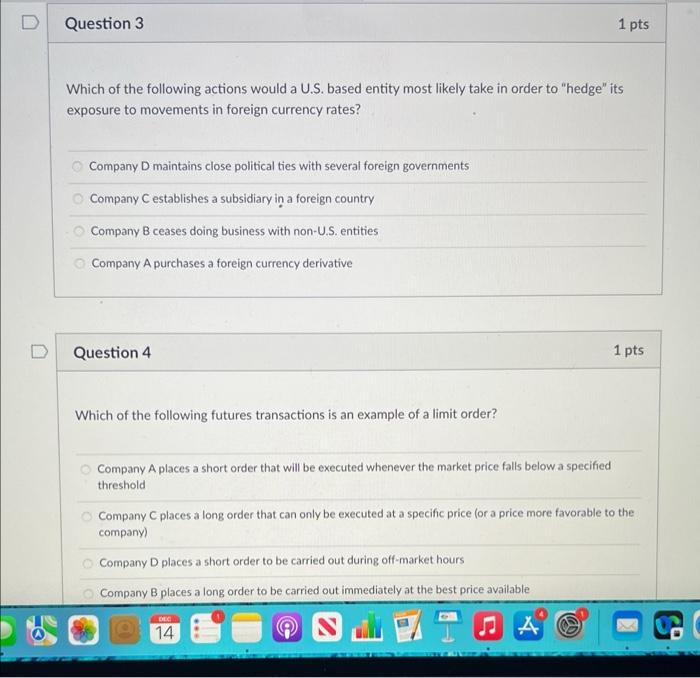

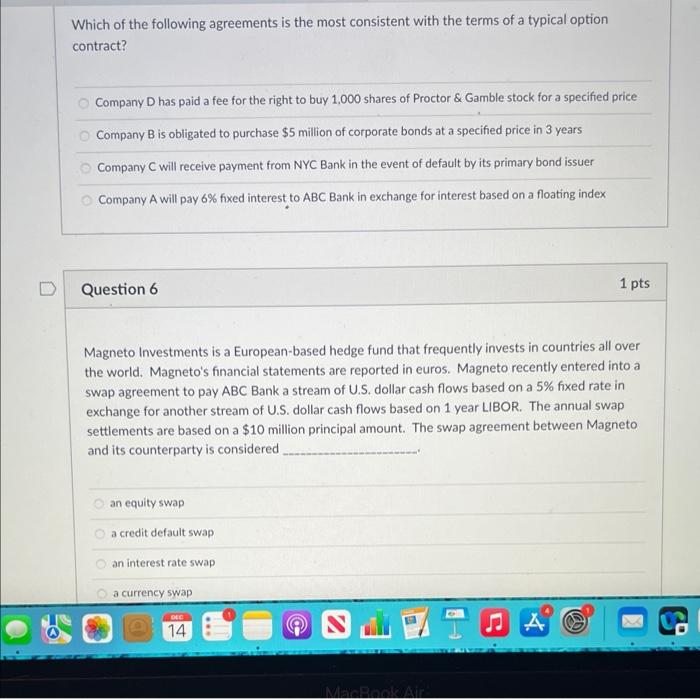

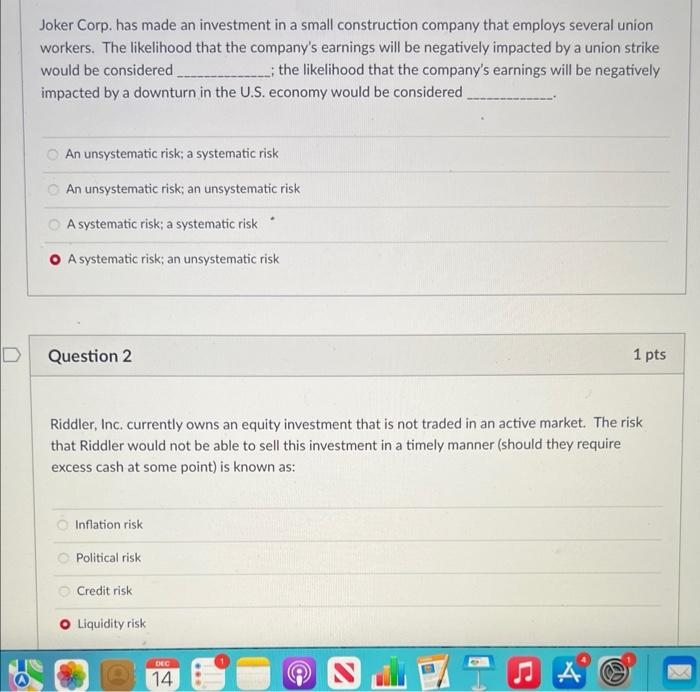

Which of the following actions would a U.S. based entity most likely take in order to "hedge" its exposure to movements in foreign currency rates? Company D maintains close political ties with several foreign governments Company C establishes a subsidiary in a foreign country Company B ceases doing business with non-U.S. entities Company A purchases a foreign currency derivative Question 4 1 pts Which of the following futures transactions is an example of a limit order? Company A places a short order that will be executed whenever the market price falls below a specified threshold Company C places a long order that can only be executed at a specific price (or a price more favorable to the company) Company D places a short order to be carried out during off-market hours Company B places a long order to be carried out immediately at the best price available Which of the following agreements is the most consistent with the terms of a typical option contract? Company D has paid a fee for the right to buy 1,000 shares of Proctor \& Gamble stock for a specified price Company B is obligated to purchase $5 million of corporate bonds at a specified price in 3 years Company C will receive payment from NYC Bank in the event of default by its primary bond issuer Company A will pay 6% fixed interest to ABC Bank in exchange for interest based on a floating index Question 6 1 pts Magneto Investments is a European-based hedge fund that frequently invests in countries all over the world. Magneto's financial statements are reported in euros. Magneto recently entered into a swap agreement to pay ABC Bank a stream of U.S. dollar cash flows based on a 5% fixed rate in exchange for another stream of U.S. dollar cash flows based on 1 year LIBOR. The annual swap settlements are based on a $10 million principal amount. The swap agreement between Magneto and its counterparty is considered an equity swap a credit default swap an interest rate swap a currency swap Joker Corp. has made an investment in a small construction company that employs several union workers. The likelihood that the company's earnings will be negatively impacted by a union strike would be considered ; the likelihood that the company's earnings will be negatively impacted by a downturn in the U.S. economy would be considered An unsystematic risk; a systematic risk An unsystematic risk; an unsystematic risk A systematic risk; a systematic risk A systematic risk; an unsystematic risk Question 2 1 pts Riddler, Inc. currently owns an equity investment that is not traded in an active market. The risk that Riddler would not be able to sell this investment in a timely manner (should they require excess cash at some point) is known as: Inflation risk Political risk Credit risk Liquidity risk