Question

When Waterways management met to review the year-end financial statements, the room was filled with excitement. Sales had been exceptional during the year and every

When Waterways management met to review the year-end financial statements, the room was filled with excitement. Sales had been exceptional during the year and every department had exceeded the budget and last years sales totals. Several years ago Waterways had implemented a bonus system based on percentage of sales over budget, and the managers were expecting healthy cheques at the end of the year. Yet the plant manager, Ryan Smith, was stunned into silence when he read the bottom line on the income statement for manufacturing operations. It was showing a loss! He immediately approached the CFO asking for an explanation. Ryan wondered, Why did we go through all that trouble and inconvenience to adopt those cost-cutting measures when they had the opposite effect? One of those measures was to move toward lean manufacturing. The CFO retrieved the following information with respect to the top-selling line from the manufacturing operations for the last three years. Production on this line began on January 1, 2014:

| 2014 | 2015 | 2016 | ||||

| Beginning inventory of finished units | 0 | |||||

| Production in units | 72,000 | 73,800 | 59,040 | |||

| Sales in units | 62,000 | 63,800 | 79,040 | |||

| Selling price | $29 | $29 | $31 | |||

| Direct material | $3 | $3 | $4 | |||

| Direct labour | 5 | 5 | 6 | |||

| Variable manufacturing overhead | 4 | 4 | 4 | |||

| Variable selling and administration | 5 | 5 | 5 | |||

| Fixed manufacturing overhead | 590,400 | 590,400 | 590,400 | |||

| Fixed selling and administration | 120,000 | 120,000 | 120,000 |

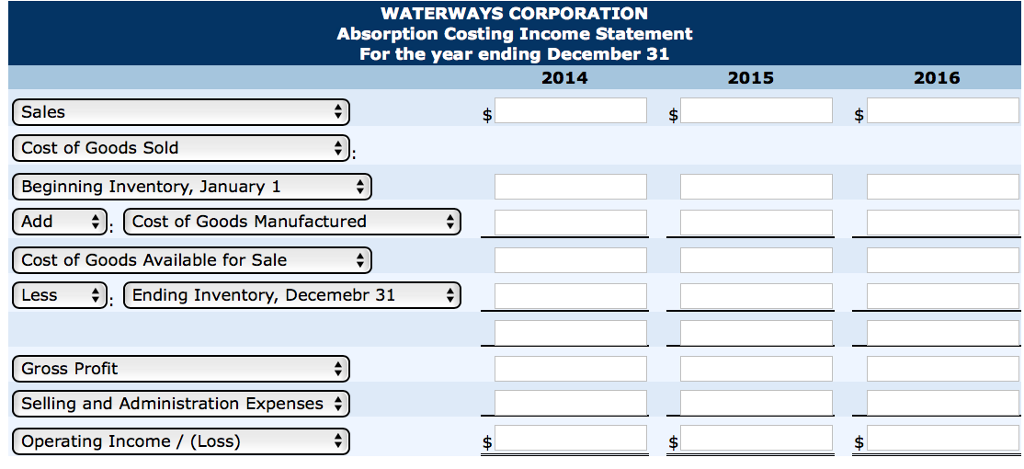

Waterways uses the absorption-costing method and accounts for inventory using FIFO.

(a1)

Using the information provided, recreate Waterways statements for this division using condensed, three-year comparative income statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started