Answered step by step

Verified Expert Solution

Question

1 Approved Answer

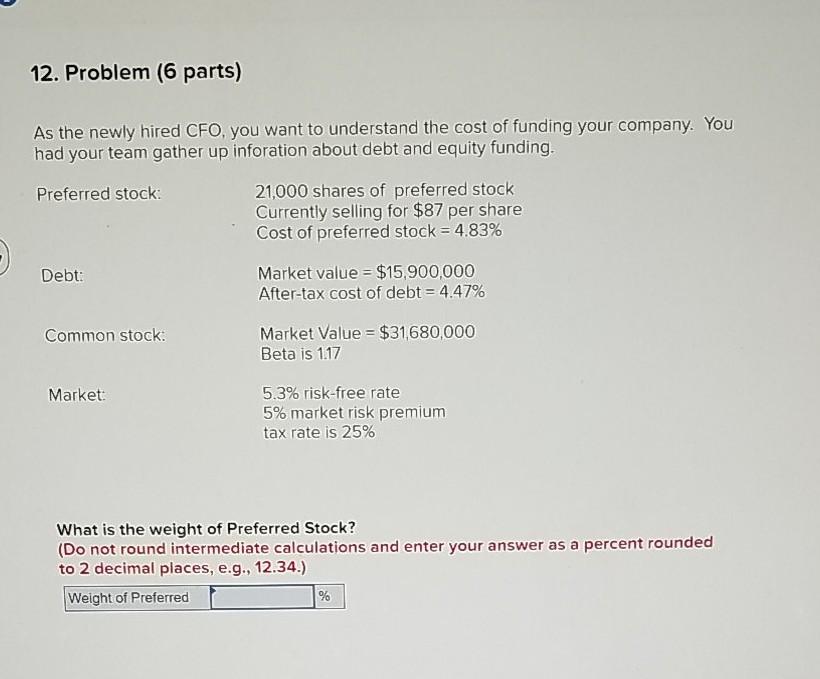

where it says formula sheet ignore and simply post the equation you used please. thanks! 12. Problem (6 parts) As the newly hired CFO, you

where it says formula sheet ignore and simply post the equation you used please. thanks!

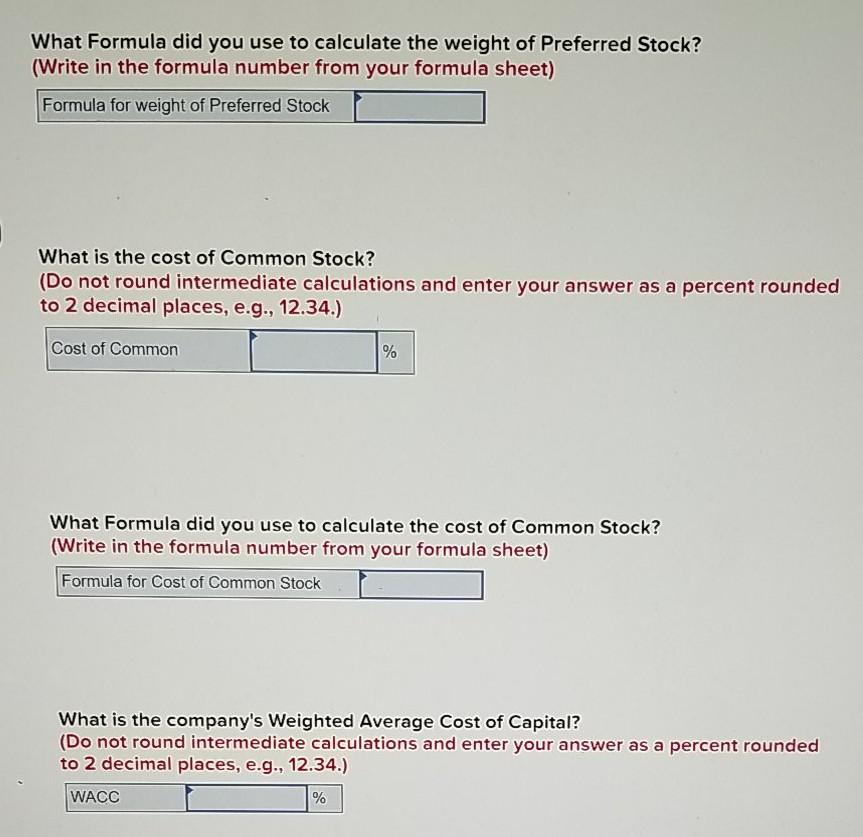

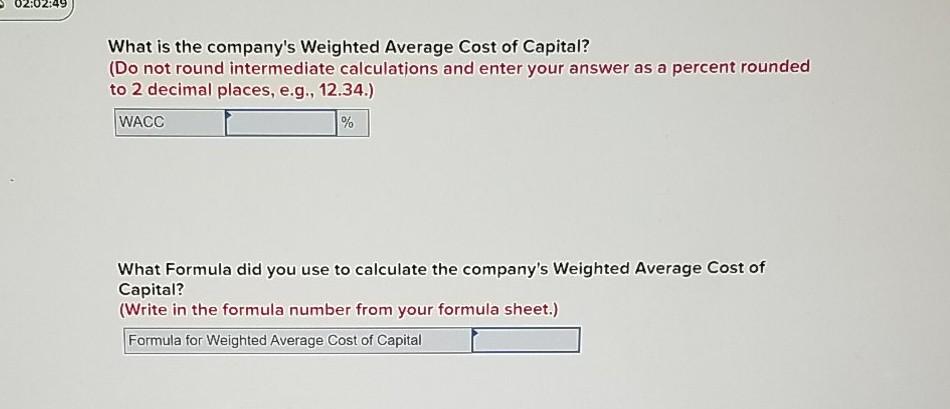

12. Problem (6 parts) As the newly hired CFO, you want to understand the cost of funding your company. You had your team gather up inforation about debt and equity funding. Preferred stock: 21,000 shares of preferred stock Currently selling for $87 per share Cost of preferred stock = 4.83% Debt: Market value = $15,900,000 After-tax cost of debt = 4.47% Common stock: Market Value = $31,680,000 Beta is 117 Market 5.3% risk-free rate 5% market risk premium tax rate is 25% What is the weight of Preferred Stock? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 12.34.) Weight of Preferred % What Formula did you use to calculate the weight of Preferred Stock? (Write in the formula number from your formula sheet) Formula for weight of Preferred Stock What is the cost of Common Stock? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 12.34.) Cost of Common % What Formula did you use to calculate the cost of Common Stock? (Write in the formula number from your formula sheet) Formula for Cost of Common Stock What is the company's Weighted Average Cost of Capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 12.34.) WACC % 02:02:49 What is the company's Weighted Average Cost of Capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 12.34.) WACC % What Formula did you use to calculate the company's Weighted Average Cost of Capital? (Write in the formula number from your formula sheet.) Formula for Weighted Average Cost of CapitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started