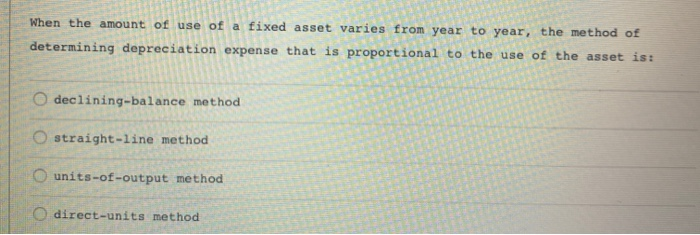

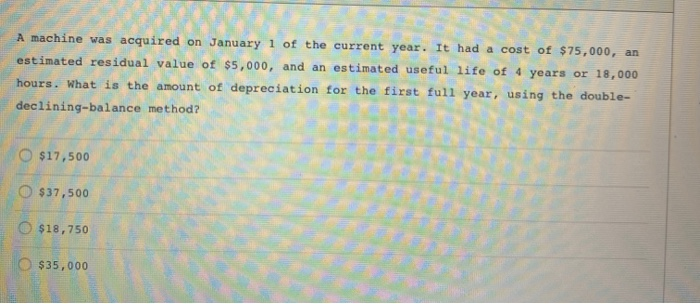

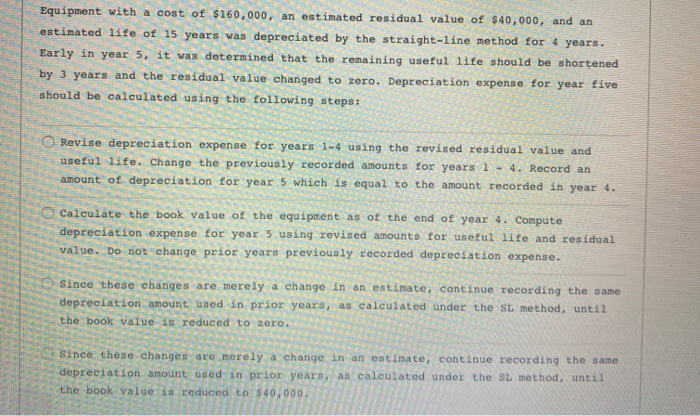

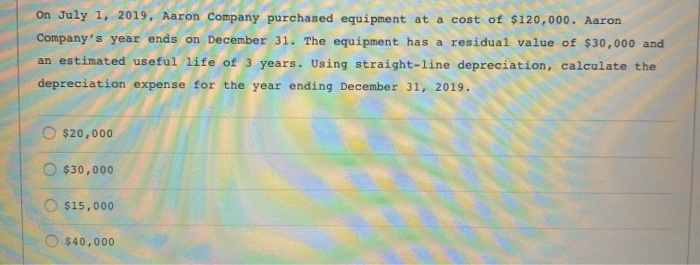

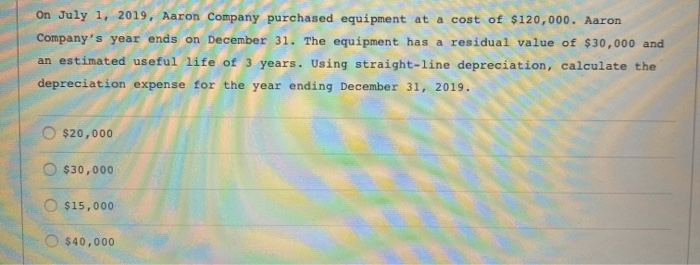

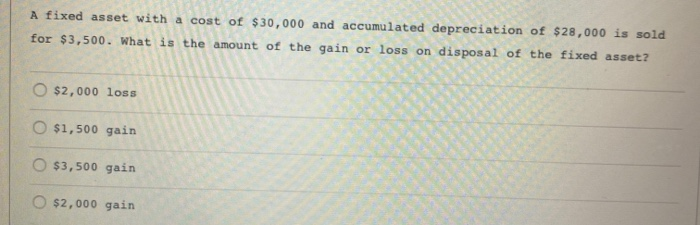

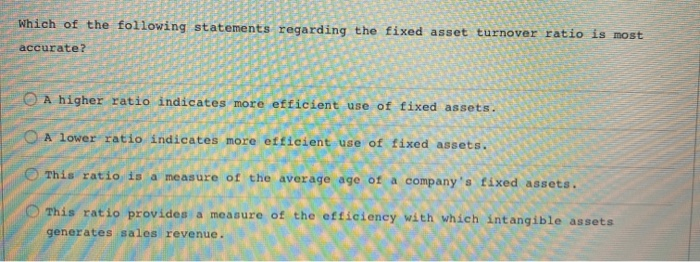

When the amount of use of a fixed asset varies from year to year, the method of determining depreciation expense that is proportional to the use of the asset is: O declining-balance method straight-line method O units-of-output method direct-units method A machine was acquired on January 1 of the current year. It had a cost of $75,000, an estimated residual value of $5,000, and an estimated useful life of 4 years or 18,000 hours. What is the amount of depreciation for the first full year, using the double- declining-balance method? $17,500 $37,500 $18,750 $35,000 Equipment with a cost of $160,000, an estimated residual value of $40,000, and an estimated life of 15 years was depreciated by the straight-line method for 4 years. Early in year 5, it was determined that the remaining useful life should be shortened by 3 years and the residual value changed to zero. Depreciation expense for year five should be calculated using the following steps: Revise depreciation expense for years 1-4 using the revised residual value and useful life. Change the previously recorded amounts for years 1 - 4. Record an amount of depreciation for year 5 which is equal to the amount recorded in year 4. Calculate the book value of the equipment as of the end of year 4. Compute depreciation expense for year 5 using revised amounts for useful life and residual value. Do not change prior years previously recorded depreciation expense. Since these changes are merely a change in an estimate, continue recording the same depreciation amount used in prior years, as calculated under the SL method, until the book value is reduced to zero. Since these changes are merely a change in an estimate, continue recording the same depreciation amount used in prior years, as calculated under the SL method, until the book value is reduced to $40,000. On July 1, 2019, Aaron Company purchased equipment at a cost of $120,000. Aaron Company's year ends on December 31. The equipment has a residual value of $30,000 and an estimated useful life of 3 years. Using straight-line depreciation, calculate the depreciation expense for the year ending December 31, 2019. $20,000 $30,000 $15,000 $40,000 On July 1, 2019, Aaron Company purchased equipment at a cost of $120,000. Aaron Company's year ends on December 31. The equipment has a residual value of $30,000 and an estimated useful life of 3 years. Using straight-line depreciation, calculate the depreciation expense for the year ending December 31, 2019. $20,000 $30,000 $15,000 O $40,000 A fixed asset with a cost of $30,000 and accumulated depreciation of $28,000 is sold for $3,500. What is the amount of the gain or loss on disposal of the fixed asset? O $2,000 loss O $1,500 gain $3,500 gain $2,000 gain Which of the following statements regarding the fixed asset turnover ratio is most accurate? O A higher ratio indicates more efficient use of fixed assets. A lower ratio indicates more efficient use of fixed assets. This ratio is a measure of the average age of a company's fixed assets. This ratio provides a measure of the efficiency with which intangible assets generates sales revenue