Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which is the right ans? Lumiere has a disability income policy that will pay him $2,200 a month for up to 24 months if he

Which is the right ans?

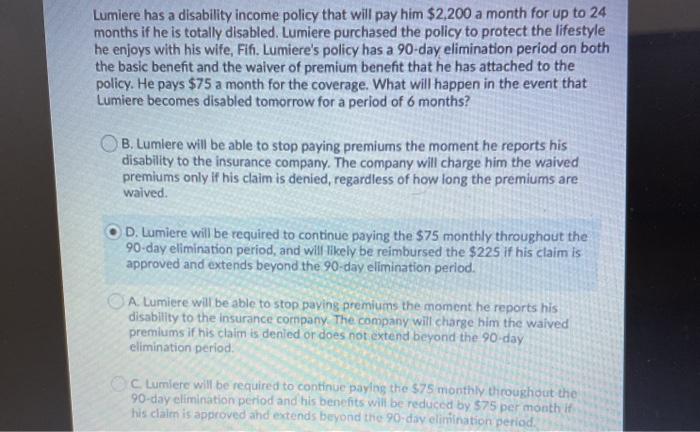

Lumiere has a disability income policy that will pay him $2,200 a month for up to 24 months if he is totally disabled. Lumiere purchased the policy to protect the lifestyle he enjoys with his wife, Fif. Lumiere's policy has a 90-day elimination period on both the basic benefit and the waiver of premium benefit that he has attached to the policy. He pays $75 a month for the coverage. What will happen in the event that Lumiere becomes disabled tomorrow for a period of 6 months? B. Lumiere will be able to stop paying premiums the moment he reports his disability to the insurance company. The company will charge him the waived premiums only if his claim is denied, regardless of how long the premiums are waived. D. Lumiere will be required to continue paying the $75 monthly throughout the 90-day elimination period, and will likely be reimbursed the $225 if his claim is approved and extends beyond the 90-day elimination period. A Lumiere will be able to stop paying premiums the moment he reports his disability to the insurance company. The company will charge him the waived premiums if his claim is denied or does not extend beyond the 90-day elimination period CC Lumiere will be required to continue paying the $75 monthly throughout the 90-day elimination period and his benefits will be reduced by $75 per month it his claim is approved and extends beyond the 90-day elimination period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started