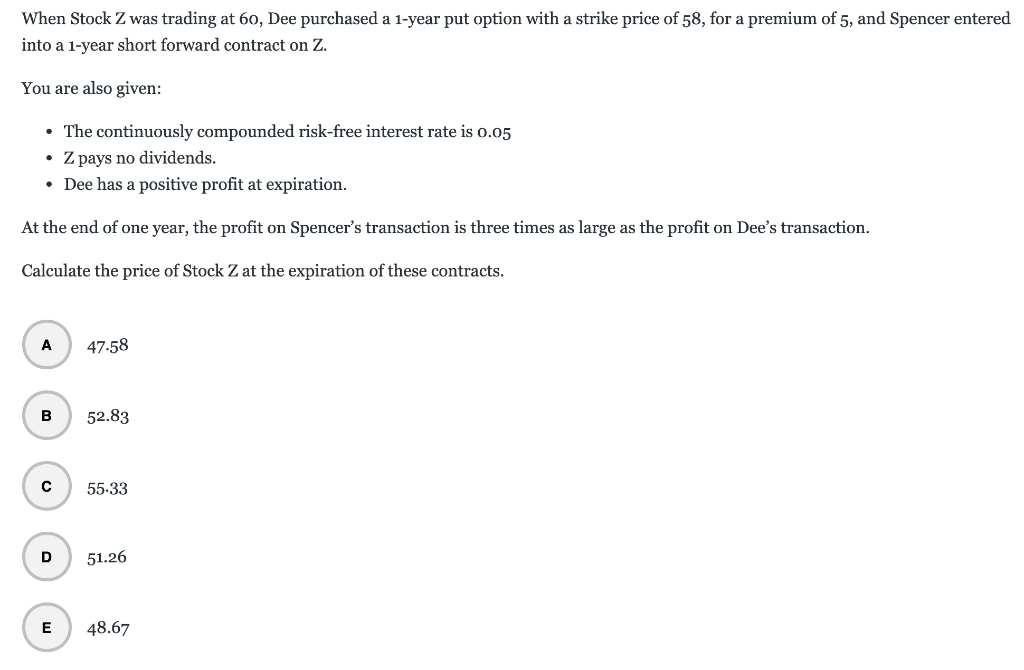

When Stock Z was trading at 60, Dee purchased a 1-year put option with a strike price of 58, for a premium of 5, and Spencer entered into a 1-year short forward contract on Z.

You are also given:

- The continuously compounded risk-free interest rate is 0.05

- Z pays no dividends.

- Dee has a positive profit at expiration.

At the end of one year, the profit on Spencers transaction is three times as large as the profit on Dees transaction.

Calculate the price of Stock Z at the expiration of these contracts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started