Which competing theory of capital structure best aligns with Metcash Limited's observed level of debt and equity?

Net Gearing Ratio Graph Below:

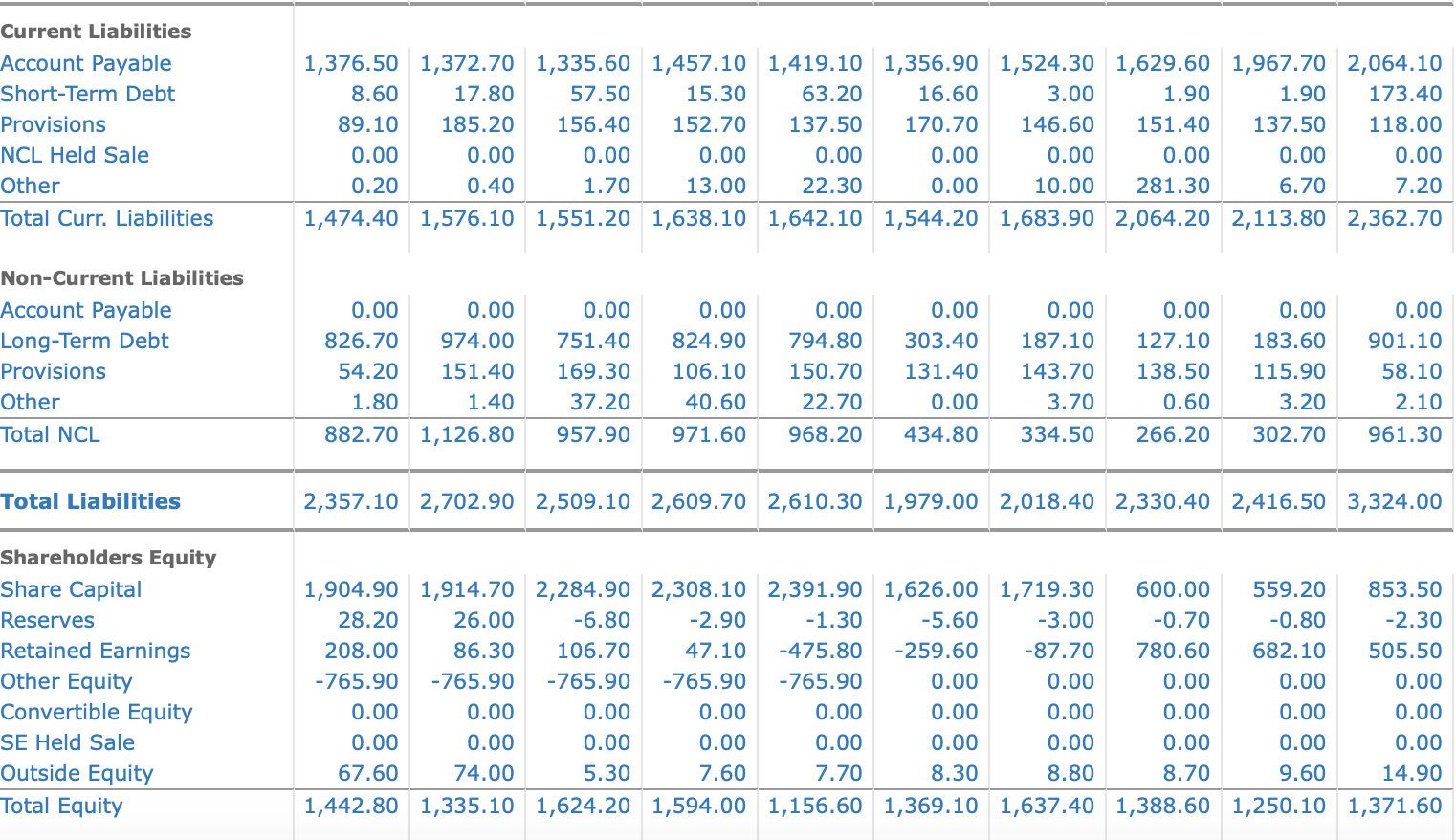

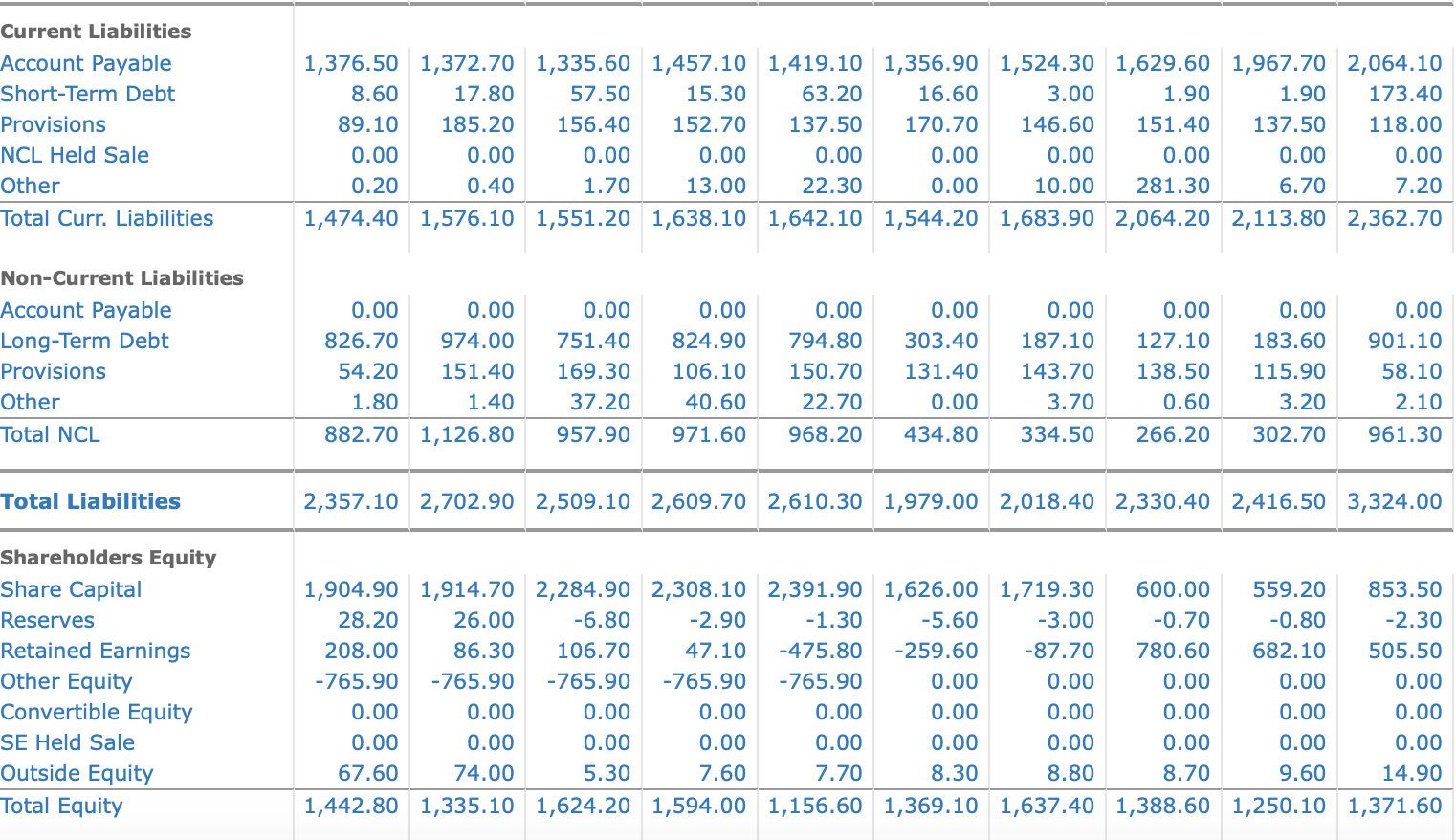

Current Liabilities Account Payable Short-Term Debt Provisions NCL Held Sale Other Total Curr. Liabilities 1,376.50 1,372.70 1,335.60 1,457.10 1,419.10 1,356.90 1,524.30 1,629.60 1,967.70 2,064.10 8.60 17.80 57.50 15.30 63.20 16.60 3.00 1.90 1.90 173.40 89.10 185.20 156.40 152.70 137.50 170.70 146.60 151.40 137.50 118.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.20 0.40 1.70 13.00 22.30 0.00 10.00 281.30 6.70 7.20 1,474.40 1,576.10 1,551.20 1,638.10 1,642.10 1,544.20 1,683.90 2,064.20 2,113.80 2,362.70 Non-Current Liabilities Account Payable Long-Term Debt Provisions Other Total NCL 0.00 0.00 826.70 974.00 54.20 151.40 1.80 1.40 882.70 1,126.80 0.00 751.40 169.30 37.20 957.90 0.00 824.90 106.10 40.60 971.60 0.00 794.80 150.70 22.70 968.20 0.00 303.40 131.40 0.00 434.80 0.00 187.10 143.70 3.70 334.50 0.00 127.10 138.50 0.60 266.20 0.00 183.60 115.90 3.20 302.70 0.00 901.10 58.10 2.10 961.30 Total