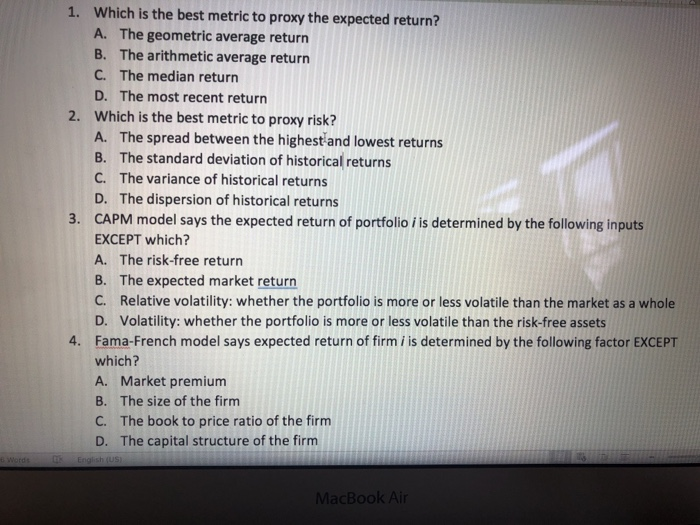

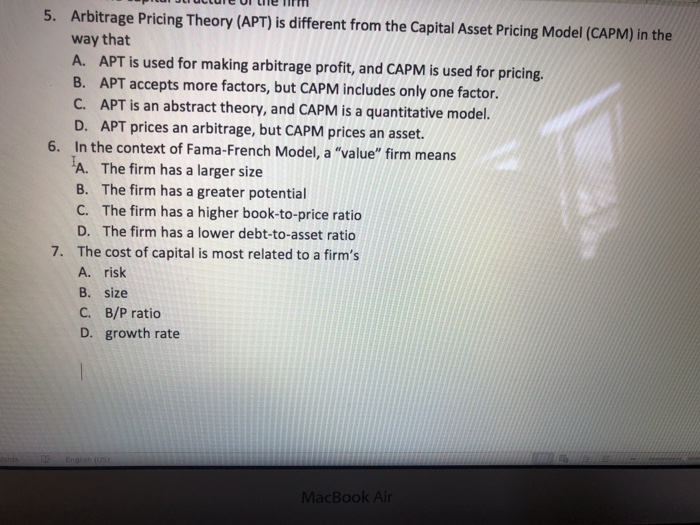

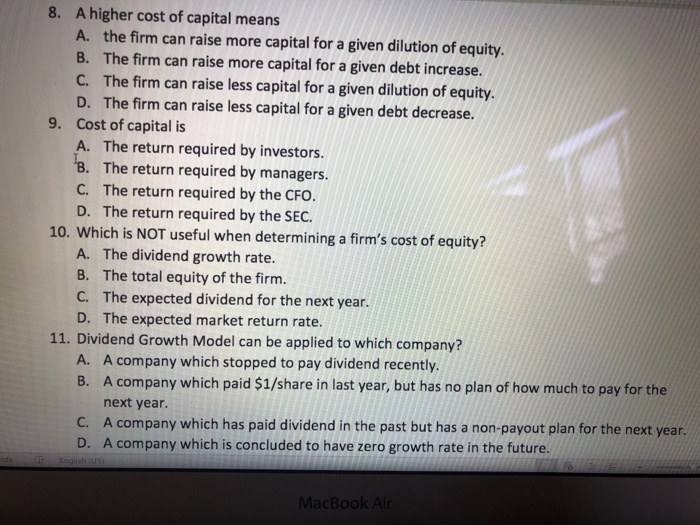

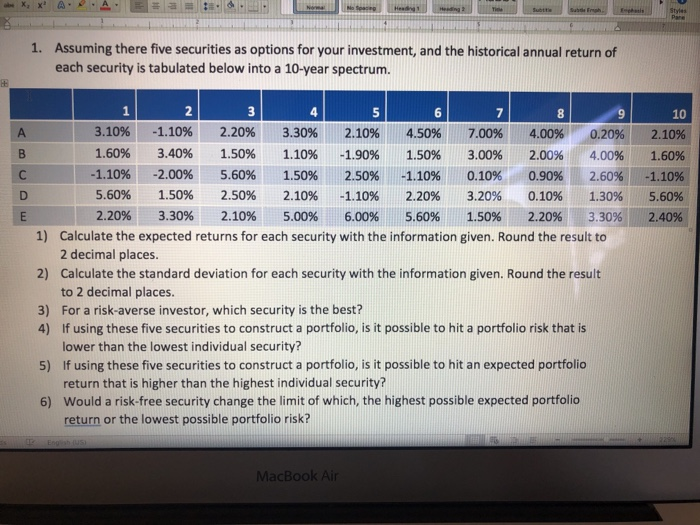

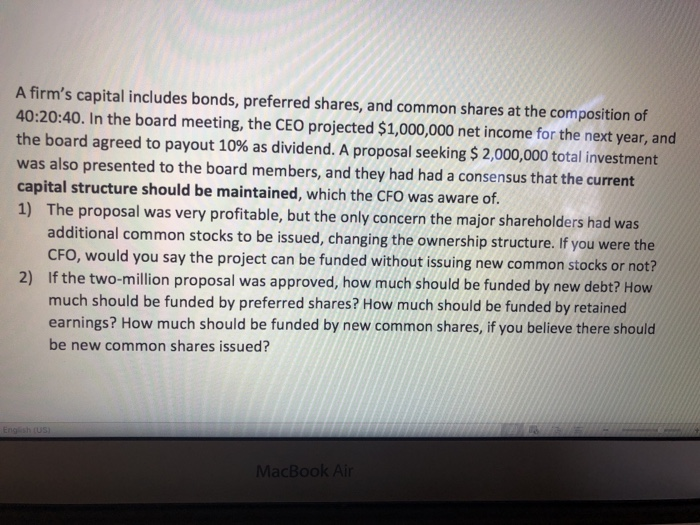

Which is the best metric to proxy the expected return? A. The geometric average return B. The arithmetic average return C. The median return D. The most recent return Which is the best metric to proxy risk? A. The spread between the highestand lowest returns B. The standard deviation of historical returns C. The variance of historical returns D. The dispersion of historical returns CAPM model says the expected return of portfolio i is determined by the following inputs EXCEPT which? A. The risk-free return B. The expected market return C. Relative volatility: whether the portfolio is more or less volatile than the market as a whole D. Volatility: whether the portfolio is more or less volatile than the risk-free assets Fama-French model says expected return of firm i is determined by the following factor EXCEPT which? A. Market premium B. The size of the firm C. The book to price ratio of the firm D. The capital structure of the firm 1. 2. 3. 4. Arbitrage Pricing Theory (APT) is different from the Capital Asset Pricing Model (CAPM) in the way that A. APT is used for making arbitrage profit, and CAPM is used for pricing. B. APT accepts more factors, but CAPM includes only one factor. C. APT is an abstract theory, and CAPM is a quantitative model. D. APT prices an arbitrage, but CAPM prices an asset. In the context of Fama-French Model, a "value" firm means A. The firm has a larger size B. The firm has a greater potential C. The firm has a higher book-to-price ratio D. The firm has a lower debt-to-asset ratio The cost of capital is most related to a firm's A. risk 5. 6. 7. B. size C. B/P ratio D. growth rate A higher cost of capital means A. the firm can raise more capital for a given dilution of equity. B. The firm can raise more capital for a given debt increase. C. The firm can raise less capital for a given dilution of equity. D. The firm can raise less capital for a given debt decrease. Cost of capital is A. The return required by investors. B. The return required by managers. C. The return required by the CFO. D. The return required by the SEC. 8. 9. 