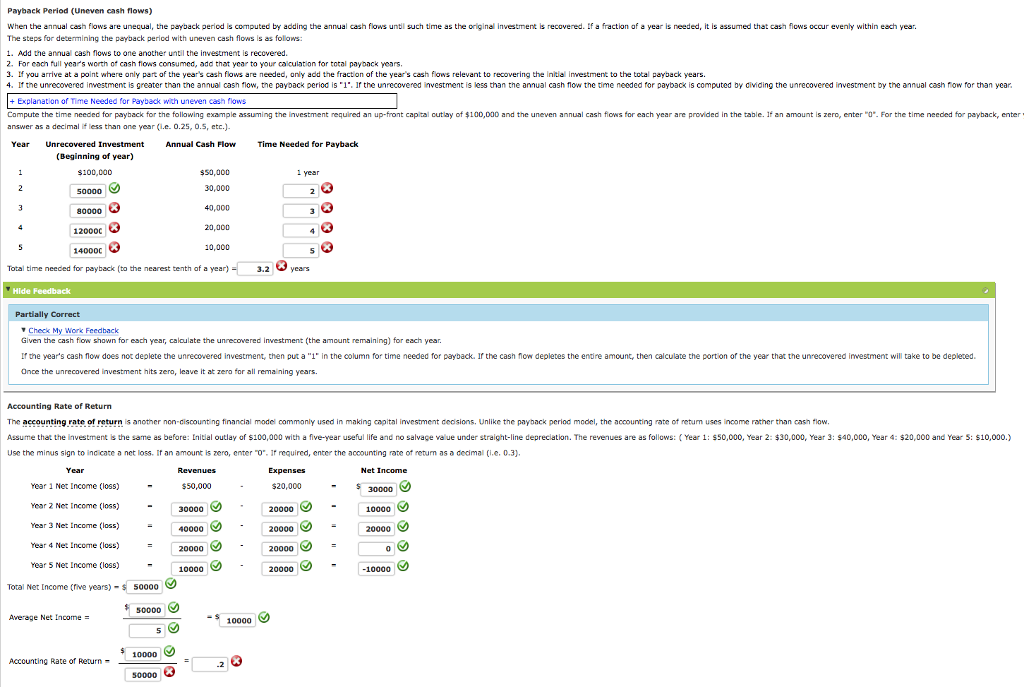

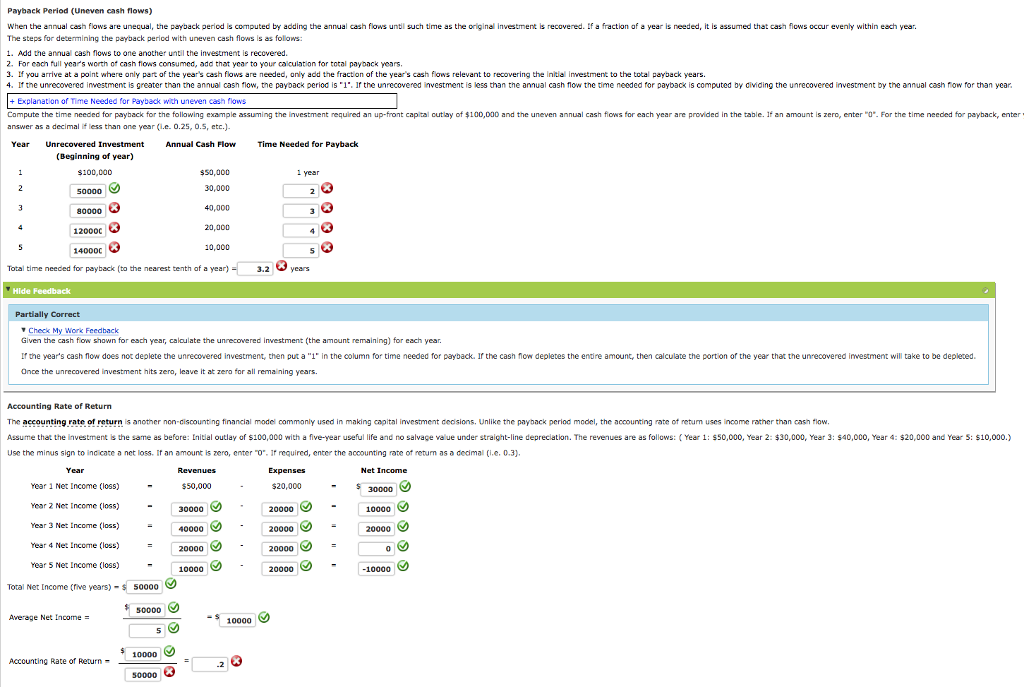

When the annual cash flows are unequal, the payback period is computed by adding the annual cash flows until such time as the original investment is recovered. If a fraction of a year is needed, it is assumed that cash flows occur evenly within each year. The steps for determining the payback period with uneven cash flows is as follows: Add the annual cash flows to one another until the investment is recovered. For each full year's worth of cash flows consumed, add that year to your calculation for total payback years. If you arrive at a point where only part of the years cash flows are needed, only add the fraction of the year's cash flows relevant to recovering the Initial Investment to the total payback years. If the unrecovered investment is greater than the annual cash flow, the payback period is "1". If the unrecovered investment is less than the annual cash flow the time needed for payback is computed by dividing the unrecovered investment by the annual cash flow for than year. Compute the time needed for payback for the following example assuming the investment required an up-front capital cutlay of $100,000 and the uneven annual cash flows for each year are provided in the table. If an amount is zero, enter "0". For the time needed for payback, enter answer as a decimal if less than one year. (i.e. 0.25, 0.5, etc.) Total time needed for payback (to the nearest tenth of a year) = Accounting Rate of Return The accounting rate of return is another non-discounting financial model commonly used in making capital investment decisions. Unlike the payback period model, the accounting rate of return uses income rather than cash flow. Assume that the investment is the same as before: Initial outlay of $100,000 with a five-year useful life and no salvage value under straight-line depreciation. The revenues are as follows: (Year 1: $50,000, Year 2: $30,000, Year 3: $40,000, Year 4: $20,000 and Year 5: $10,000.) Use the minus sign to indicate a net loss. If an amount is zero, enter "0". If required, enter the accounting rate of return as a decimal (i.e. 0.3). Total Net Income (rive years) = $50000 Average Net income = $50000/5 = $10000 Accounting Rate of Return = 10000/50000 = -2