Liabilities 2,357.10 2,702.90 2,509.10 2,609.70 2,610.30 1,979.00 2,018.40 2,330.40 2,416.50 3,324.00 Shareholders Equity Share Capital Reserves Retained Earnings Other Equity Convertible Equity SE Held Sale Outside Equity Total Equity 1,904.90 1,914.70 2,284.90 2,308.10 2,391.90 1,626.00 1,719.30 600.00 559.20 853.50 28.20 26.00 -6.80 -2.90 -1.30 -5.60 -3.00 -0.70 -0.80 -2.30 208.00 86.30 106.70 47.10 -475.80 -259.60 -87.70 780.60 682.10 505.50 -765.90 -765.90 -765.90 -765.90 -765.90 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 67.60 74.00 5.30 7.60 7.70 8.30 8.80 8.70 9.60 14.90 1,442.80 1,335.10 1,624.20 1,594.00 1,156.60 1,369.10 1,637.40 1,388.60 1,250.10 1,371.60 Current Liabilities Account Payable Short-Term Debt Provisions NCL Held Sale Other Total Curr. Liabilities 1,376.50 1,372.70 1,335.60 1,457.10 1,419.10 1,356.90 1,524.30 1,629.60 1,967.70 2,064.10 8.60 17.80 57.50 15.30 63.20 16.60 3.00 1.90 1.90 173.40 89.10 185.20 156.40 152.70 137.50 170.70 146.60 151.40 137.50 118.