10. Which is NOT useful when determining a firm's cost of equity? A. The dividend growth rate. B. The total equity of the firm C. The expected dividend for the next year. D. The expected market return rate. 11. Dividend Growth Model can be applied to which company? A. A company which stopped to pay dividend recently B. A company which paid $1/share in last year, but has no plan of how much to pay for the next year. C. A company which has paid dividend in the past but has a non-payout plan for the next year D. A company which is concluded to have zero growth rate in the future. Assuming there five securities as options for your investment, and the historical annual return of each security is tabulated below into a 10-year spectrum. 1. 3.10% 1.60% -1.10% 5.60% 2.20% 2 -1.10% 3.40% -2.00% 1.50% 3.30% 2.20% 1.50% 5.60% 2.50% 2.10% 4 3.30% 1.10% 1.50% 2.10% 5.00% 2.10% -1.90% 2.50% -1.10% 6.00% 6 4.50% 1.50% -1.10% 2.20% 5.60% 7.00% 3.00% 0.10% 3.20% 1.50% 8 4.00% 2.00% 0.90% 0.10% 2.20% 10 0.20% 2.10% 4.00% 1.60% 2.60%--1.10% 1.30% 5.60% 3.30% 2.40% 1) 2) 3) Calculate the expected returns for each security with the information given. Round the result to 2 decimal places. Calculate the standard deviation for each security with the information given. Round the result to 2 decimal places. For a risk-averse investor, which security is the best? If using these five securities to construct a portfolio, is it possible to hit a portfolio risk that is lower than the lowest individual security? If using these five securities to construct a portfolio, is it possible to hit an expected portfolio return that is higher than the highest individual security? Would a risk-free security change the limit of which, the highest possible expected portfolio return or the lowest possible portfolio risk? 4) 5) 6) acBoo A firm's capital includes bonds, preferred shares, and common shares at the composition of 40:20:40. In the board meeting, the CEO projected $1,000,000 net income for the next year, and the board agreed to payout 10% as dividend. A proposal seeking $ 2,000,000 total investment was also presented to the board members, and they had had a consensus that the current capital structure should be maintained, which the CFO was aware of. 1) The proposal was very profitable, but the only concern the major shareholders had was additional common stocks to be issued, changing the ownership structure. If you were the CF O, would you say the project can be funded without issuing new common stocks or not? If the two-million proposal was approved, how much should be funded by new debt? How much should be funded by preferred shares? How much should be funded by retained earnings? How much should be funded by new common shares, if you believe there should be new common shares issued? 2)