- Which company has a better profit margin ratio?

Explain what you learned about the change in profit margin within each company and why this may be important to consider.

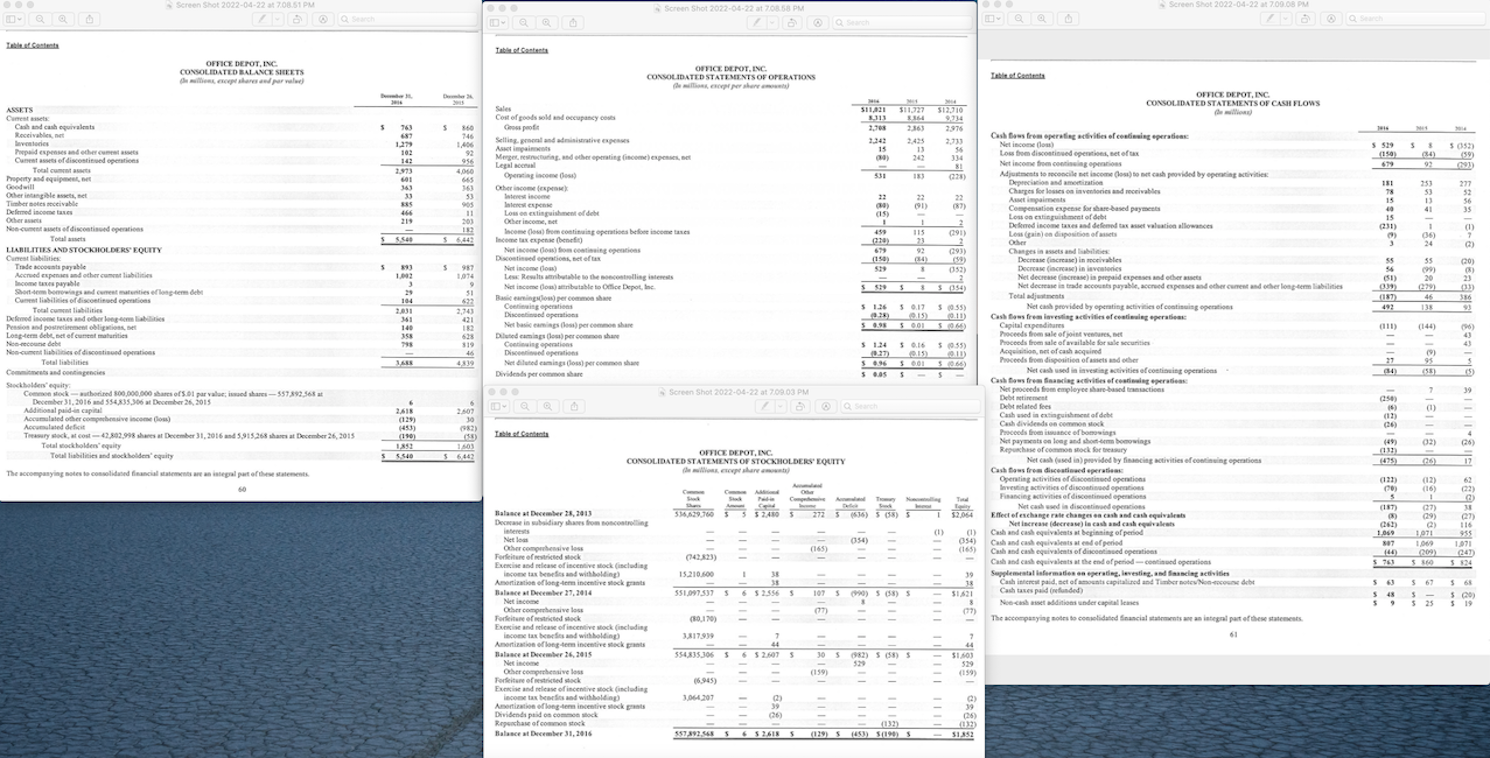

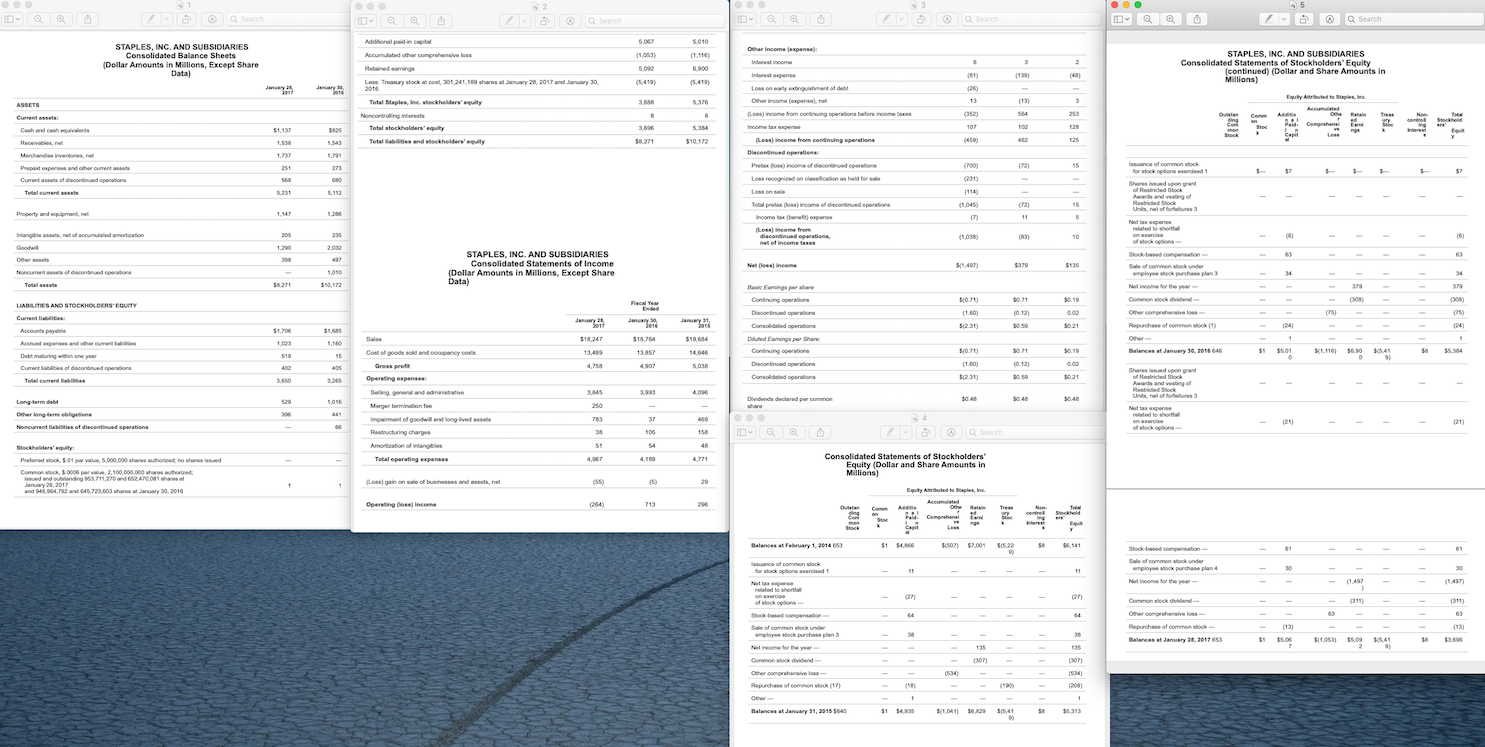

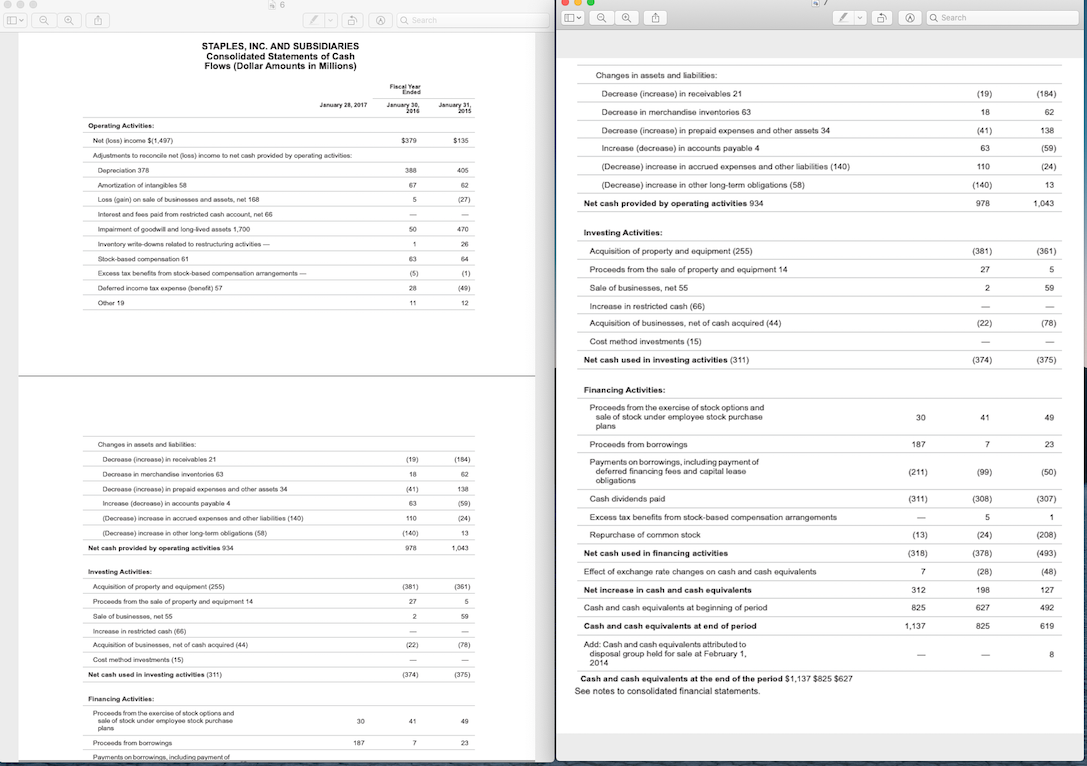

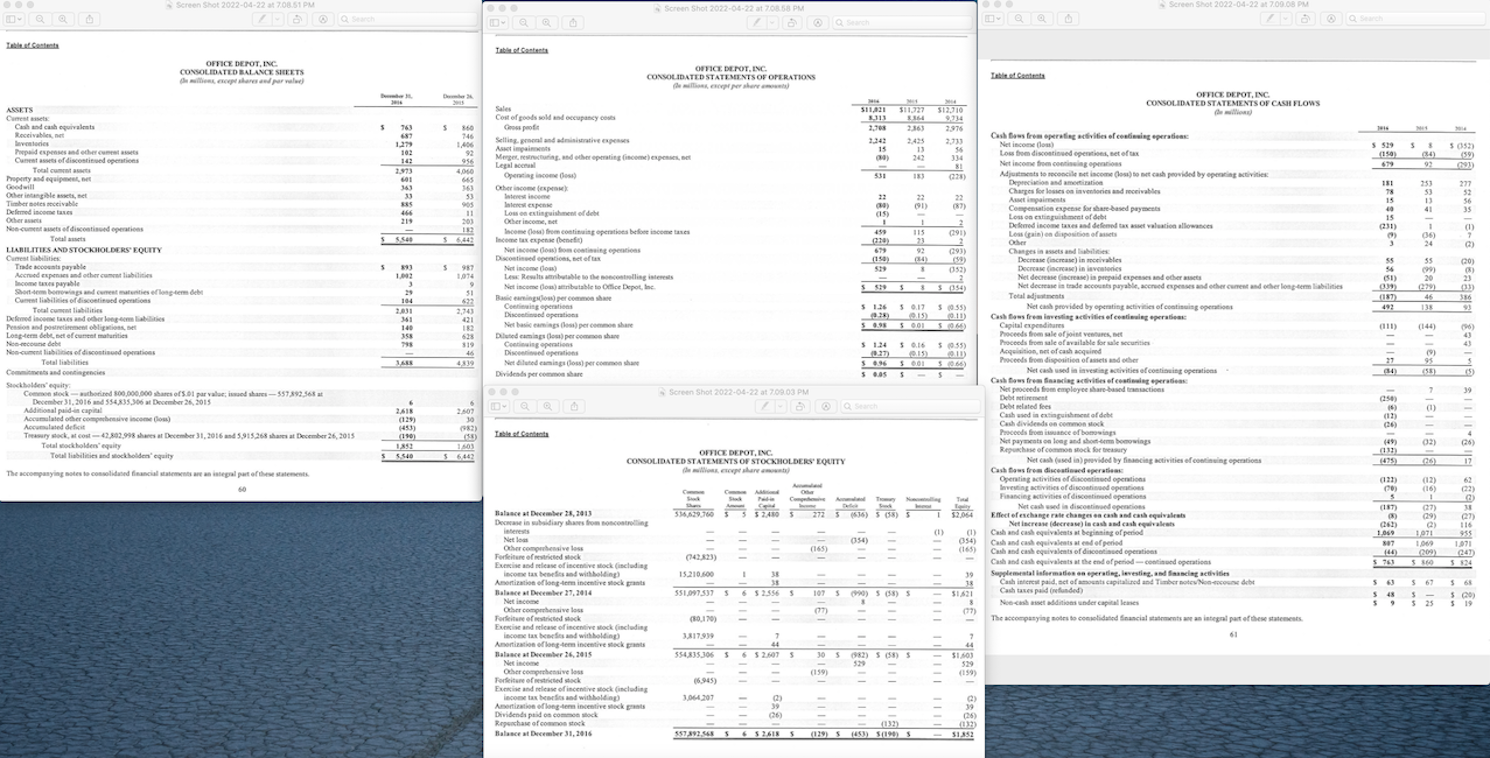

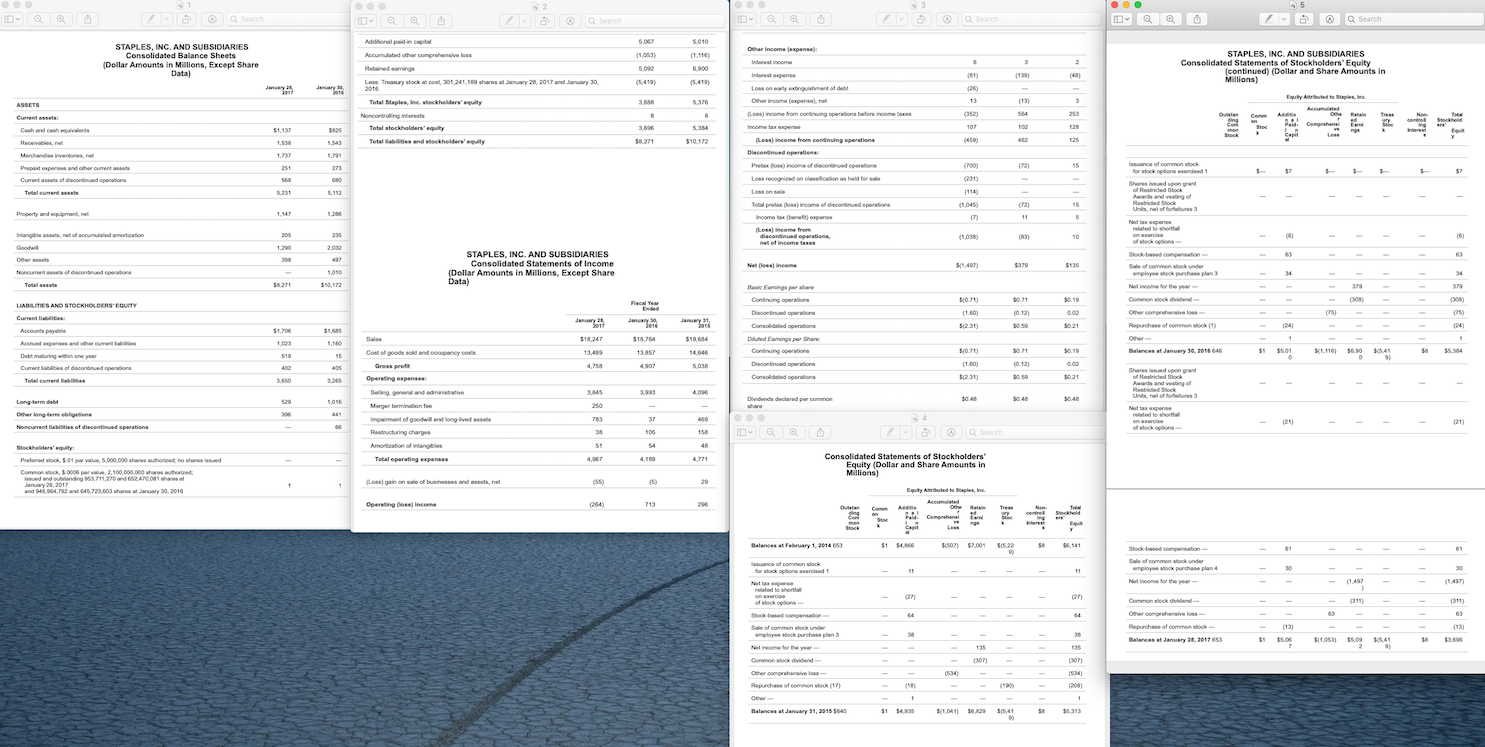

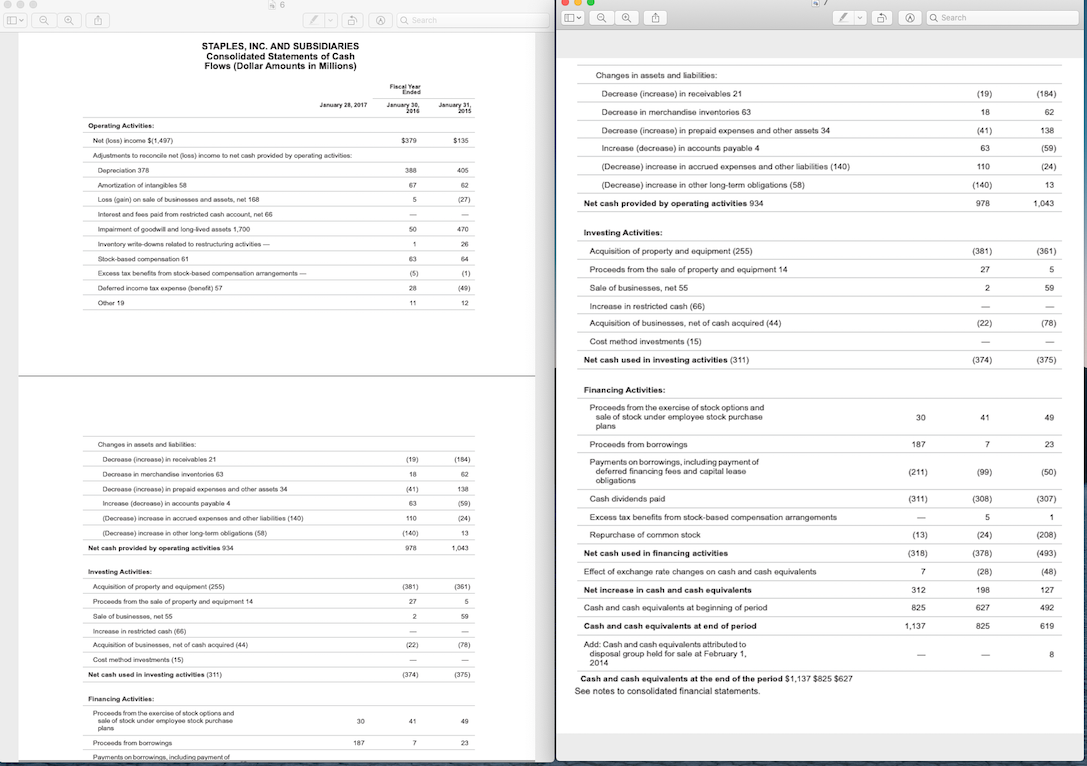

E | a || | | | | | ||= | ]] | g - $ | | | | | | | | == | - | % 1s - | # 1 * = 1: STATEMENTS OF CASH FLOW HIIHII 0 4 * 12, 5 296 001 ** *st | | | | | | | | | | | | | | | g | | |# | | | # % | | | | IIIIIIIIIIII-III OF OPERATIONS CONSOLIDONTICE DEPOT.INC t 2012 .700039 OFFICE DEPOT, INC 1131 ? SOLIDATED BALANCE SHEETS 5 Q Search @ Q Search O Q Search Q 5.062 5.010 (1.116 STAPLES, INC. AND SUBSIDIARIES Consolidated Balance Sheets (Dollar Amounts in Millions, Except Share Data) 5 3 2 (1053) 5.02 (5,415) 6.900 STAPLES, INC. AND SUBSIDIARIES Consolidated Statements of Stockholders' Equity (continued) (Dollar and Share Amounts in Millions) (130) () 5.419 sary Additional pada Accumulated other comprehensive Retained earning Lo Try tocco, 301,241,00 shares at January 20, 2017 and