Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Where necessary, use the table of present value factors. A link to download a copy of the PV factors is provided in the test instructions

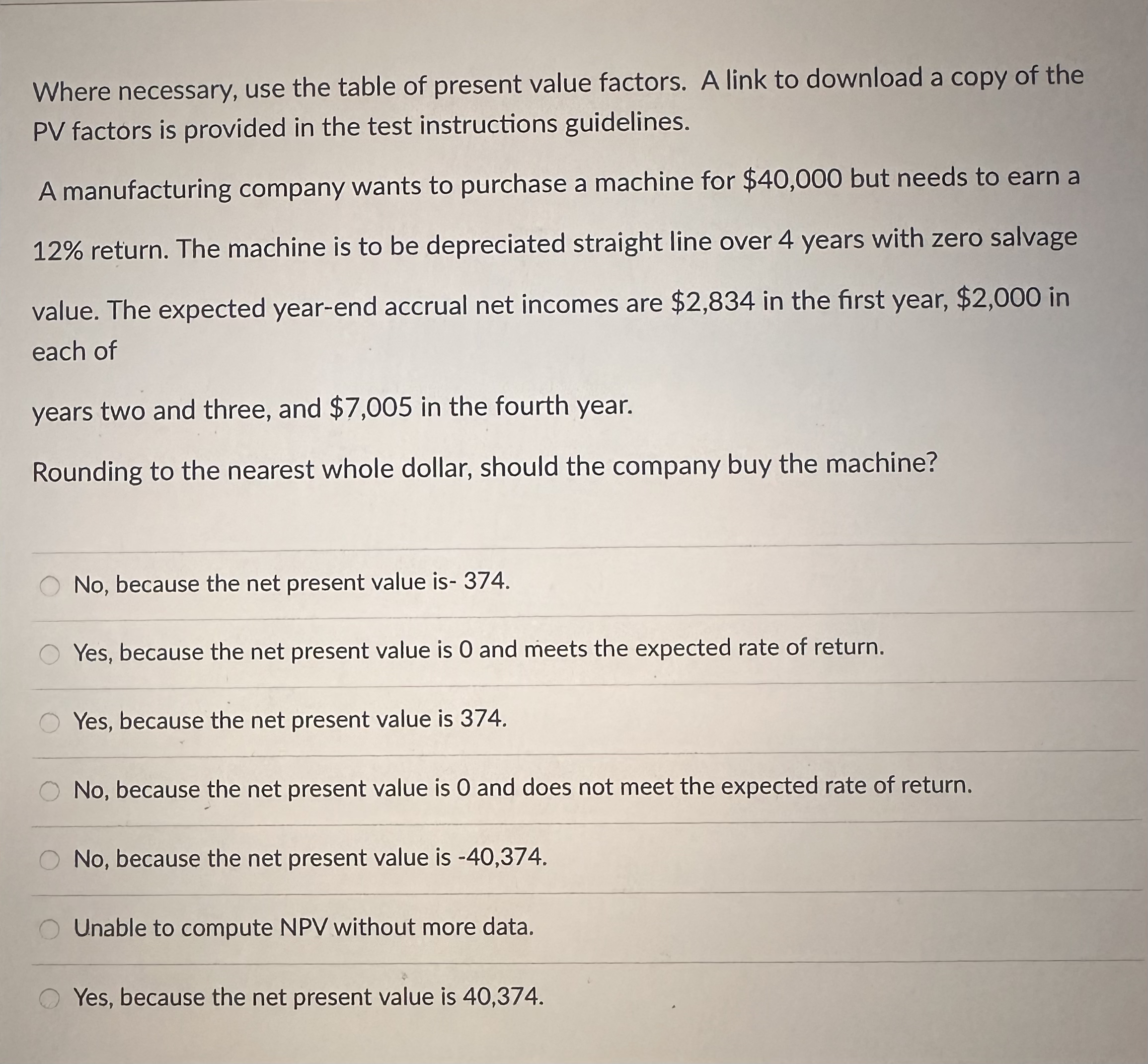

Where necessary, use the table of present value factors. A link to download a copy of the PV factors is provided in the test instructions guidelines.

A manufacturing company wants to purchase a machine for $ but needs to earn a return. The machine is to be depreciated straight line over years with zero salvage value. The expected yearend accrual net incomes are $ in the first year, $ in each of

years two and three, and $ in the fourth year.

Rounding to the nearest whole dollar, should the company buy the machine?

No because the net present value is

Yes, because the net present value is and meets the expected rate of return.

Yes, because the net present value is

No because the net present value is and does not meet the expected rate of return.

No because the net present value is

Unable to compute NPV without more data.

Yes, because the net present value is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started