Answered step by step

Verified Expert Solution

Question

1 Approved Answer

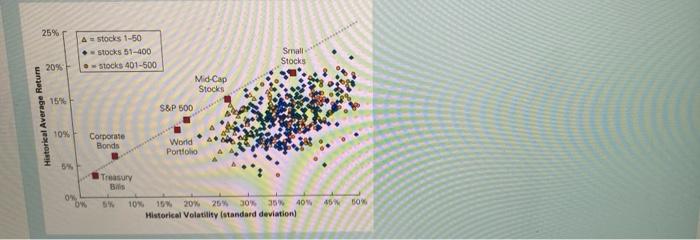

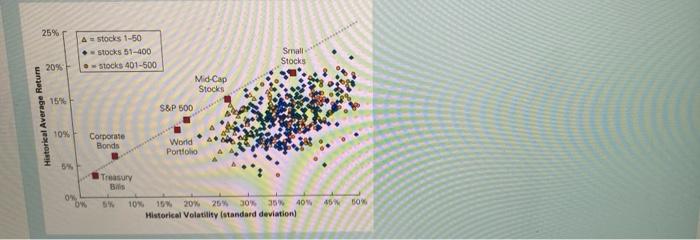

Which is the false? A. If beta is sorted in the following order: Small Stocks > Mid-Cap Stocks > S & P500, the figure above

Which is the false?

25% Astocks 1-50 stocks 51-400 stocks 401-500 Small Stocks 2095 Mid-Cap Stocks 15% S&P 500 Historical Average Return 10% Corporate Bonds World Portfolio 3 Treasury Bilis O by 50% 10% 19 20% 25% 30% 36 40% 45% Historical Volatility standard deviation) A. If beta is sorted in the following order: Small Stocks > Mid-Cap Stocks > S & P500, the figure above is consistent with CAPM B. If the volatility of returns is the exact risk factor that explains stock returns, individual The lack of a clear relationship between a stock's volatility and return suggests that the market is not behaving normally. C. The reason why the relationship between portfolio volatility and return shows a stronger positive correlation than individual stocks is because the portfolio's return has the inherent risk removed. D. Among the S&P500, Mid-Cap Stocks, and Small Stocks portfolios, the reason why the S&P500 has the lowest return is because the number of stocks that make up the S&P500 is the largest, so the diversification effect is maximized.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started