January 30 2016 Total Staplesne stockholders' equity Non controlling wees Total stockholders'quity Total and stockholdersity 36 5376 (13) 3 8 8 (352) 564 253 A ASSETS Current Cash and cash vos Receivables, et Com Stoc Accu OR ed Pold! Comprehnal Capii Less co Sched * 3606 107 51.137 Stive 190 5.354 $10.172 1.530 143 58274 (450) Other Income (expense) Interest income Interpone Low on early extinguishment of debt Other como expo, no Los) income from conting operations before income Income tax expen Los income from continuing operations () Discontinued operations Pretaxon) income of discontinued operations Los recognized on classification as held for sale Lomonale Yotal protexessincome of deperation Income tax benefit expense Los) income from discontinued operation nel of income taxes 1,781 (700) 273 (72) 15 57 $7 Prepaid expenses and the Current site of discontinued operations Total current (231) Insuance of common stock for stock options and Shares inued upongest grand of Restricted Stock Awd and vesting of Restricted Stock Units, not of forfours 5.112 (114) (1.045 (72) 15 Property and equipment, net 1,147 1.296 1 11 5 205 235 (1.036) (83) 50 16) Intangible, el amor Gooi 120 2,032 on or of ons Stock based compensation Sale of common stock under Other 300 STAPLES, INC. AND SUBSIDIARIES Consolidated Statements of Income (Dollar Amounts in Millions, Except Share Data) 437 Net oss income $135 1,050 34 M Noncurrent sets of discrepations Totalt 55.271 $10,172 379 37 30.1 50.19 (0) (0) End January 5:07) (1.60) 10.12) 0.02 (75) (75) 050 3021 20 (24) $1,206 $1.685 January 011 $18.247 January 2015 $19 6M Be Earrings per have Continuing operations Discontinued operation Consolidated operations Duted Earings per Share Continuing operations Discord operations Consolidated operations One comprehensive ios - Repurchase of common stock (1) 1 One Balances at January 30, 2016 646 Sales LIABILITIES AND STOCKHOLDERS' EQUITY Current Accounts payable Arses and the current Debt maturing within one year Current bit of continued erine Total current la $18764 $ 1 1 1.023 1,16 13.489 50.71 14.646 $1 $5.01 1.116) 38 5:19 $5384 15 50.19 0.02 56.90 5.41 0 9 400 4,75 $0.71) (1.60) 52.31) 4,907 5.000 (012) 3.650 Shared upon grant Anwand voting of 3255 30145 3.93 4000 Rad 529 Dividends docere por common $0.40 $0.48 30:48 5,096 Cost of goods sold and occupancy costs Gross profe Operating expenses Selling and drive