Answered step by step

Verified Expert Solution

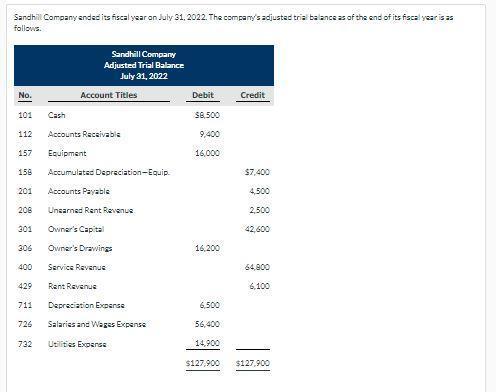

Question

1 Approved Answer

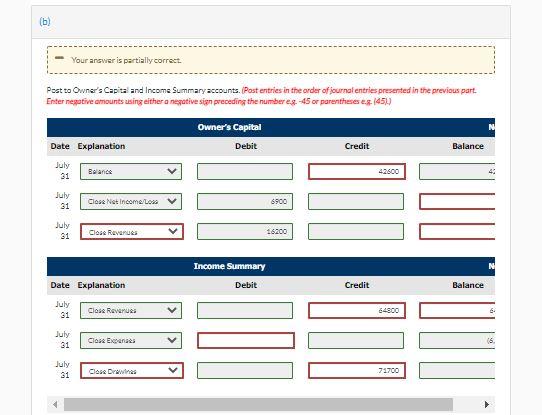

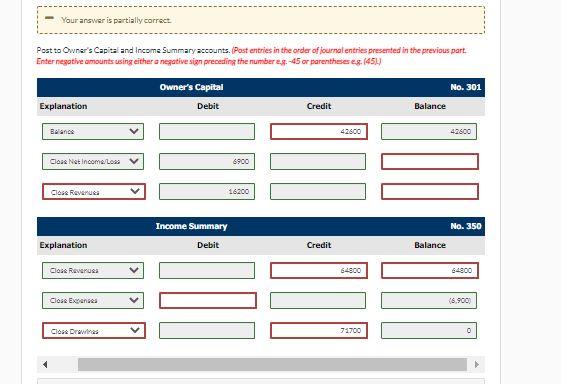

Where the RED is ; is where I need help; what goes there & what numbers am I missing? I am lost QUESTION IS: Post

Where the RED is ; is where I need help; what goes there & what numbers am I missing? I am lost

QUESTION IS: Post to Owners Capital and Income Summary accounts. (Post entries in the order of journal entries presented in the previous part. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Word Bank:

- Accounts Payable

- Accounts Receivable

- Accumulated Depreciation-Buildings

- Accumulated Depreciation-Equipment

- Accumulated Depreciation-Delivery Trucks

- Advertising Expense

- Buildings

- Cash

- Debt Investments

- Delivery Trucks

- Depreciation Expense

- Equipment

- Gasoline Expense

- Income Summary

- Income Tax Expense

- Income Taxes Payable

- Insurance Expense

- Interest Expense

- Interest Payable

- Interest Receivable

- Interest Revenue

- Inventory

- Land

- Long-term Debt

- Long-term Investments

- Maintenance and Repairs Expense

- Miscellaneous Expense

- Mortgage Payable

- No Entry

- Notes Payable

- Notes Receivable

- Owner's Capital

- Owner's Drawings

- Patent Needs

- Prepaid Advertising

- Prepaid Insurance

- Prepaid Rent

- Rent Expense

- Rent Revenue

- Salaries and Wages Expense

- Salaries and Wages Payable

- Service Revenue

- Short-Term Investments

- Stock Investments

- Supplies

- Supplies Expense

- Ticket Revenue

- Unearned Rent Revenue

- Unearned Service Revenue

- Utilities Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started