Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Where are you chegg study experts.You people really dishurt me) (This is question given by teacher to us how you said that this is uncomplete?)

(Where are you chegg study experts.You people really dishurt me)

(Where are you chegg study experts.You people really dishurt me)

(This is question given by teacher to us how you said that this is uncomplete?)

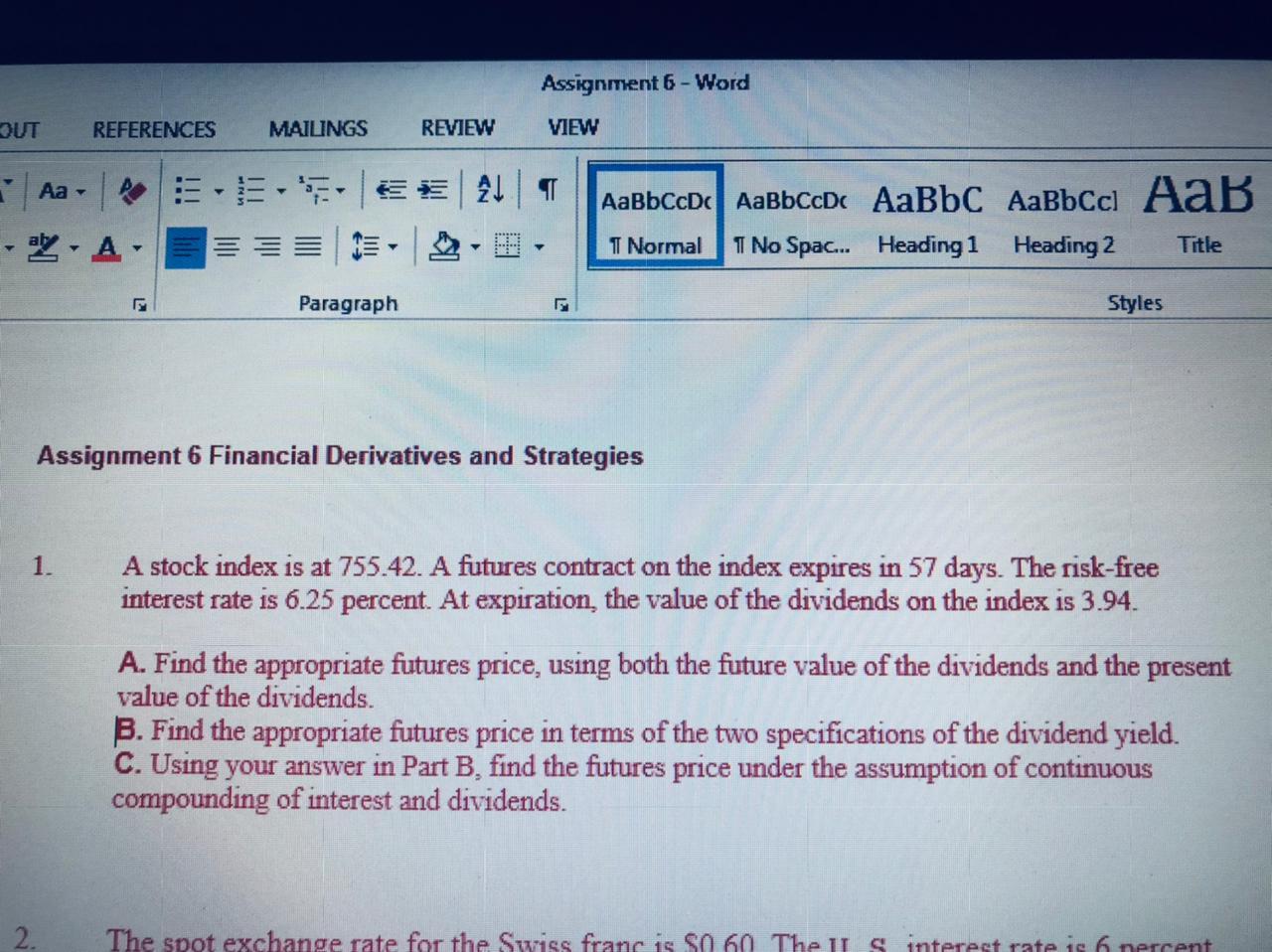

Assignment 6 - Word BUT REFERENCES MAILINGS REVIEW VIEW ,! T - Aa- ay - A- | cDe AaBbc . 1 No Spac... Heading1 Heading 2 I Normal Title Paragraph Styles Assignment 6 Financial Derivatives and Strategies 1. A stock index is at 755.42. A futures contract on the index expires in 57 days. The risk-free interest rate is 6.25 percent. At expiration, the value of the dividends on the index is 3.94. A. Find the appropriate futures price, using both the future value of the dividends and the present value of the dividends. B. Find the appropriate futures price in terms of the two specifications of the dividend yield. C. Using your answer in Part B. find the futures price under the assumption of continuous compounding of interest and dividends. 2. The spot exchange rate for the Swiss franc is SO 60. The us interest rate is 6 percent Assignment 6 - Word BUT REFERENCES MAILINGS REVIEW VIEW ,! T - Aa- ay - A- | cDe AaBbc . 1 No Spac... Heading1 Heading 2 I Normal Title Paragraph Styles Assignment 6 Financial Derivatives and Strategies 1. A stock index is at 755.42. A futures contract on the index expires in 57 days. The risk-free interest rate is 6.25 percent. At expiration, the value of the dividends on the index is 3.94. A. Find the appropriate futures price, using both the future value of the dividends and the present value of the dividends. B. Find the appropriate futures price in terms of the two specifications of the dividend yield. C. Using your answer in Part B. find the futures price under the assumption of continuous compounding of interest and dividends. 2. The spot exchange rate for the Swiss franc is SO 60. The us interest rate is 6 percentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started