Morger formination for Impairment of goodwill and long-lived assets Restructuring charges Amortion of brangibles Total operating expenses Long term debit Other long termine Noncurrent liabilities of discontinued operations 250 780 459 Net taxe pense ed ons of stock options (21) 21) 66 105 15 Q Search 51 54 48 4967 4,10 4771 Stockholders' equity Predstock5.01 pr. 5.000.000 shares with no shared Common stock 5.000 per val. 2.100.000.000 January 28, 2017 dandang53.711.270 and 652.470.001 and 46.964,782 and 645,723,600 shares of January 30, 2016 Consolidated Statements of Stockholders' Equity (Dollar and Share Amounts in Millions) (L) gainons of businesses and net (55) 15) 29 Operating income 713 206 on sing mon Stock the Red Trees Comprehen Las El CA Balances at February 1, 2014 659 51 14.06 3507) $7001 ) $ 515.22 38 1.141 51 11 11 30 30 11.40 (1.407) lance of common stock for stock options are Nutters od toho of stocks Shock based compensation Sweco che employee who has plen 3 (27) Stock-based compensation Sale of common stock under employee stock purchase plan Not income for the year Common stock dividend Other comprehensive Repurchase of common Balances at January 28, 2017 653 271 - (11) 63 63 (13) (13) 38 $ 55,00 7 1053 18 55,00 5:41 $ 2 9) 135 35 OT) 154) Common lock dividend Other comprehensive Repurchase of common stock (17) Other Balances at January 31, 2015 5660 (10 1 1 $5,313 $ 51 54,935 $(1041) 6.29 ) $ $15.41 50 @ @ Q Search Q Q Search Q STAPLES, INC. AND SUBSIDIARIES Consolidated Statements of Cash . Flows (Dollar Amounts in Millions) (19) (184) January 28, 2017 January 30 2016 January 31 2015 18 62 138 $379 $135 Changes in assets and liabilities: Decrease increase) in receivables 21 Decrease in merchandise inventories 63 Decrease increase) in prepaid expenses and other assets 34 Increase (decrease) in accounts payable 4 (Decrease) increase in accrued expenses and other liabilities (140) (Decrease) increase in other long-term obligations (58) Net cash provided by operating activities 934 63 (59) 405 110 Operating Activities: Net (los) income $11.497) Adjustments to reconcile net (o) income to net cash provided by operating activities: Depreciation 378 Amortization of Intangible 58 Los gain) on sale of businesses and assets, net 168 Interest and fous paid from restricted cash account, net 66 Impairment of goodwill and longived assets 1.700 (24) 388 67 (140) 13 5 (27) 