Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which machine should be purchased? machine A or B? Additional Exercise 177 KSU Corp. is considering purchasing one of two new diagnostic machines. Either machine

Which machine should be purchased?

machine A or B?

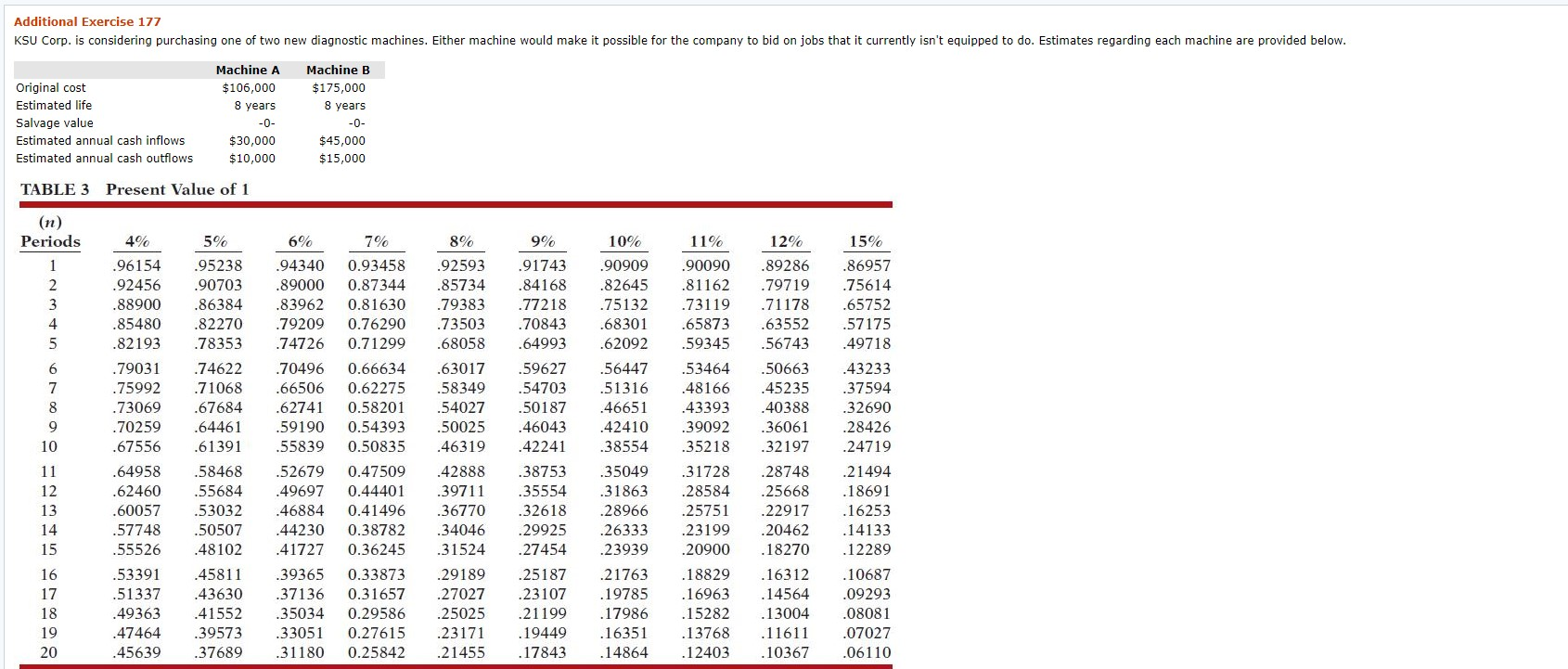

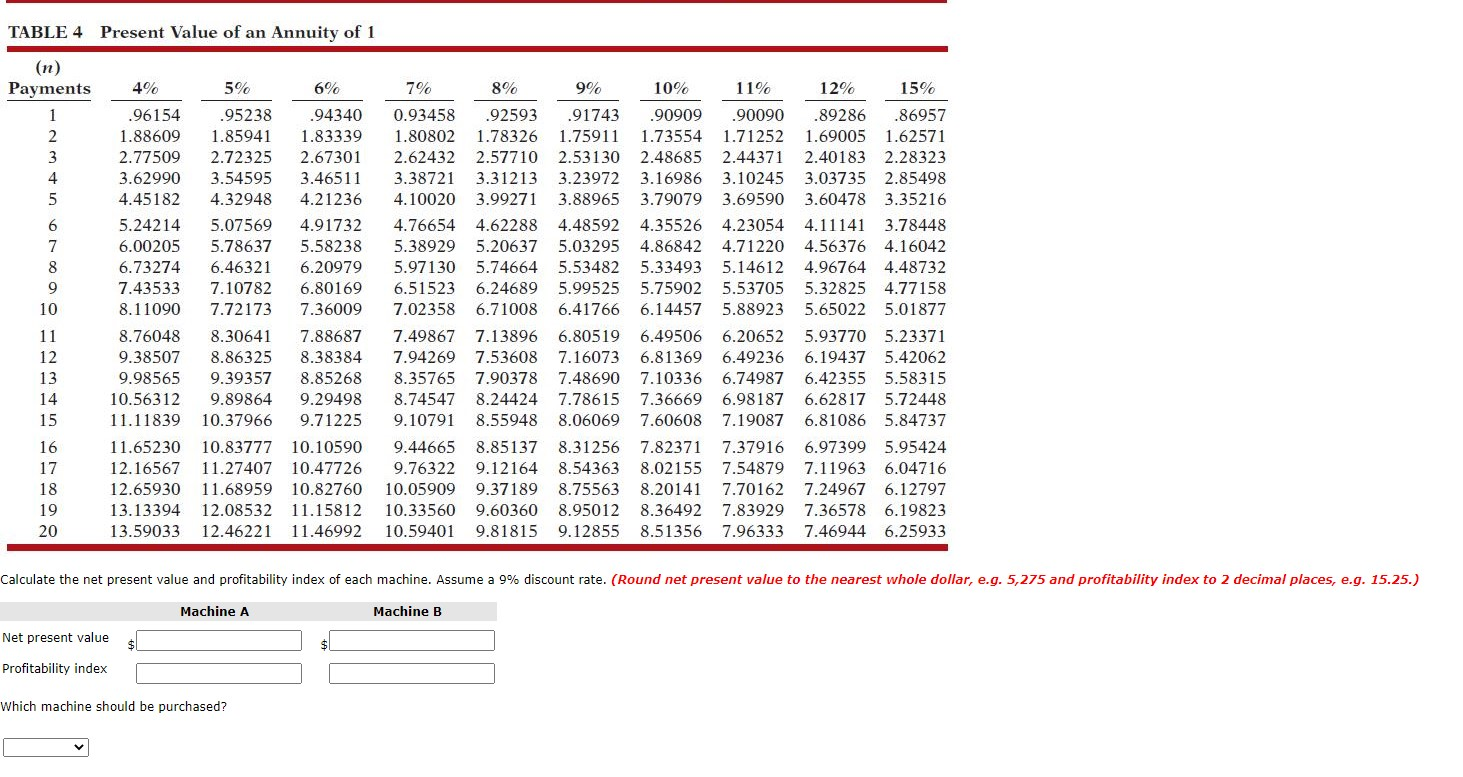

Additional Exercise 177 KSU Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided below. Original cost Estimated life Salvage value Estimated annual cash inflows Estimated annual cash outflows Machine A $106,000 8 years -0- $30,000 $10,000 Machine B $175,000 8 years -0- $45,000 $15,000 TABLE 3 Present Value of 1 4% 6% 15% Periods 1 2 3 4 5 5% 95238 .90703 .86384 .82270 .78353 9% .91743 .84168 .77218 .70843 .64993 10% .90909 .82645 .75132 .68301 .62092 .86957 .75614 .65752 .57175 .49718 6 7 8 9 10 .96154 .92456 .88900 .85480 .82193 .79031 .75992 .73069 .70259 .67556 .64958 .62460 .60057 .57748 .55526 .53391 .51337 .49363 .47464 .45639 .74622 .71068 .67684 .64461 .61391 .58468 .55684 .53032 .50507 .48102 .56447 .51316 .46651 .42410 .38554 7% 0.93458 0.87344 0.81630 0.76290 0.71299 0.66634 0.62275 0.58201 0.54393 0.50835 0.47509 0.44401 0.41496 0.38782 0.36245 0.33873 0.31657 0.29586 0.27615 0.25842 .94340 .89000 .83962 .79209 .74726 .70496 .66506 .62741 .59190 .55839 .52679 .49697 .46884 44230 .41727 .39365 .37136 .35034 .33051 .31180 8% .92593 .85734 .79383 .73503 .68058 .63017 .58349 .54027 .50025 .46319 .42888 .39711 .36770 .34046 .31524 .29189 .27027 .25025 .23171 .21455 .59627 .54703 .50187 .46043 .42241 .38753 .35554 .32618 .29925 .27454 11% .90090 .81162 .73119 .65873 .59345 .53464 48166 .43393 .39092 .35218 .31728 .28584 .25751 .23199 .20900 .18829 .16963 .15282 .13768 .12403 12% .89286 .79719 .71178 .63552 56743 .50663 .45235 40388 .36061 .32197 .28748 .25668 .22917 .20462 .18270 .16312 .14564 .13004 .11611 .10367 11 12 13 14 15 .35049 .31863 .28966 .26333 .23939 43233 .37594 .32690 .28426 .24719 .21494 .18691 .16253 .14133 .12289 .10687 .09293 .08081 .07027 .06110 16 17 18 19 20 45811 .43630 41552 .39573 .37689 .25187 .23107 .21199 .19449 .17843 .21763 .19785 .17986 .16351 .14864 TABLE4 Present Value of an Annuity of 1 (n) Payments 8% 2 3 4 5 6 7 8 9 10 4% .96154 1.88609 2.77509 3.62990 4.45182 5.24214 6.00205 6.73274 7.43533 8.11090 8.76048 9.38507 9.98565 10.56312 11.11839 11.65230 12.16567 12.65930 13.13394 13.59033 5% .95238 1.85941 2.72325 3.54595 4.32948 5.07569 5.78637 6.46321 7.10782 7.72173 8.30641 8.86325 9.39357 9.89864 10.37966 10.83777 11.27407 11.68959 12.08532 12.46221 6% .94340 1.83339 2.67301 3.46511 4.21236 4.91732 5.58238 6.20979 6.80169 7.36009 7.88687 8.38384 8.85268 9.29498 9.71225 10.10590 10.47726 10.82760 11.15812 11.46992 7% 9% 10% 11% 12% 15% 0.93458 .92593 .91743 90909 .90090 .89286 .86957 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 7.02358 6.71008 6.41766 6.14457 5.88923 5.650225.01877 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 10.33560 9.60360 8.95012 8.36492 7.839297.36578 6.19823 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933 11 12 13 14 15 16 17 18 19 20 Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. (Round net present value to the nearest whole dollar, e.g. 5,275 and profitability index to 2 decimal places, e.g. 15.25.) Machine A Machine B Net present value Profitability index Which machine should be purchasedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started