Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Where is income in this income statement? How could I calculate return on shareholders equity using this information? should I invest in this business? (analysis)

Where is income in this income statement? How could I calculate return on shareholders equity using this information? should I invest in this business? (analysis)

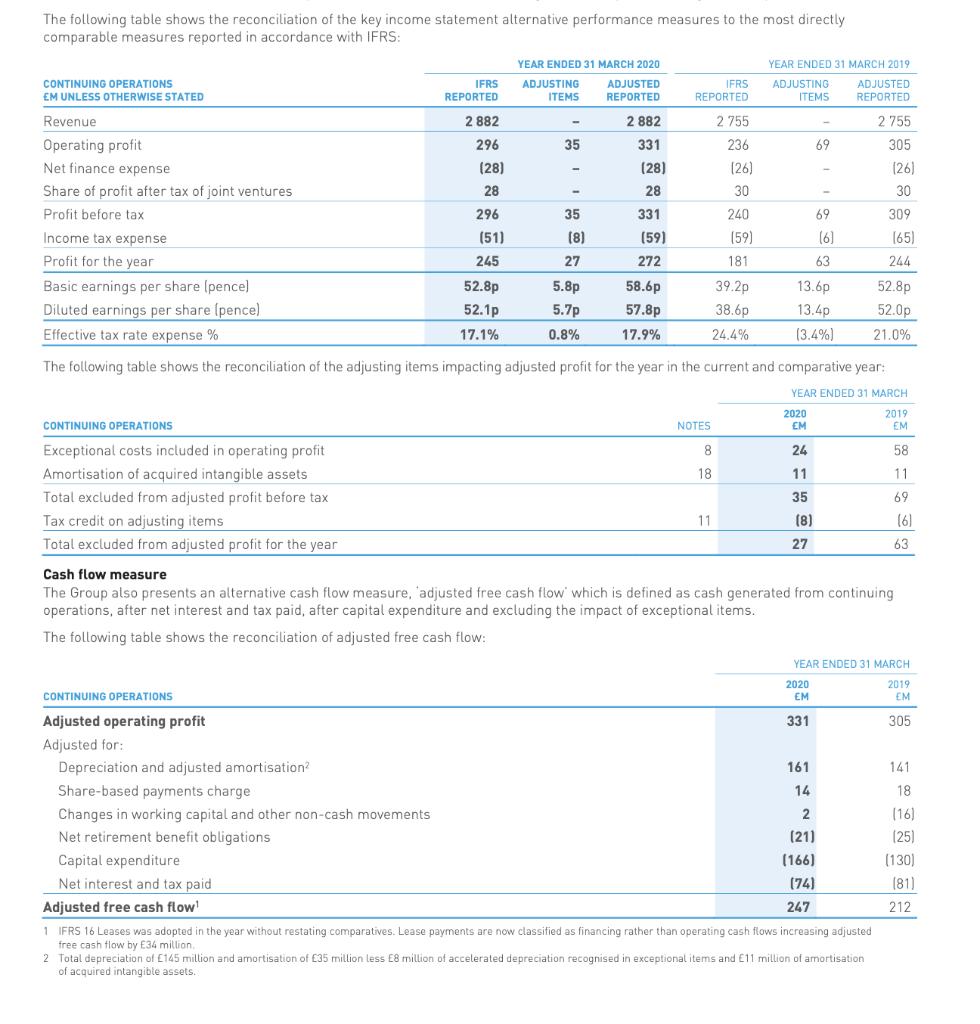

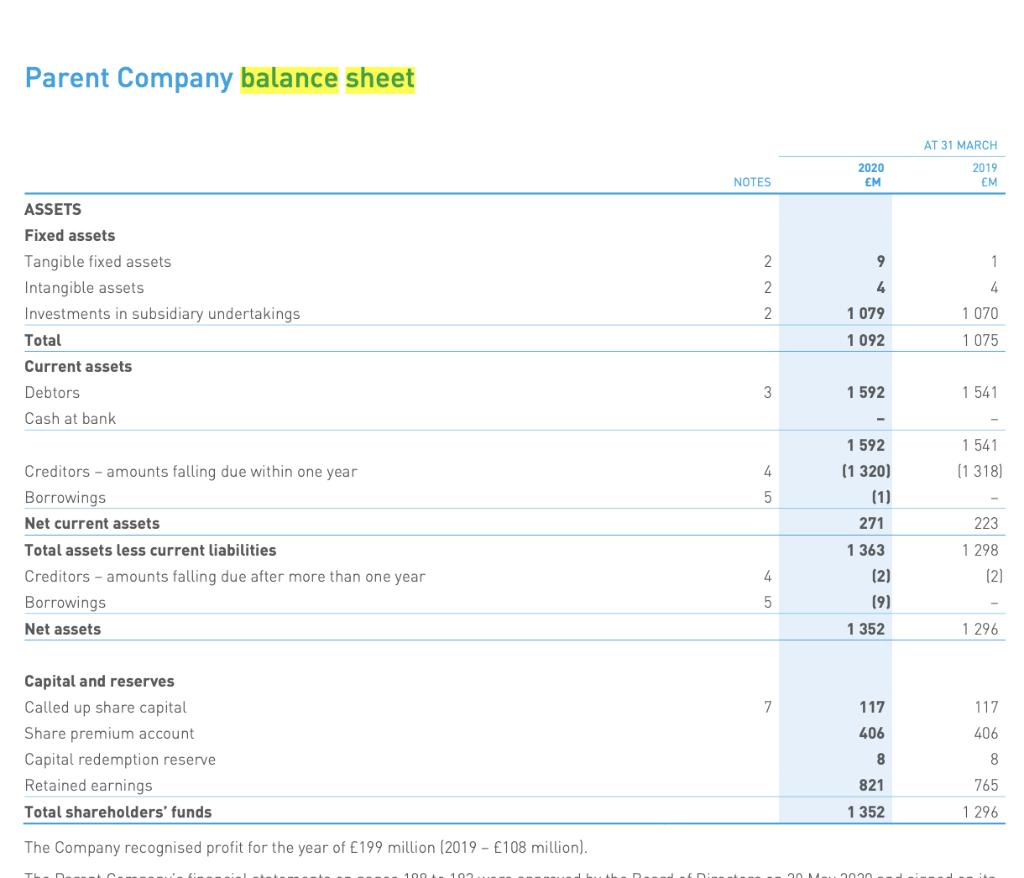

The following table shows the reconciliation of the key income statement alternative performance measures to the most directly comparable measures reported in accordance with IFRS: YEAR ENDED 31 MARCH 2020 YEAR ENDED 31 MARCH 2019 ADJUSTED ADJUSTED REPORTED CONTINUING OPERATIONS IFRS ADJUSTING IFRS ADJUSTING EM UNLESS OTHERWISE STATED REPORTED ITEMS REPORTED REPORTED ITEMS Revenue 2 882 2 882 2 755 2 755 Operating profit 296 35 331 236 69 305 Net finance expense (28) (28) (26) (26) Share of profit after tax of joint ventures 28 28 30 30 Profit before tax 296 35 331 240 69 309 Income tax expense (51) (8) (59) (59) (6] [65) Profit for the year 245 27 272 181 63 244 Basic earnings per share Ipence) 52.8p 5.8p 58.6p 39.2p 13.6p 52.8p Diluted earnings per share (pence) 52.1p 5.7p 57.8p 38.6p 13.4p 52.0p Effective tax rate expense % 17.1% 0.8% 17.9% 24.4% (3.4%) 21.0% The following table shows the reconciliation of the adjusting items impacting adjusted profit for the year in the current and comparative year: YEAR ENDED 31 MARCH 2020 2019 EM CONTINUING OPERATIONS NOTES EM Exceptional