Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following are accurate? Complete the common-size income statement for the year ending December 31, 2019 and compare it to the common-size income

Which of the following are accurate?

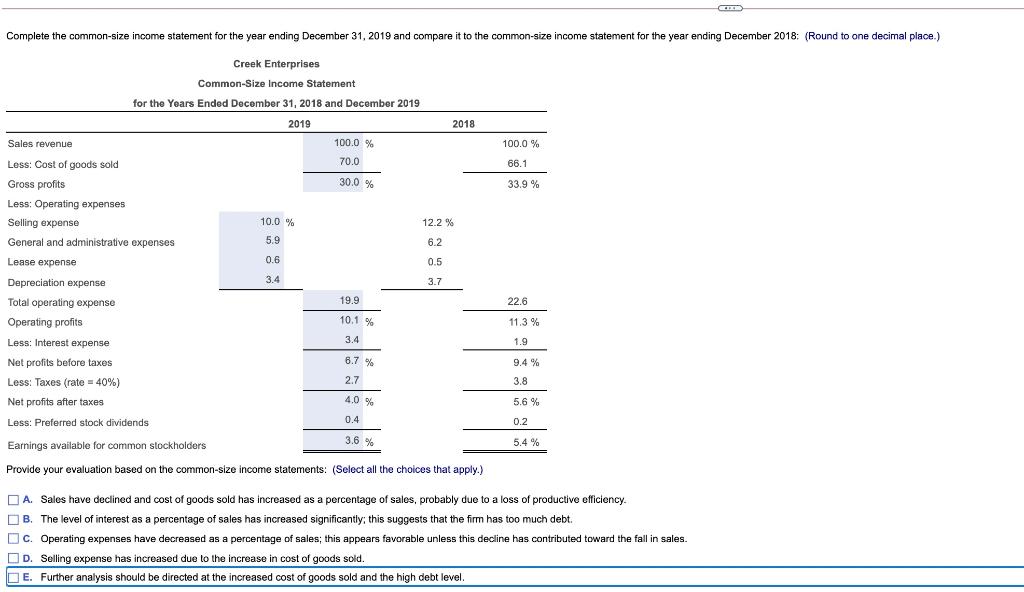

Complete the common-size income statement for the year ending December 31, 2019 and compare it to the common-size income statement for the year ending December 2018: (Round to one decimal place.) 100.0 % 66.1 30.0 % 33.9% Creek Enterprises Common-Size Income Statement for the Years Ended December 31, 2018 and December 2019 2019 2018 Sales revenue 100.0 % Less: Cost of goods sold 70.0 Gross profits Less: Operating expenses Selling expense 10.0 % 12.2 % General and administrative expenses 5.9 6.2 Lease expense 0.6 0.5 3.4 Depreciation expense 3.7 19.9 Total operating expense Operating profits 3.4 Less: Interest expense Net profits before taxes Less: Taxes (rate = 40%) 2.7 Net profits after taxes 0.4 Less: Preferred stock dividends - 22.6 10.1 % 11.3 % 1.9 6.7 % 9.4 % 3.8 4.0 % 5.6 % 0.2 3.6 % 5.4 % Earnings available for common stockholders Provide your evaluation based on the common-size income statements: (Select all the choices that apply.) | A. Sales have declined and cost of goods sold has increased as a percentage of sales, probably due to a loss of productive efficiency a B. The level of interest as a percentage of sales has increased significantly; this suggests that the firm has too much debt. C. Operating expenses have decreased as a percentage of sales; this appears favorable unless this decline has contributed toward the fall in sales. D. Selling expense has increased due to the increase in cost of goods sold. E. Further analysis should be directed at the increased cost of goods sold and the high debt levelStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started