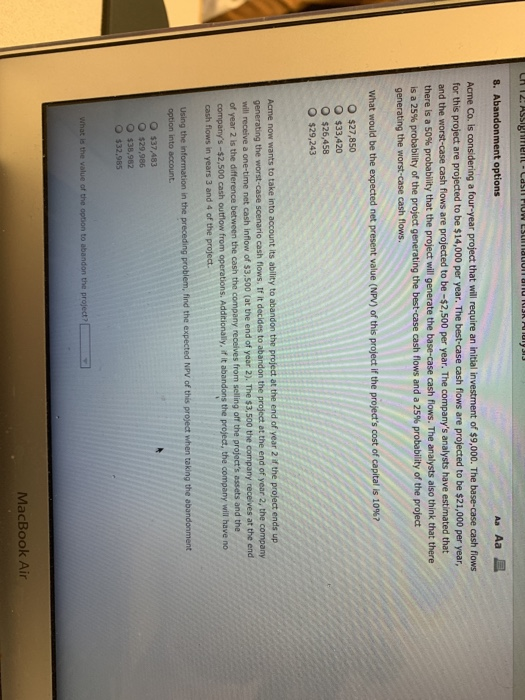

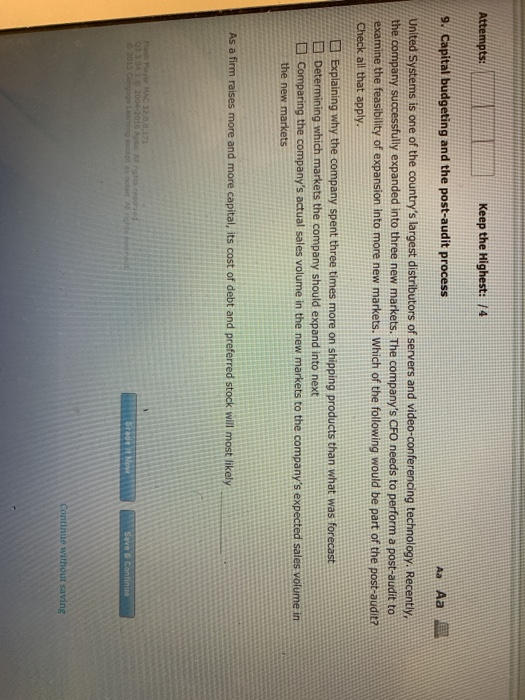

when the CFO adjusts the cost per ton of the cardboard, the project's NPV will decrease. MacBook Air O Expansion option O Timing option focus on its sedans. 8. Abandonment options As Aa Acme Co. is considering a four-year project that will require an initial investment of $9,000. The base-case cash flows for this project are projected to be $14,000 per year. The best-case cash flows are projected to be $21,000 per year, and the worst-case cash flows are projected to be-$2,500 per year. The company's analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash flows and a 25% probability of the project generating the worst-case cash flows. What would be the expected net present value (NPV) of this project if the project's cost of capital is 10%? $27,850 O $33,420 O $26,458 O $29,243 Acme now wants to take into accountits ability to abandon the projedt at the end of year 2 if the project ends up will receive a one-time net cash inflow of $3,500 (at the end of year 2). The $3,500 the company recelves at the end of year 2 is the difference between the cash the company receives from selling off the project's assets and the company's -$2,500 cash outlow from operations. Additionally, if it abandons the projedt, the company will have no cash flows in years 3 and 4 of the project. the option into account. O $37,483 O $38,982 O $32,985 MacBook Air Keep the Highest: /4 Attempts 9. Capital budgeting and the post-audit process United Systems is one of the country's largest distributors of servers and video-conferencing technology. Recently, the company successfully expanded into three new markets. The company's CFO needs to perform a post-audit to examine the feasibility of expansion into more new markets. Which of the following would be part of the post-audit? Check all that apply Explaining why the company spent three times more on shipping products than what was forecast a Determining which markets the company should expand into next Comparing the company's actual sales volume in the new markets to the company's expected sates volume in the new markets As a firm raises more and more capital, its cost of debt and preferred stock will most likely