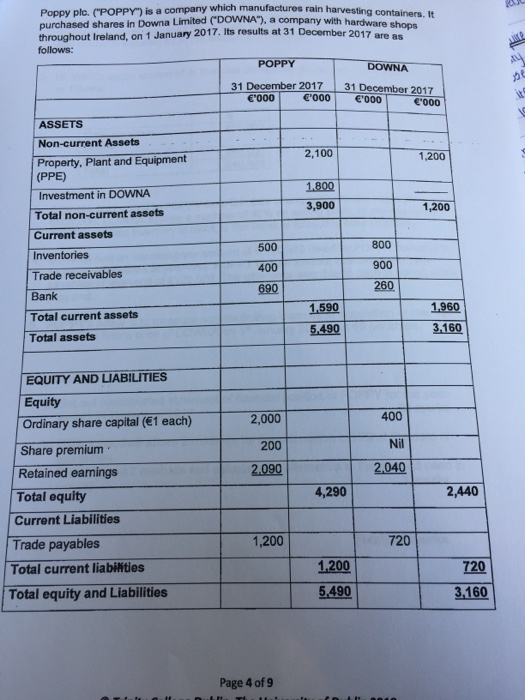

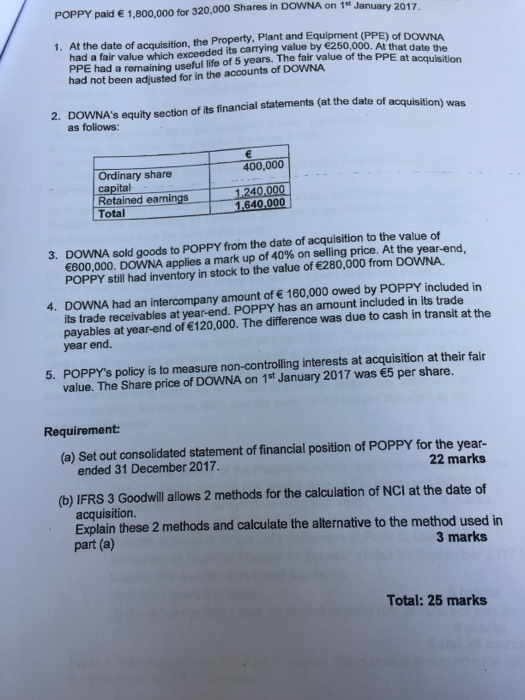

which manufactures rain harvesting containers. It Poppy plc. (POPPY") is a company purchased shares in Downa Limited CDOWNA"), a company with hardware throughou follows t Ireland, on 1 January 2017. Its results at 31 December 2017 are as POPPY DOWNA 31 December 2017 31 December 2017 '000'000 '000 ASSETS Non-current Assets Property, Plant and Equipment (PPE) Investment in DOWNA Total non-current assets Current assets Inventories Trade receivables 2,100 1,200 1800 3,900 1,200 500 400 690 800 900 260 Bank 1.590 1,960 Total current assets 3.160 Total assets EQUITY AND LIABILITIES Equity 2,000 200 400 Nil Ordinary share capital (1 each) Share premium Retained earnings Total equity Current Liabilities Trade payables 4,290 2,440 1,200 720 Total current liabilities 200 720 Total equity and Liabilities 5,490 3.160 Page 4 of 9 POPPY paid 1,800,000 for 320,000 Shares in DOWNA on 1M January 2017. 1. At the date of acquisition, the Property, Plant and Equipment (PPE) of DOWNA value by had a fair value which exceeded its carrying value by 250,000. At that date PPE had a remaining useful life of 5 years. The fair value of the PPE at acquisition the not been adjusted for in the accounts of DOWNA DOWNA's equity section of its financial statements (at the date of acquisition) was as follows 2. Ordinary share 400,000 ital Retained earnings1.640,000 Total 3. DOWNA sold goods to POPPY from the date of acquisition to the value of 600,000. DOWNA applies a mark up of 40% on selling price. At the year-end. POPPY still had inventory in stock to the value of 280,000 from DOWNA. 4. DOWNA had an intercompany amount of 160,000 owed by POPPY included in its trade receivables at year-end. POPPY has an amount included in its trade payables at year-end of 120,000. The difference was due to cash in transit at the year end. 5. POPPY's policy is to measure non-controlling interests at acquisition at their fair value. The Share price of DOWNA on 1st January 2017 was 5 per share. Requirement: (a) Set out consolidated statement of financial position of POPPY for the year- 22 marks ended 31 December 2017. (b) IFRS 3 Goodwill allows 2 methods for the calculation of NCI at the date of acquisition. Explain these 2 methods and calculate the alternative to the method used in part (a) 3 marks Total: 25 marks which manufactures rain harvesting containers. It Poppy plc. (POPPY") is a company purchased shares in Downa Limited CDOWNA"), a company with hardware throughou follows t Ireland, on 1 January 2017. Its results at 31 December 2017 are as POPPY DOWNA 31 December 2017 31 December 2017 '000'000 '000 ASSETS Non-current Assets Property, Plant and Equipment (PPE) Investment in DOWNA Total non-current assets Current assets Inventories Trade receivables 2,100 1,200 1800 3,900 1,200 500 400 690 800 900 260 Bank 1.590 1,960 Total current assets 3.160 Total assets EQUITY AND LIABILITIES Equity 2,000 200 400 Nil Ordinary share capital (1 each) Share premium Retained earnings Total equity Current Liabilities Trade payables 4,290 2,440 1,200 720 Total current liabilities 200 720 Total equity and Liabilities 5,490 3.160 Page 4 of 9 POPPY paid 1,800,000 for 320,000 Shares in DOWNA on 1M January 2017. 1. At the date of acquisition, the Property, Plant and Equipment (PPE) of DOWNA value by had a fair value which exceeded its carrying value by 250,000. At that date PPE had a remaining useful life of 5 years. The fair value of the PPE at acquisition the not been adjusted for in the accounts of DOWNA DOWNA's equity section of its financial statements (at the date of acquisition) was as follows 2. Ordinary share 400,000 ital Retained earnings1.640,000 Total 3. DOWNA sold goods to POPPY from the date of acquisition to the value of 600,000. DOWNA applies a mark up of 40% on selling price. At the year-end. POPPY still had inventory in stock to the value of 280,000 from DOWNA. 4. DOWNA had an intercompany amount of 160,000 owed by POPPY included in its trade receivables at year-end. POPPY has an amount included in its trade payables at year-end of 120,000. The difference was due to cash in transit at the year end. 5. POPPY's policy is to measure non-controlling interests at acquisition at their fair value. The Share price of DOWNA on 1st January 2017 was 5 per share. Requirement: (a) Set out consolidated statement of financial position of POPPY for the year- 22 marks ended 31 December 2017. (b) IFRS 3 Goodwill allows 2 methods for the calculation of NCI at the date of acquisition. Explain these 2 methods and calculate the alternative to the method used in part (a) 3 marks Total: 25 marks