Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which is the correct answer? You are currently heavily invested in Company A. You are of the belief Company A is not expected to increase

Which is the correct answer?

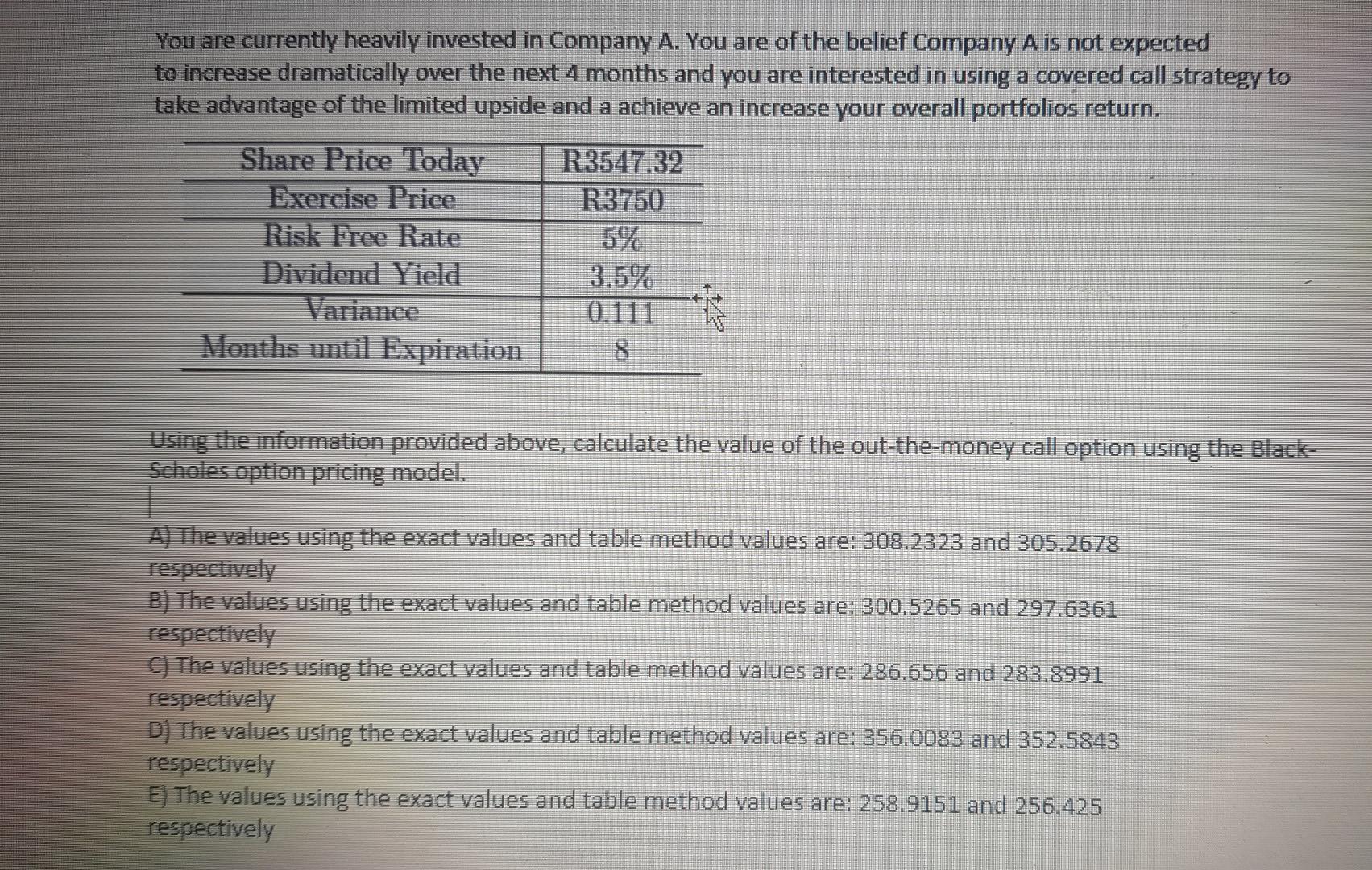

You are currently heavily invested in Company A. You are of the belief Company A is not expected to increase dramatically over the next 4 months and you are interested in using a covered call strategy to take advantage of the limited upside and a achieve an increase your overall portfolios return. Share Price Today Exercise Price Risk Free Rate Dividend Yield Variance Months until Expiration R3547.32 R3750 5% 3.5% 0.111* 8 Using the information provided above, calculate the value of the out-the-money call option using the Black- Scholes option pricing model. A) The values using the exact values and table method values are: 308.2323 and 305.2678 respectively B) The values using the exact values and table method values are: 300.5265 and 297.6361 respectively C) The values using the exact values and table method values are: 286.656 and 283.8991 respectively D) The values using the exact values and table method values are: 356.0083 and 352.5843 respectively E) The values using the exact values and table method values are: 258.9151 and 256.425 respectivelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started