Answered step by step

Verified Expert Solution

Question

1 Approved Answer

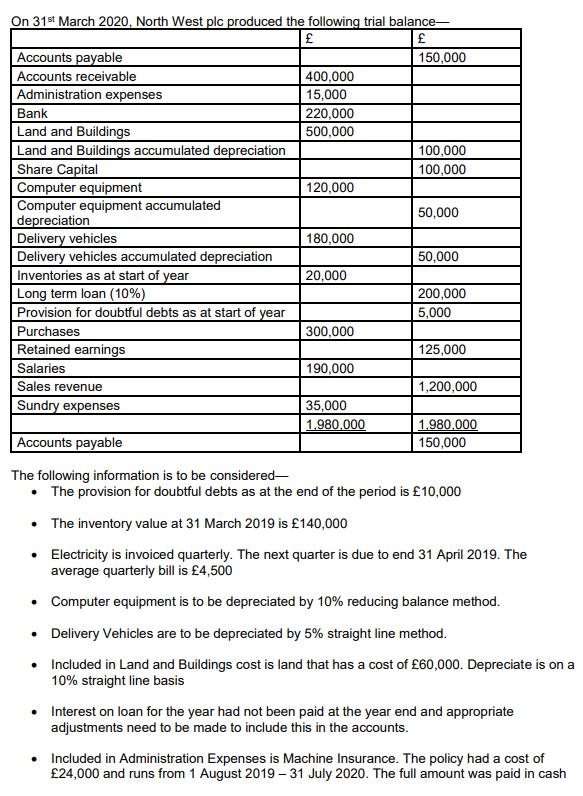

Where did the figures for admin and depreciation come from/calculated on the profit and loss account from the Trial balance and additional information below: On

Where did the figures for admin and depreciation come from/calculated on the profit and loss account from the Trial balance and additional information below:

On 31st March 2020, North West plc produced the following trial balance- Accounts payable Accounts receivable Administration expenses Bank Land and Buildings Land and Buildings accumulated depreciation Share Capital Computer equipment Computer equipment accumulated depreciation Delivery vehicles Delivery vehicles accumulated depreciation 400,000 15,000 220,000 500,000 120,000 180,000 20,000 300,000 190,000 150,000 Inventories as at start of year Long term loan (10%) Provision for doubtful debts as at start of year Purchases Retained earnings Salaries Sales revenue Sundry expenses Accounts payable The following information is to be considered- The provision for doubtful debts as at the end of the period is 10,000 The inventory value at 31 March 2019 is 140,000 Electricity is invoiced quarterly. The next quarter is due to end 31 April 2019. The average quarterly bill is 4,500 Computer equipment is to be depreciated by 10% reducing balance method. Delivery Vehicles are to be depreciated by 5% straight line method. Included in Land and Buildings cost is land that has a cost of 60,000. Depreciate is on a 10% straight line basis 35,000 1,980,000 100,000 100,000 50,000 50,000 200,000 5,000 125,000 1,200,000 1,980,000 150,000 Interest on loan for the year had not been paid at the year end and appropriate adjustments need to be made to include this in the accounts. Included in Administration Expenses is Machine Insurance. The policy had a cost of 24,000 and runs from 1 August 2019-31 July 2020. The full amount was paid in cash On 31st March 2020, North West plc produced the following trial balance- Accounts payable Accounts receivable Administration expenses Bank Land and Buildings Land and Buildings accumulated depreciation Share Capital Computer equipment Computer equipment accumulated depreciation Delivery vehicles Delivery vehicles accumulated depreciation 400,000 15,000 220,000 500,000 120,000 180,000 20,000 300,000 190,000 150,000 Inventories as at start of year Long term loan (10%) Provision for doubtful debts as at start of year Purchases Retained earnings Salaries Sales revenue Sundry expenses Accounts payable The following information is to be considered- The provision for doubtful debts as at the end of the period is 10,000 The inventory value at 31 March 2019 is 140,000 Electricity is invoiced quarterly. The next quarter is due to end 31 April 2019. The average quarterly bill is 4,500 Computer equipment is to be depreciated by 10% reducing balance method. Delivery Vehicles are to be depreciated by 5% straight line method. Included in Land and Buildings cost is land that has a cost of 60,000. Depreciate is on a 10% straight line basis 35,000 1,980,000 100,000 100,000 50,000 50,000 200,000 5,000 125,000 1,200,000 1,980,000 150,000 Interest on loan for the year had not been paid at the year end and appropriate adjustments need to be made to include this in the accounts. Included in Administration Expenses is Machine Insurance. The policy had a cost of 24,000 and runs from 1 August 2019-31 July 2020. The full amount was paid in cash

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

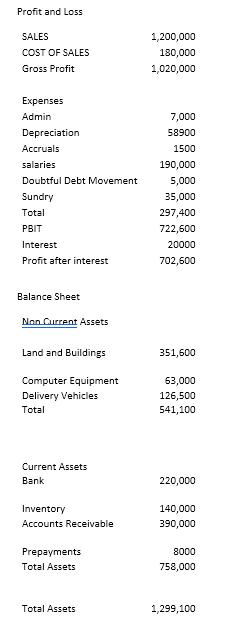

1 Administration Expenses Machine Insurance Policy cost for the year 24000 Time covered by the policy within the financial year 8 months Remaining cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started