costs included in operating profit 8 24 58 Amortisation of acquired intangible assets 18 11 11 Total excluded from adjusted profit before tax 35 69 Tax credit on adjusting items 11 (8) (6) Total excluded from adjusted profit for the year 27 63 Cash flow measure The Group also presents an alternative cash flow measure, 'adjusted free cash flow which is defined as cash generated from continuing operations, after net interest and tax paid, after capital expenditure and excluding the impact of exceptional items. The following table shows the reconciliation of adjusted free cash flow: YEAR ENDED 31 MARCH 2020 EM 2019 EM CONTINUING OPERATIONS Adjusted operating profit 331 305 Adjusted for: Depreciation and adjusted amortisation? 161 141 Share-based payments charge 14 18 Changes in working capital and other non-cash movements 2 (16) Net retirement benefit obligations (21) (25) Capital expenditure (166) (130) Net interest and tax paid (74) (81) Adjusted free cash flow 247 212 1 IFRS 16 Leases was adopted in the year without restating comparatives. Lease payments are now classified as financing rather than operating cash flows increasing adjusted free cash flow by 34 million. 2 Total depreciation of E145 million and amortisation of 35 million less E8 million of accelerated depreciation recognised in exceptional items and E11 million of amortisation of acquired intangible assets.

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Return on Shareholders Equity Ratio is a measure of relat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started