Answered step by step

Verified Expert Solution

Question

1 Approved Answer

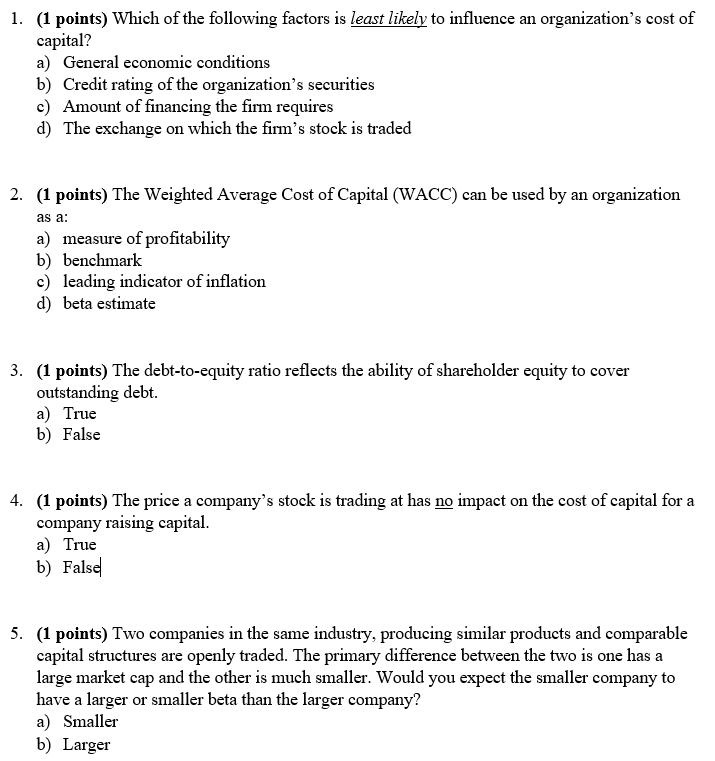

Which is the more difficult input to estimate when calculating the Weighted Average Cost of Capital (WACC), debt or equity? Briefly explain why? (3 points)

- Which is the more difficult input to estimate when calculating the Weighted Average Cost of Capital (WACC), debt or equity? Briefly explain why?

- (3 points) Why are there so many different adjustments and inputs used by industry professionals when calculating the WACC? Provide at three example and explain.

- (4 points) CK Tech, a technology company, has had a 20% rate of growth for five consecutive years and has produced steady positive cash flows. The most recent economic and technology sector indicators show signs of slowing growth. CK Tech recently announced the issuance of bonds totaling 40% of the companys current market cap. What would be a possible reason CK Tech has decided to raise capital this way? Explain why it is or is not an appropriate financing method for this organization?

Bonus question (2 point)

(2 points) The financial analysis function in Bloomberg for a stock is:

- FAN

- ANA

- FA

- FIN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started