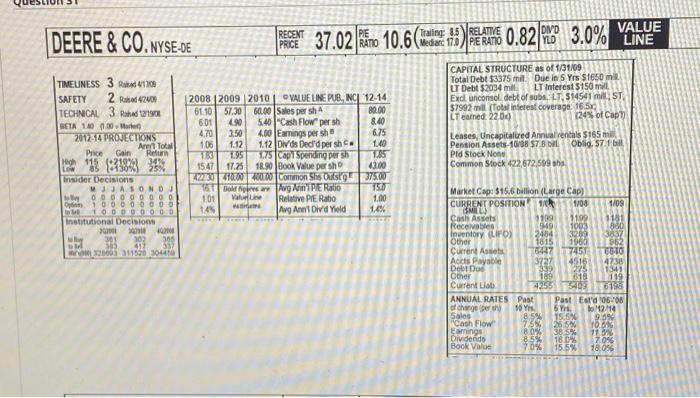

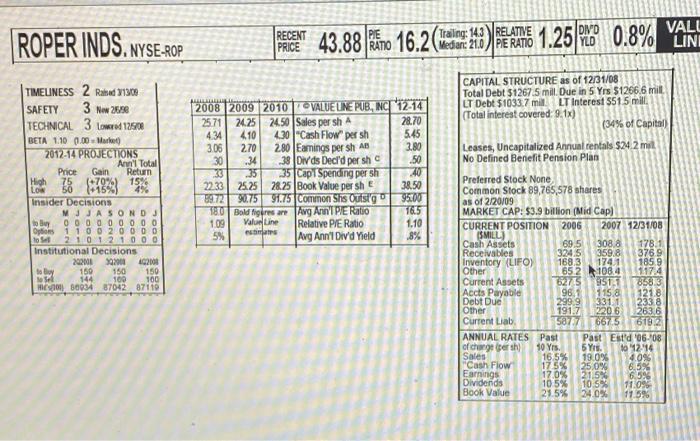

Which firm is better able to handle its debt? Deere O Roper DEERE & CO. NYSE-DE het 37.02 km 10.6 (0.82 3.0% WHERE (10) RECENT PE RATIO Traiing: 1.5 VRELATIVE DVD YLD VALUE LINE PRICE TIMEUNESS 3 Road 1300 SAFETY 2 R42001 TECHNICAL 3 Rahad 1904 SETA 140 000 More 201224 PROJECTIONS Ant To Price Gain Return High 115 34N CAPITAL STRUCTURE as of 1/31/09 Total Debt $3375 mil Due in 5 yrs $1650 mil u Debt $2034 mill LT Interest $150 mill Exclunconsol, debt of subs, LT, 314541 millST $7992 mil (Total interest coverage: 16.5 LT earned: 2200 1249 of Cap Leases, Uncapitalized Annual rentals 5165 mil Pension Assets-10/08 S7 8 il. Oblig. 37.1 bill Pld Stock None Common Stock 422,672,599 ha 2008 2009 2010 | VALUE LINE PUB, INCL 12.14 61.1057.30 60.00 Salespersh 80.00 601 490 5.40 "Cash Flow" per sh 8.40 4.70 2.50 4.00 Earnings per she 106 1.12 1.12 Dids Dedd per sh. 1.40 153 1.95 1.75 Cap Spending persh 185 15:47 17.25 18.90 Book Value per sho 13.00 22:30 210000.00 Common Shs Outst375.00 11 Avg Ann'IPE Ratio 750 101 Value Relative PE Ratio 1.00 14 Avg Anni Divd Yield 1.4% 6.75 Insider Decisions JASOND 0.000 institutional Decisions old 302 305 585 412 33 13000311590 441 Market Cap: $15.6 billion (Large Cap) CURRENT POSITION 1/08 1/09 SMILLI Cash Assets 1199 1199 3181 Receivables 9449 1003 860 Inventory Liro) 2484 Other 1615 Current Assets 6447 010 Acts Payable 3727 4730 Debt Dod 339 1341 Other 119 Current List 4255 09 6198 ANNUAL RATES Past Past Est 06:08 changer 16 Y 5 Yr bo 1214 Sales 85% 15.5% Cash Flow Earnings TO 8.0% 3824 17 Dividende 8.5% 1803 704 Book Value 70% 15.5% 78.0% PIE | ROPER INDS. NYSE-ROP PROCENT 43.88 ) RETRO 16.2 Trailing: 14.3 RELATIVE Medar: 21.0 PE RATIO 1.25 DIVO YLD 0.8% VALL LINI LLLLLL TIMELINESS 2 Rated 91300 SAFETY 3 New 28.96 TECHNICAL 3 Lomweed 1250 BETA 110 0.00 2012-14 PROJECTIONS An'l Total Price Gain Return High (470% 15% Low 4% Insider Decisions MJ JASONOJ to Buy 0000OOOOO 110020 ODO to 21.01.21000 Institutional Decisions 2020012001 102001 to 150 150 150 sel 144 100 100 HE700 80034 87042 8711 H 2008 2009 2010 VALUE UNE PUB, NC 12-14 2571 24.25 24.50 Sales per sh 28.70 434 410 4.30 Cash Flow persh 545 306 270 280 Eamings per sh AB 3.80 30 .34 38 Divds Decl'd persh 50 33 .35 35 Cap Spending per sh 240 2233 25.25 28.25 Book Value per she 38.50 697290.75 91.75 Common Shs Outsig 95.00 180 Bold Tigres are Avg Ann'IPE Ratio 16.5 1.09 Valur Line Relative P/E Ratio 1.10 5% Avg Ann'l Did Yield .8% 8RREE CAPITAL STRUCTURE as of 12/31/08 Total Debt $1267.5 mill. Due in 5 yrs $1266.6 mill LT Debt $1033.7 mil LT Interest 5515 mill. (Total interest covered: 9.1x) (34% of Capital) Leases, Uncapitalized Annual rentals $24.2 mil No Defined Benefit Pension Plan Preferred Stock None Common Stock 89,765,578 shares as of 2120/09 MARKET CAP: $3.9 billion (Mid Cap) CURRENT POSITION 2006 2007 12/31/08 SMILL) Cash Assets 69 5 308 8 178.1 Receivables 324.5 359.8 376.9 Inventory KLIFO) 168.3 1741 1859 Other 652 108.4 1174 Current Assets 62115 951.1 85013 Accts Payable 96.1 115.8 1218 Debt Due 299.9 3311 2338 Other 191.7 2206 2636 Current Liab 5877 6675618.2 ANNUAL RATES Past Past Est'd 06.08 of charge persh) 10 Yrs. 5 Yrs. 101214 Sales 16.5% 19.0% 4.09 Cash Flow 175% 250% 6.3% Earnings 17 0% 21.5% 6.5% Dividends 10.5% 10.5% 11.0% Book Value 25.5% 24.0% 11.5%