978 1,043 50 470 1 20 (381) (361) 83 54 27 Inventory write-downs related to restructuring activities - Stock-based compensation 61 Excess tax benefit from stock based compensation arrangements Deferred income tax expense benef) 57 Other 19 (5) (1) 5 Investing Activities: Acquisition of property and equipment (255) Proceeds from the sale of property and equipment 14 Sale of businesses, net 55 Increase in restricted cash (66) Acquisition of businesses, net of cash acquired (44) 20 (49) 2. 59 11 12 (22) (78) Cost method investments (15) Net cash used in investing activities (311) (374) (375) Financing Activities: Proceeds from the exercise of stock options and sale of stock under employee stock purchase plans 30 41 49 Proceeds from borrowings 187 7 23 (19) (154) 18 Payments on borrowings, including payment of deferred financing foos and capital lease obligations (211) (99) (50) (41) 138 Changes in and abilities Decrease increase in recevables 21 Decrease in merchandise inventorius 63 Decrease increase) in prepaid expenses and other ass 34 Increase (decrease) in accounts payable 4 (Decrease increase in accrued expenses and other liabilities (140) (Decrease) increase in other long-term obligations (58) Net cash provided by operating activities 934 Cash dividends paid (311) (308) (307) 63 (59) 110 (244) 5 1 (140) 13 (13) (24) (208) 978 1,043 (318) (378) (493) ( 7 (28) (48) (381) (361) 312 198 127 27 5 Excess tax benefits from stock-based compensation arrangements Repurchase of common stock Net cash used in financing activities Effect of exchange rate changes on cash and cash equivalents Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Add: Cash and cash equivalents attributed to disposal group hold for sale at February 1. 2014 Cash and cash equivalents at the end of the period $1,137 $825 $627 See notes to consolidated financial statements 825 627 Investing Activities : Acquisition of property and equipment (255) Proceeds from the sale of property and equipment 14 Sale of businesses. net 55 Increase in restricted cash (66 Acquisition of businesses, not of cash acquired (44) Cool method investments (15) 492 2 59 1,137 825 619 (22) (78) 8 Nel cash used in investing activities (311) (374) (375) Financing Activities Proceeds from the exercise of stock options and sale of stock under employee stock purchase plans 30 41 Proceeds from borrowing 187 7 23 Payments on borrowing inchinamente