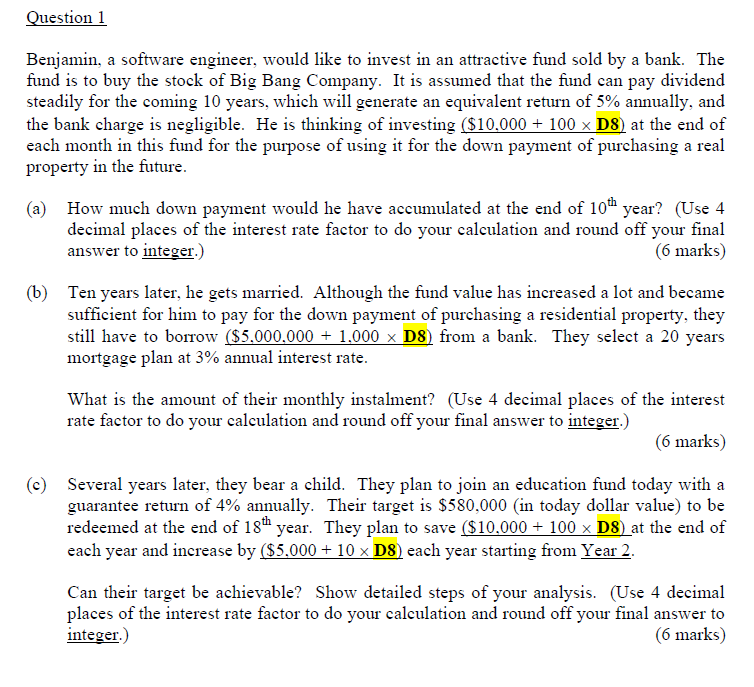

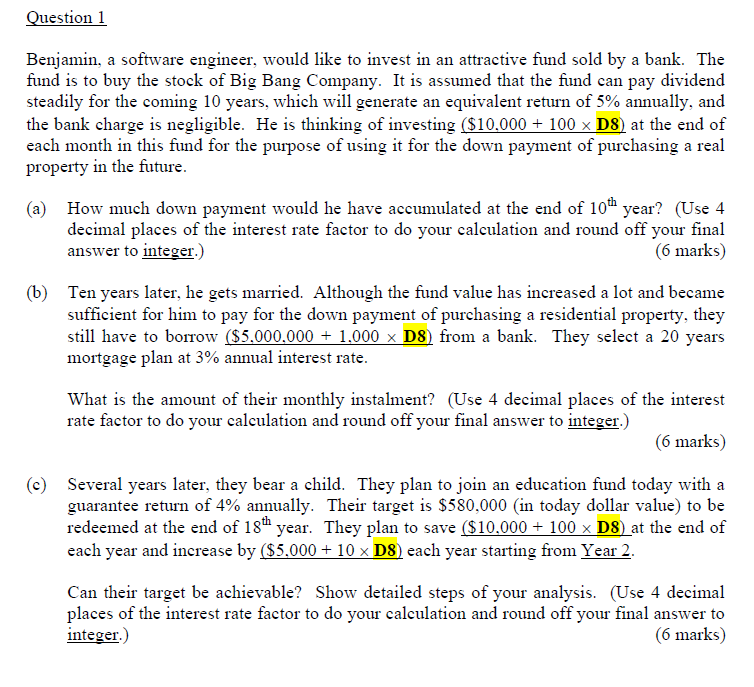

Where D8 = 2

Question 1 Benjamin, a software engineer, would like to invest in an attractive fund sold by a bank. The fund is to buy the stock of Big Bang Company. It is assumed that the fund can pay dividend steadily for the coming 10 years, which will generate an equivalent return of 5% annually, and the bank charge is negligible. He is thinking of investing ($10,000 + 100 x D8) at the end of each month in this fund for the purpose of using it for the down payment of purchasing a real property in the future. (a) How much down payment would he have accumulated at the end of 10th year? (Use 4 decimal places of the interest rate factor to do your calculation and round off your final answer to integer.) (6 marks) (6) Ten years later, he gets married. Although the fund value has increased a lot and became sufficient for him to pay for the down payment of purchasing a residential property, they still have to borrow ($5,000,000 + 1,000 x D8) from a bank. They select a 20 years mortgage plan at 3% annual interest rate. What is the amount of their monthly instalment? (Use 4 decimal places of the interest rate factor to do your calculation and round off your final answer to integer.) (6 marks) (c) Several years later, they bear a child. They plan to join an education fund today with a guarantee return of 4% annually. Their target is $580,000 in today dollar value) to be redeemed at the end of 18th year. They plan to save ($10,000 + 100 x D8) at the end of each year and increase by ($5,000 + 10 x D8) each year starting from Year 2. Can their target be achievable? Show detailed steps of your analysis. (Use 4 decimal places of the interest rate factor to do your calculation and round off your final answer to integer.) (6 marks) Question 1 Benjamin, a software engineer, would like to invest in an attractive fund sold by a bank. The fund is to buy the stock of Big Bang Company. It is assumed that the fund can pay dividend steadily for the coming 10 years, which will generate an equivalent return of 5% annually, and the bank charge is negligible. He is thinking of investing ($10,000 + 100 x D8) at the end of each month in this fund for the purpose of using it for the down payment of purchasing a real property in the future. (a) How much down payment would he have accumulated at the end of 10th year? (Use 4 decimal places of the interest rate factor to do your calculation and round off your final answer to integer.) (6 marks) (6) Ten years later, he gets married. Although the fund value has increased a lot and became sufficient for him to pay for the down payment of purchasing a residential property, they still have to borrow ($5,000,000 + 1,000 x D8) from a bank. They select a 20 years mortgage plan at 3% annual interest rate. What is the amount of their monthly instalment? (Use 4 decimal places of the interest rate factor to do your calculation and round off your final answer to integer.) (6 marks) (c) Several years later, they bear a child. They plan to join an education fund today with a guarantee return of 4% annually. Their target is $580,000 in today dollar value) to be redeemed at the end of 18th year. They plan to save ($10,000 + 100 x D8) at the end of each year and increase by ($5,000 + 10 x D8) each year starting from Year 2. Can their target be achievable? Show detailed steps of your analysis. (Use 4 decimal places of the interest rate factor to do your calculation and round off your final answer to integer.) (6 marks)