Question

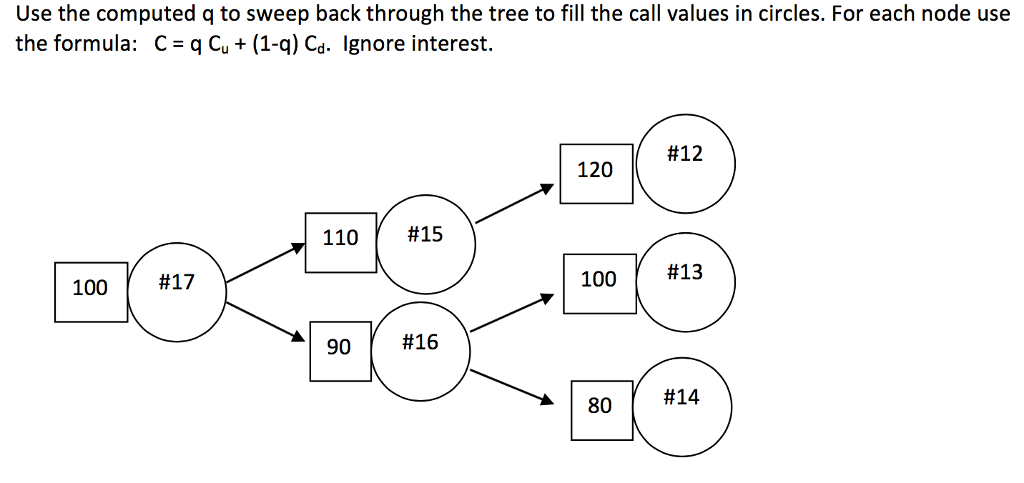

Where #12 = 10, #13 = 0, #14 = 0, #15 = 5, #16 = 0, #17 = 2.5 q = 0.5 Su = 110,

Where #12 = 10, #13 = 0, #14 = 0, #15 = 5, #16 = 0, #17 = 2.5

q = 0.5 Su = 110, S = 100, Sd = 90 q = (S - Sd) / (Su - Sd)

Exercise #18. Today, the delta (hedge ratio) is = (Cu-Cd) / (Su-Sd) = -------------------- (decimal fraction)

Exercise #19. Todays call premium is: $______________. (2 decimals)

Exercise #20. Interpret the delta. If you sell a call option on one hundred shares, the delta hedge will require you to buy _______________ shares of stock (how many?).

Exercise #21. At the same time, the delta hedge will require you to borrow $________________ (Bear in mind that you will collect a premium for one option on one hundred shares.)

Use the computed q to sweep back through the tree to fill the call values in circles. For each node use the formula: C J q Cu (1-q) Cd. Ignore interest. #12 120 110 #15 #13 #17 100 90 #16 80 #14Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started