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.20 0.40 1.70 13.00 22.30 0.00 10.00 281.30 6.70 7.20 1,474.40 1,576.10 1,551.20 1,638.10 1,642.10 1,544.20 1,683.90 2,064.20 2,113.80 2,362.70 Non-Current Liabilities Account Payable Long-Term Debt Provisions Other Total NCL 0.00 0.00 826.70 974.00 54.20 151.40 1.80 1.40 882.70 1,126.80 0.00 751.40 169.30 37.20 957.90 0.00 824.90 106.10 40.60 971.60 0.00 794.80 150.70 22.70 968.20 0.00 303.40 131.40 0.00 434.80 0.00 187.10 143.70 3.70 334.50 0.00 127.10 138.50 0.60 266.20 0.00 183.60 115.90 3.20 302.70 0.00 901.10 58.10 2.10 961.30 Total Liabilities 2,357.10 2,702.90 2,509.10 2,609.70 2,610.30 1,979.00 2,018.40 2,330.40 2,416.50 3,324.00 Shareholders Equity Share Capital Reserves Retained Earnings Other Equity Convertible Equity SE Held Sale Outside Equity Total Equity 1,904.90 1,914.70 2,284.90 2,308.10 2,391.90 1,626.00 1,719.30 600.00 559.20 853.50 28.20 26.00 -6.80 -2.90 -1.30 -5.60 -3.00 -0.70 -0.80 -2.30 208.00 86.30 106.70 47.10 -475.80 -259.60 -87.70 780.60 682.10 505.50 -765.90 -765.90 -765.90 -765.90 -765.90 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 67.60 74.00 5.30 7.60 7.70 8.30 8.80 8.70 9.60 14.90 1,442.80 1,335.10 1,624.20 1,594.00 1,156.60 1,369.10 1,637.40 1,388.60 1,250.10 1,371.60