Answered step by step

Verified Expert Solution

Question

1 Approved Answer

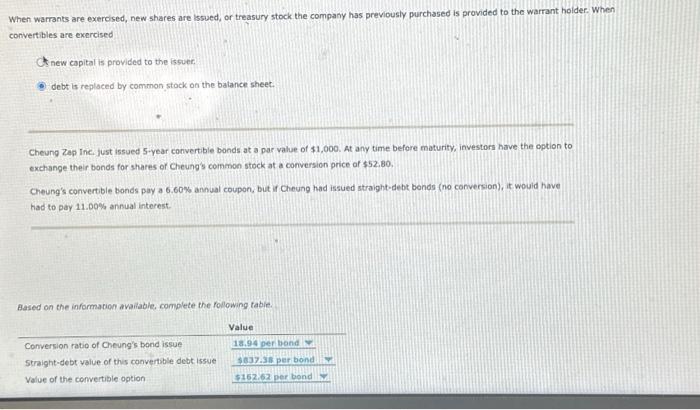

When warrants are exercised, new shares are issued, or treasury stock the company has previously purchased is provided to the warrant holder. When convertibles

When warrants are exercised, new shares are issued, or treasury stock the company has previously purchased is provided to the warrant holder. When convertibles are exercised new capital is provided to the issuer. debt is replaced by common stock on the balance sheet. Cheung Zap Inc. just issued 5-year convertible bonds at a par value of $1,000. At any time before maturity, investors have the option to exchange their bonds for shares of Cheung's common stock at a conversion price of $52.80. Cheung's convertible bonds pay a 6.60% annual coupon, but if Cheung had issued straight-debt bonds (no conversion), it would have had to pay 11.00% annual interest. Based on the information available, complete the following table. Conversion ratio of Cheung's bond issue Value 18.94 per bond w Straight-debt value of this convertible debt issue Value of the convertible option. $837.38 per bond $162.62 per bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started