Answered step by step

Verified Expert Solution

Question

1 Approved Answer

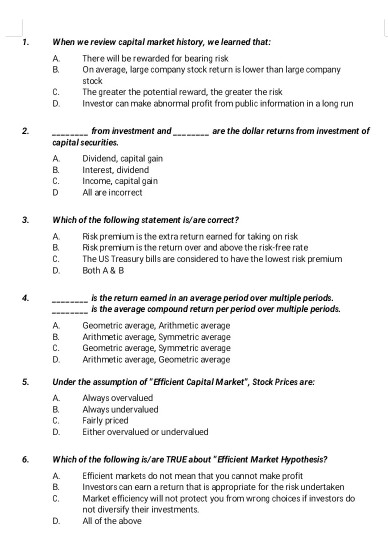

When we review capital market history, we learned that: 1. A. There will be rewarded for bearing risk On average, large company stock return is

When we review capital market history, we learned that: 1. A. There will be rewarded for bearing risk On average, large company stock return is lower than large company stock B. C. The greater the potential reward, the greater the risk Investor can make abnormal profit from public information in a long run D. 2. from investment and are the dollar returns from investment of capital securities. Dividend, capital gain Interest, dividend Income, capital gain All are incorrect A. B. C. D Which of the following statement is/are correct? 3. A. Risk premium is the extra return earned for taking on risk Risk premium is the return over and above the risk-free rate The US Treasury bills are considered to have the lowest risk premium B C. D. Both A & B is the return eamed in an average period over multiple periods. is the average compound return per period over multiple periods. 4. A Geometric average, Arithmetic average Arithmetic average, Symmetric average Geometric average, Symmetric average Arithmetic aver age, Geometric average B. C. D. 5. Under the assumption of "Efficient Capital Market", Stock Prices are: Always overvalued Always undervalued Fairly priced Either overvalued or undervalued A. B C. D. 6. Which of the following is/are TRUE about "Efficient Market Hypothesis? Efficient markets do not mean that you cannot make profit Investors can earn a return that is appropriate for the risk undertaken Market efficiency will not protect you from wrong choices if investors do not diversify their investments. All of the above A. B C. D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started